Stock market data on LED display. | ©shutterstock.com

Stock market data on LED display. | ©shutterstock.com

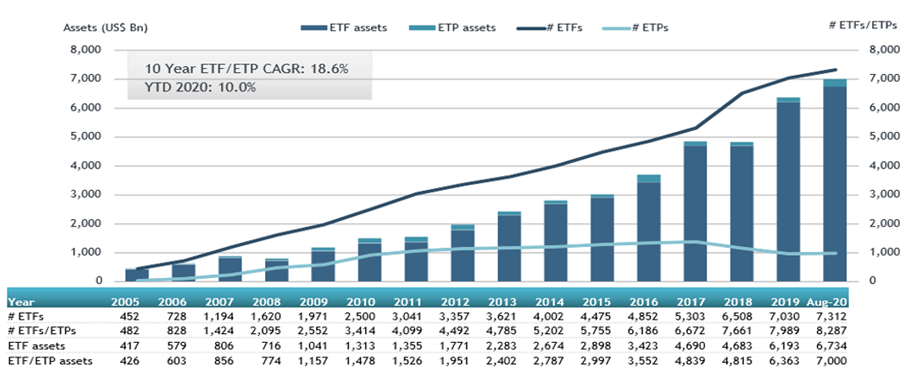

Exchange-traded funds (ETFs) have experienced tremendous growth following the financial crisis, with $7 trillion in assets under management worldwide as of August 2020 (ETFGI 2020). Their popularity is attributed to the fact that they offer investors an inexpensive way to gain exposure to a wide variety of asset classes, combined with intraday liquidity by allowing their shares to be continuously traded on exchanges.

Figure 1: Global ETF assets under management growth

Source: ETFGI 2020.

The ETF market is split into two segments. In the primary market, a select group of market participants called authorized participants (APs) trade directly with the ETFs, creating or redeeming ETF shares in exchange for cash or the underlying securities. In the secondary market, all other investors can trade ETF shares on exchanges or over-the-counter. APs profit from their unique positioning in the primary market by exploiting arbitrage opportunities arising from deviations of ETF share prices from the value of the underlying portfolio, thus ensuring the close alignment of the two.

The growth of ETFs has sparked a debate across industry practitioners, academics, and policy makers on whether ETFs contribute to smooth market functioning, especially during times of stress. In the recent market turmoil of March 2020, ETFs appear to have acted as price discovery mechanisms, especially for illiquid underlying securities such as corporate bonds, as investors traded the more liquid ETF shares instead (Bank of England 2020; Aramonte and Avalos 2020). Yet, in previous instances, such as the flash crash of 2010, it has been argued that ETFs propagated liquidity shocks to the underlying equities (Commodity Futures Trading Commission and Securities and Exchange Commission 2010). Hence, the debate has not been resolved and understanding the mechanism through which ETFs affect the underlying securities is crucial as they increasingly dominate the markets in which they invest.

To shed light on this mechanism, in my paper, co-authored with Paweł Fiedor from the Central Bank of Ireland, we use a unique proprietary data set of the Central Bank of Ireland containing all Irish ETFs and their holdings to look at the effects of Irish ETFs on the liquidity, prices, and volatility of their underlying equities and corporate debt securities. Ireland is the main hub of ETFs in the euro area, with Irish ETFs managing €424 billion in assets as of September 2018, around two-thirds of the euro area total.

The rich data set allows us to run panel regressions at the underlying security level on a daily frequency, to assess the effects of ETFs while controlling for a host of other factors, including security and time fixed effects. We run the regressions for each underlying asset class separately, to understand the differential impacts of ETFs on them.

Our main findings can be summarized as follows. First, ETFs propagate liquidity shocks to the underlying equities but not to the underlying corporate debt securities, meaning that when ETFs become illiquid, this can also negatively affect the liquidity of equities but has no effect on the liquidity of corporate debt securities. Second, when demand shocks hit the ETF share prices, they can also strongly affect the prices of equities but only have a weak effect on the prices of corporate debt securities. Third, higher ETF ownership of equities increases their volatility, but higher ETF ownership of corporate debt securities decreases their volatility.

To understand why such differential effects occur across the two underlying asset classes, we rely on a theoretical framework that looks at links between assets that are formed via information channels. Information links are formed when investors use information from one asset to price the other (Cespa and Foucault 2014). We argue that ETFs form such information links with the underlying securities through the activity of APs who continuously exploit arbitrage opportunities between the two markets. However, the degree of arbitrage activity and the resulting strength of the information link depend on the accessibility of the underlying assets. If the underlying securities are easy-to-trade with small transaction costs, such as exchange-traded equities, this facilitates the activity of APs and creates a strong information link. However, if the underlying securities are hard-to-trade with significant search and transaction costs, such as over-the-counter-traded corporate debt securities, this limits the ability of APs to exploit arbitrage opportunities, thus creating a weak information link with the ETFs and limiting the transmission of shocks.

The proposed mechanism of information links and our empirical findings are consistent with how ETFs have behaved in previous periods of stress. According to Commodity Futures Trading Commission and Securities and Exchange Commission (2010), when SPY, the largest US ETF tracking the S&P 500 index, became illiquid and suffered price declines in the flash crash of 2010, the market makers in the underlying equities increased their quoted bid-ask spreads or stopped intermediating entirely as they became uncertain about the value of the securities, at least as reflected in the ETF share price. In other words, the strong information link broke down during stress, which propagated the liquidity shock from the ETF to the underlying equities. More recently, in March 2020, many corporate bond ETFs were trading at large discounts to their underlying securities as the latter became completely illiquid and their prices remained stale while investors traded ETF shares instead. The demand shocks hitting the ETF share prices were not being transmitted to the underlying corporate debt securities because of their inaccessibility, which is a manifestation of the weak information link that exists between the two markets as the information present in the ETF shares was not being incorporated into the underlying securities.

Our paper contributes to the debate on whether ETFs facilitate smooth market functioning by arguing that it depends on the accessibility of the underlying markets, which determines the strength of the information link that is formed between the two. This is important from a policy perspective as it sheds light on the mechanism through which ETFs can propagate shocks to the underlying securities through various channels, including their liquidity, prices, and volatility. As ETFs continue to grow, their systemic importance will increase, so it is crucial to obtain a holistic view of how they can propagate shocks, and our paper contributes to this goal.

The views expressed in this blog post and paper are those of the authors only and not of the Central Bank of Ireland or the ESCB.

References

Aramonte, S. and Avalos, F. (2020). The recent distress in corporate bond markets: cues from ETFs. BIS Bulletin No. 6.

Bank of England (2020). Interim Financial Stability Report May 2020.

Cespa, G. and Foucault, T. (2014). Illiquidity Contagion and Liquidity Crashes. Review of Financial Studies, 27(6):1615–1660.

Commodity Futures Trading Commission and Securities and Exchange Commission (2010). Findings regarding the market events of May 6, 2010.

ETFGI (2020). ETFGI reports assets invested in ETFs and ETPs listed globally broke through the $7 trillion milestone at the end of August 2020. Retrieved from: https://etfgi.com/news/press-releases/2020/09/etfgi-reports-assets-invested-etfs-and-etps-listed-globally-broke

Join the Conversation