Global network and Business partnership concept | © shutterstock.com

Global network and Business partnership concept | © shutterstock.com

Over-the-counter (OTC) derivatives played a significant role in the global financial crisis of 2007–09 (Stulz 2010; Cont 2010). The complex and opaque structure of OTC markets and lack of regulation led to uncertainty, which brought markets to a standstill (Haldane 2009). As a response to the crisis, the G20 leaders committed to increasing the safety and transparency of derivatives markets. This led to a series of reforms, most notably the Dodd-Frank Wall Street Reform in the United States and the European Market Infrastructure Regulation in the European Union. One of the key elements of the regulatory reforms is represented by the mandatory central clearing of certain types of standardized OTC derivatives via central clearing counterparties (CCPs) and the requirements to exchange collateral (margins) to mitigate counterparty risk. The importance of CCPs in the post-crisis landscape became even more evident in the course of the March 2020 turmoil in global financial markets when CCPs called an unprecedented amount of margins : for EU and UK CCPs, it is estimated that initial and variation margins rose on the order of hundreds of billions in the space of a few weeks (ESRB 2020).

Mechanics of central clearing

A CCP is a post-trading institution, which interposes itself between the two counterparties of a contract.

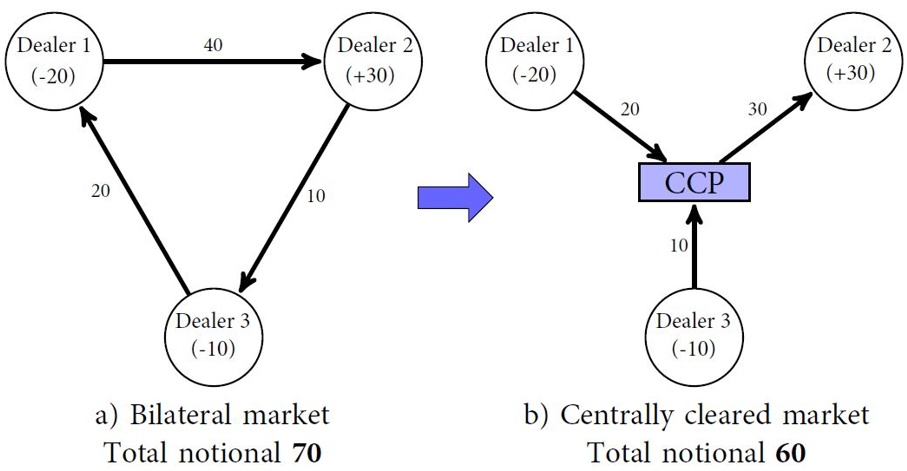

Figure 1: Transition from a bilateral market to a CCP

Figure 1, panel a, provides a stylized illustration of a bilateral market where dealers are exposed to each other via derivative contracts. For instance, Dealer 1 should receive 20 from Dealer 3 and pay 40 to Dealer 2; therefore, Dealer 1 has a net position of -20. As figure 1, panel b, illustrates, the introduction of a CCP significantly changes the liability structure in the market. Dealers are no longer directly exposed to each other via derivative contracts but become members of the CCP.

In our working paper (joint with Marco D'Errico and Stefano Battiston), we argue that this infrastructural reform, intended to improve financial stability, is not neutral in terms of valuation. We introduce a minimal theoretical model and show that due to counterparty risk and collateral costs, the impact on valuation, for a particular dealer, depends, in particular, on its credit quality and the size of its portfolio. Moreover, mutualization of funds and risks in a CCP leads to externalities between members, in the sense that the valuation of a contract depends on the characteristics of the CCP and all its members. We identify three channels at the root of this shift in valuation: netting, loss-mutualization, and funding costs.

