Hands holsing a plant. | © Adobe Stock

Hands holsing a plant. | © Adobe Stock

The existential threat posed by ecological unsustainability requires all policy makers, including financial authorities, to contemplate how they can contribute to effective solutions. The central banking and financial supervisory communities have already initiated serious consideration of how to address the issue from the monetary policy and financial stability angles. However, so far, there has been no attention to the ecological implications of financial market infrastructures (FMIs), in particular those supporting national and international payment systems around the world.

Yet, FMIs, such as payment, clearing, and settlement systems, and the services they deliver to economies and societies at large consume vast amounts of earth resources to power data centers, build and sustain computer networks, and produce equipment. Thus, their future evolution can make a huge difference in ecological sustainability, depending on the direction it takes.

In their capacity as overseers of the national payment systems (NPS), central banks hold a key responsibility to ensure that the NPS and its domestic and international linkages evolve consistently with ecological sustainability. Central banks should play a critical role, as this two-part blog post will argue.

Central Banks and the Green Agenda

The world is in a state of “ecological overshoot,” as the human demand for renewable resources exceeds the ecosystems’ regenerative capacities, the waste created by people and their economies outstrips the ecosystems’ assimilative and recycling capacities, and greenhouse gas emissions are compromising our planet’s environmental balance.1

International organizations like the United Nations and the World Bank have long played a key advocacy and technical advisory role and are ramping up their efforts to address ecological degradation. The yearly sessions of the Conference of the Parties (COP) to the United Nations Framework Convention on Climate Change show that while achieving a common and effective policy approach is still a faraway proposition, the topic has gone from being a fringe issue to a global priority. Governments and public opinion worldwide have become more aware of the problems and a growing number of countries are committed to taking action to deal with them. In addition, financial authorities at the national and international levels are taking initiatives for preparing financial systems to facilitate the transition to more sustainable economies.

Central banks and supervisory authorities have established the Network for Greening the Financial System (NGFS), a global association that advocates for more sustainable financial systems, which produces reports and studies and promotes the exchange of information on the topic. The NGFS, which had only eight members in 2017, now has 127 members, including all the major central banks and 20 observers comprising international financial organizations, like the Financial Stability Board, and international standard-setting bodies, the World Bank, the International Monetary Fund, and regional development banks.

The coalition of central banks and supervisory authorities with a green mandate is growing, and many are building capacity for both their own staff and the financial community to promote green finance.

Payment Systems and Ecological Sustainability

On payment systems and FMIs more broadly, however, no vision has been developed at the national or international level to mitigate their ecological impact. True, new cashless technologies may be more energy efficient than the old ones, resulting in climate co-benefits.2 Cashless payments are greener, since stopping the use of physical cash saves on environmental cost and reduces the need for transport, for example, to pay bills, receive payments, or withdraw cash. Digital payment services may also play the role of enablers for other green finance initiatives. For example, microgrid-type projects (solar, wind) hinge on the availability of digital payments, and digitalization makes it possible to offer, in a more affordable way, climate-relevant insurance (for weather/disaster-related risks), investment (green bonds, exchange-traded funds), and lending (project finance for clean energy, loans for making housing or businesses more energy efficient).

What has not yet been considered is the broader context of reliance on underlying payment infrastructures, with the associated network and other technology services required for data processing and service delivery (Rochemont 2018). Many low-carbon technologies use much larger amounts of metal than traditional fossil fuel–based systems, which creates environmental challenges as metal extraction and processing are significant contributors to global warming and major pollutants (Hund et al. 2020; Coppola 2021).

As another example, with the development of technologies applied to the provision of financial services (“fintech”), the lure of digital currencies and distributed ledger technologies may imply that electronic payments are “clean,” as their environmental impact is not immediately visible. However, electronic payments can seriously damage the environment if they are not designed to minimize their ecological footprint. Currently, coal and other fossil fuels are a major source of electricity worldwide for cryptocurrency mining operations (Corbet and Yarovaya 2020),3 and cryptocurrency mining generates a significant amount of electronic waste as its specialized hardware rapidly becomes obsolete.4

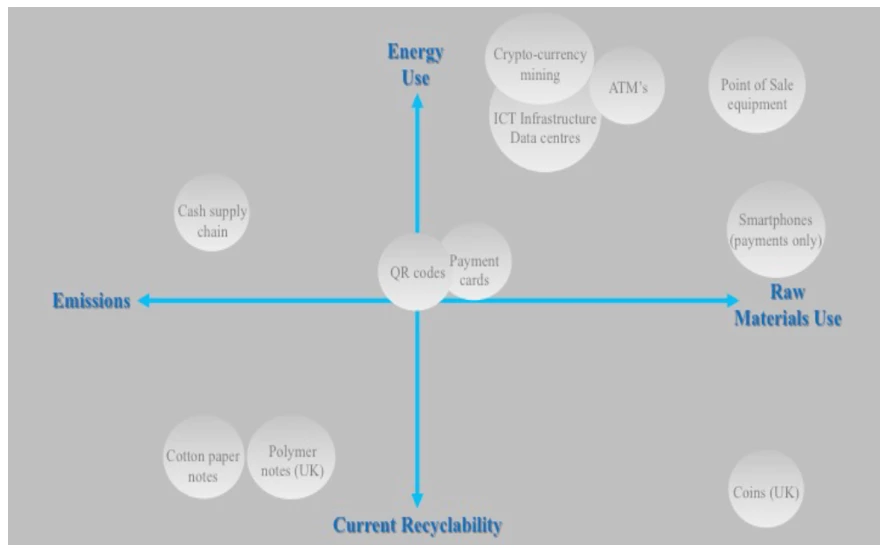

Figure 1. Means of Payment and Underlying Infrastructure: Environmental Footprint

Source: Rochemont 2018.

Figure 1 summarizes the environmental impact of the various means of payment and highlights the pressures on emissions, raw materials, and energy use, as well as the recycling maturity of UK coins and notes.

Part 2 of this blog post will discuss what central banks should do in this context.

References

Coppola, F. 2021. “From Carbon to Metals: The Renewable Energy Transition.” Coppola Comment, March 16, 2021.

Corbet, S., and L. Yarovaya. 2020. “The Environmental Effects of Cryptocurrencies.” In Cryptocurrency and Blockchain Technology, edited by S. Corbet, A. Urquhart, and L. Yarovaya, 149–84. Berlin: de Gruyer.

GFN (Global Footprint Network). 2021. “Earth Overshoot Day.” Global Footprint Network, Oakland, CA.

Hund, K., D. La Porta, T. P. Fabregas, T. Laing, and J. Drexhage. 2020. “Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition.” Climate-Smart Mining Facility, World Bank, Washington, DC.

Rochemont, S. 2018. “An Addendum to ‘A Cashless Society-Benefits, Risks and Issues’ (2018 Addendum), Issue 21 — Environmental Sustainability of a Cashless Society.” Institute and Faculty of Actuaries, London.

Join the Conversation