Credit to firms can be classified in two categories: revolving credit lines and term loans. Revolving credit lines offer borrowers the option to draw funds up to a limit, repay and redraw them as they see fit. In term loans, borrowers usually make a single draw of funds and commit to pay a fixed amount periodically. Both types of credit have pros and cons. However, it is not clear what determines whether a firm obtains a revolving credit or a term loan. In particular, two interesting questions arise. First, what is the relationship between the type of credit to firms and the economic cycle? Second, are there any differences between those types of loans in terms of pricing? In a recently released paper, I explore these questions for Mexican firms, using credit level information from Mexico’s National Banking and Securities Commission (CNBV) for the period of 2001-2012.

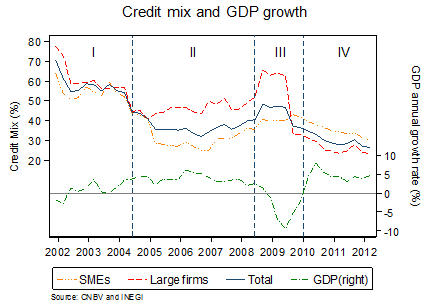

In the study, I find a significant relationship between the type of credit and the economic cycle. At the aggregate level, the data show that in slowdowns and recessions revolving credit increases (as a proportion of the total outstanding amount of credit to firms). In economic booms, the proportion of revolving credit falls, which means that term loans become more important. The data also show different patterns between small and medium enterprises (SMEs) and large firms. The figure below shows four periods. In period I, the revolving credit proportion (the credit mix) is almost the same for both sizes of firms: around 60%. In period II, term loans are more important for SMEs than for large firms. Period III (the period of the financial crisis in the US) depicts an increase in revolving credit for both types of firms, but large firms seem to have a stronger reaction. Finally, in period IV –a time of recovery and growth– term loans are more important for large firms than for SMEs.

As I discuss in the paper, the credit mix and its relationship with the economy could be the result of many factors. For example, revolving credits usually have short-term maturities and variable interest rates, whereas term loans have longer maturities and fixed rates. It is possible that firms demand different types of credit as their circumstances and liquidity needs change. However, when analyzing the data at the micro level, the study shows that new firms entering the market are the ones responsible for the changes in the aggregate credit mix. This means that the firms switching between types of credit are not the same through time.

The study also analyzes the differences in interest rates between types of credit. Controlling for credit and borrowers’ characteristics, my results suggest that revolving credit lines have higher interest rates than term loans. I argue that some of the reasons behind those differences could be, for instance, that the option the revolving credit provides does not come for free for either the borrower or the bank. For the borrower, having a revolving credit line entails having liquidity almost immediately but at a higher cost; for the bank, it represents a greater challenge in terms of valuation and risk management, as it implies higher asymmetric information problems.

The study is the first in Mexico to analyze credit firm dynamics from this perspective. However, in drawing conclusions from it, some caveats need to be considered. First, the analysis is purely exploratory. It does not rely on any theoretical model. Hence, it does not explain whether the type of credit is determined by the supply or demand side. And it does not provide a comprehensive examination of whether one type of credit is more profitable for banks or more efficient for the system as a whole. Similarly, the paper does not determine whether regulatory and supervisory authorities in Mexico should be worried when one type of credit is growing, or whether other authorities should contribute to stimulate one type of credit over the other. These unexplored issues are a sample of the topics that should be studied in future research.

A Spanish version of the paper can be found at this link.

Join the Conversation