Netting and counterparties' credit quality

Netting allows offsetting the value of multiple positions between counterparties and eliminates the same nominal amount of assets and liabilities. However, for a relatively high-quality counterparty, the probability to fulfill liabilities is higher than the probability to receive the same amount of assets. Therefore, we show that netting increases the contract value for relatively high-quality counterparties. Due to mutualization and the CCP’s additional "skin in the game" capital, a CCP is likely to have a higher credit quality than any single member. Therefore, the credit quality effect of netting diminishes members' incentives to net once they are in a CCP. We also show that a deal arranged between two CCP members could lead to a positive netting effect for both counterparties if it increases the net position of a relatively risky member and decreases that of a relatively safe member. The resulting deterioration of the CCP quality affects all the other CCP members in the form of negative externalities.

Network view on loss-mutualization

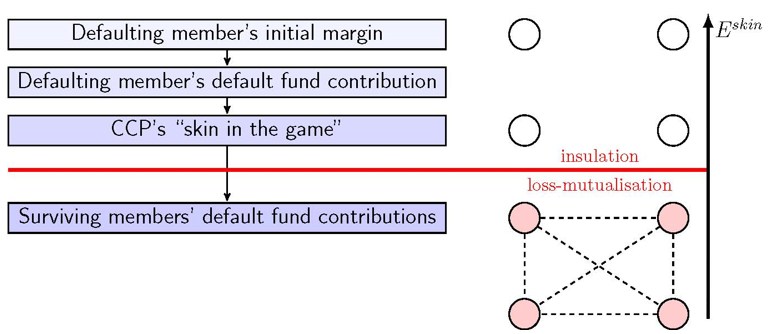

Since dealers are not risk-free, a CCP requires them to post collateral in the form of initial and variation margin and default fund contributions. Figure 2 illustrates a standard risk-management scheme of a CCP, often known as a "default waterfall."

Figure 2: "Default waterfall" structure and a network of expected exposures

In the case of a member's default, if the defaulting member's collateral and the CCP's "skin in the game" capital are not sufficient to cover all losses, default fund contributions of the surviving members would be used. Due to such structure of the "default waterfall," the network of expected exposures between CCP members could change from full insulation to a fully connected graph and members are indirectly affected by the counterparty risk on the contracts of all other CCP members. The threshold level of the CCP’s "skin in the game" capital is hit when the volatility of the underlying asset increases or the credit quality of CCP members deteriorates, that is, precisely in times of financial distress. Creating interlinkages between members, mutualization can reduce the effect of idiosyncratic shocks, but it can intensify contagion and propagation of distress in case of large aggregate shocks.

Disproportionality of funding costs

A CCP is required to hold sufficient resources to cover the default of its two largest members, a so-called "Cover 2" standard.

Figure 3: Funding requirements under different concentration measures

Figure 3, panel a, demonstrates that, under the "Cover 2" standard, further growth of a "large" (one of the largest two) member creates negative externalities to all the other CCP members by increasing their funding costs. Since the increased total funding requirement is divided among all the CCP members proportionally to their exposure, "small" members face disproportionally high funding costs. This effect remains when the Herfindahl index is employed as an alternative to the "Cover 2" concentration measure (see figure 3, panel b). In the paper, we suggest a way to avoid negative externalities by assigning individual funding requirements based on the member's contribution to the employed concentration index.

Overall, our results suggest that for a particular dealer, the transition to central clearing has an ambiguous effect on the counterparty risk and funding costs. In our model, due to additional netting opportunities, the transition is more beneficial to higher quality dealers, although they are more likely to participate in the mutualization of losses.

Olga Briukhova is a Swiss Finance Institute PhD Candidate in Finance at the University of Zurich. More details about her research can be found on her website: https://www.sfi.ch/en/people/olga-briukhova.

References

Cont, R. (2010). Credit Default Swaps and Financial Stability. Financial Stability Review, 14, 35–43.

European Systemic Risk Board (2020). Liquidity Risks arising from margin calls.

Haldane, A. G. (2009). Rethinking the Financial Network. Bank of England Speech.

Stulz, R. M. (2010). Credit Default Swaps and the Credit Crisis. Journal of Economic Perspectives, 24 (1), 73–92.

Join the Conversation