A recession is a difficult time to start a business. Credit is tight, consumers are wary, and the future appears uncertain. It seems logical that entrepreneurs would have been deterred from starting a new business during the 2008-09 global financial crisis, but how widespread was this phenomenon, and are there signs that new firm creation has begun to recover? The 2012 Entrepreneurship Database released today provides a novel look at these trends. Based on data from business registries in over 130 economies, the Entrepreneurship Database measures the number of newly registered private limited liability companies per year.

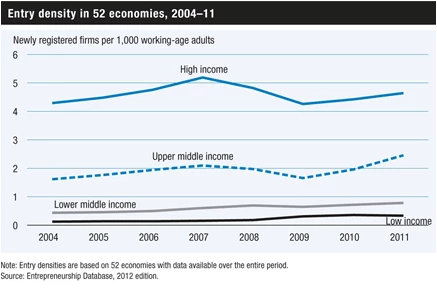

The data leaves little doubt that the global financial crisis of 2008-09 had a destructive effect on new firm registrations. The figure below shows that new firm entry density – the number of newly registered private limited liability companies per 1,000 working age adults –dropped sharply in 2008 and 2009 in high-income economies. In the developing world, many economies experienced a slow-down and drops in new firm registrations, particularly in 2009. Indeed, previous work with Inessa Love based on the 2010 edition of this data found that the speed and intensity with which the crisis affected new firm registration varied by income level and crisis intensity. Economies with higher levels of income (GDP per capita), those with highly developed financial systems (as measured by the ratio of domestic credit to GDP), and those hit the hardest by the crisis experienced early and sharper contractions in the rate of new firm creation. In Ireland, for example, new firm registrations fell by 29 percent between 2007 and 2009. Ethiopia, on the other hand, experienced an 11 percent increase in new firm registrations over the same period.

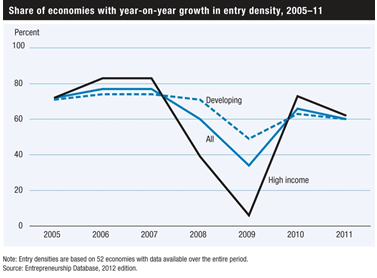

Although we lack counterfactuals to empirically assess how many economies experienced slowdowns in new firm registration as a result of the crisis, measurements of year-on-year growth in entry density provide compelling evidence that the impact of the crisis was indeed widespread. Before the crisis, about 70 percent of economies in our sample achieved positive year-on-year growth in entry density. In 2008 and 2009, this value was 60 and 34 percent, respectively. Just 6 percent of high-income economies had more firms registering in 2009 than in 2008. It is clear that the impact of the crisis on entry density is not merely a case of a few large economies skewing aggregate trends – but instead a major and widespread adverse effect on new firm creation in the majority of economies.

The 2012 edition of the Entrepreneurship Database provides the first look at patterns of recovery in new firm registrations. Given that many economies are still experiencing the effects of the crisis, it is too early for a comprehensive examination of post-crisis rebounds in new firm registrations. However, a few clear patterns are starting to emerge. There was an undeniable turnaround in 2010, with 66 percent of economies in the sample experiencing an increase in entry density over their 2009 levels. In 2011, about 60 percent of economies saw an improvement in the rate of new firm registration, considerably below the precrisis annual average of 75 percent. For the majority of economies, entry density in 2011 remained significantly lower than in 2007.

Learn more about trends in new firm creation over the crisis and recovery by downloading the country-level data, 2012 Entrepreneurship Database Viewpoint.

Resources:

Join the Conversation