Houses built with 100 dollar bills | © shutterstock.com

Houses built with 100 dollar bills | © shutterstock.com

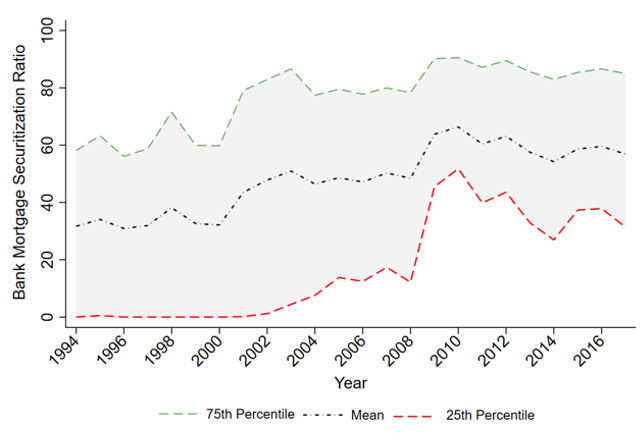

Unlike traditional banks that used to hold loans until they matured or were paid off, modern banks prefer to combine assets into pools and sell them to market investors through securitization. This is known as the rising adoption of the originate-to-distribute model in the banking sector. In the mortgage market, banks’ securitization ratio has increased from about 30% in 1994 to more than 50% in 2017 (see figure 1 for the trend).

Figure 1: Banks’ Mortgage Securitization in the United States

It is widely believed that this rising securitization trend was an important driver of the 2008 global financial crisis. Meanwhile, across banks in any given year, there exists a large dispersion of securitization activities. An interesting but understudied question is what drives the dispersion. Existing literature studying this question mostly focuses on default risk in mortgages. In a new paper, I offer a new angle by examining the interest rate risk and prepayment risk in mortgages.1

The key argument in this paper is that retaining or securitizing a mortgage depends on a bank’s ability to take the interest rate risk in the mortgage. This ability is determined by the maturity of a bank’s liabilities. In particular, banks with longer-maturity liabilities are more capable of taking the interest rate risk in mortgages. The fundamental logic behind this is maturity matching. Banks match the maturities of their liabilities with the maturities of their asset holdings to ensure that the overall exposure of their net interest income to fluctuations of interest rates is within a reasonable range. This is extremely important for banks’ risk management, considering their limited use of interest rate derivatives to hedge the risk.

I measure the maturity of a bank’s liability using the interest expense beta proposed by Drechsler,

Savov, and Schnabl (2021). This interest expense beta reflects the sensitivity of a bank’s interest expenses to changes in the federal funds rate. The higher the beta is, the higher the sensitivity of a bank’s liability to interest rates is, implying that the liabilities of low-beta banks are similar to long-term and fixed-rate debt. Consequently, low-beta banks have longer maturities in liabilities.

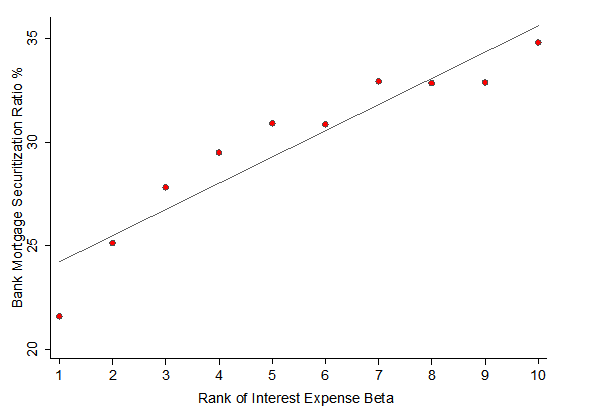

My empirical results show that in the conforming mortgage market,2 banks with longer-maturity liabilities retain more mortgages, while banks with short-maturity liabilities securitize more mortgages (see figure 2 for a visual presentation of the results). A one standard deviation increase in maturity is associated with a 5.09% increase in mortgage securitization. This is also reflected in banks’ balance sheets—banks with maturity one standard deviation above the average hold 7.3% more residential real estate loans on their balance sheets.

Figure 2: Maturities of Banks’ Liabilities and Mortgage Securitization

In addition, for jumbo mortgages that cannot be securitized through the government-sponsored enterprises—Fannie Mae and Freddie Mac, which are dominant players in the securitization market—banks with shorter-maturity liabilities have a much lower approval rate. This is because the restriction on securitizing jumbo mortgages forces banks with short-maturity liabilities to take too much interest rate risk. To avoid this, banks with short-maturity liabilities approve fewer jumbo mortgages ex ante.

However, holding mortgages on balance sheets exposes banks to prepayment risk. This risk is also very prominent in the U.S. market, due to the lack of prepayment penalties. The prepayment risk matters more for banks with longer-maturity liabilities, as they hold more mortgages on balance sheets. I show that these banks avoid the prepayment risk in two ways. First, ex ante, anticipating the risk, they securitize more mortgages. In doing this, they transfer the prepayment risk to other market investors. Second, ex post, they avoid the risk through fewer supplies of refinancing options, that is, rejecting household refinancing requests or making the financing options less attractive. This directly prohibits households from paying mortgages before maturity.

Policy Implications

Analyzing banks’ securitization decisions enables understanding the deeper the root of the 2008 global financial crisis, which helps regulators better monitor banks' risk taking in the mortgage market. This paper emphasizes that interest rate risk and prepayment risk are equally as important as default risk in explaining banks’ mortgage securitization activities. Considering the limited financial and human resources of bank regulators, taking the maturities of banks’ liabilities into consideration during inspections may be a more efficient way to regulate the mortgage market when it becomes too hot.

Reference:

Drechsler, I., Savov, A. and Schnabl, P., 2021. Banking on deposits: Maturity transformation without interest rate risk. Journal of Finance, 76(3), pp.1091–1143.

Join the Conversation