The balance sheet of sovereign entities is far more complex than the balance sheet of private companies. For example, the institutions that manage the assets of a sovereign are different than those which oversee the liabilities, often with different mandates. Other issues include the definition of the “sovereign” and the scope of its balance sheet, the complex valuation of tangible assets and recognition of financial instruments, negative net worth, incomplete recording, and many others. As a result, unlike private companies, most governments manage their balance sheets as separate sub-portfolios without having a holistic approach.

However, some governments have worked to develop a comprehensive balance sheet management approach, and New Zealand has been very successful in this regard. Their holistic approach is able to provide decision makers with a complete picture of the government’s financial position, which allows them to identify mismatches and offset risks.

The concept of Sovereign asset and liability management (SALM) was first described in 2001 in the joint WB/IMF Guidelines for Public Debt Management and later conceptualized in a book “Sound Practice in Government Debt Management” by G. Wheeler 1 in 2004. Given the recognized benefits of the asset and liability management, it is surprising how little we know about the extent of its practice across countries.

In a recent World Bank Policy Research Working Paper “How Do Countries Use an Asset and Liability Management Approach ? A Survey on Sovereign Balance Sheet Management”, we explored how countries are using a sovereign asset and liability management framework and how it is related to the production of their balance sheet, as well as the objectives, priority areas, and challenges associated with its implementation. In coordination with the OECD and the IMF, we conducted a survey that included countries from advanced economies, emerging markets and developing countries. We examined the results of twenty-eight countries who responded to the questionnaire.

Our findings indicate that almost all the twenty-eight respondent countries produce a balance sheet to monitor the overall financial position of the government. However, only six of them (21 percent) use that balance sheet to determine and monitor mismatches between sovereign assets and liabilities.

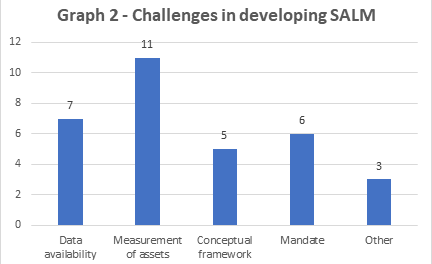

Many countries face institutional challenges in the design and implementation of an effective SALM framework. The challenges cited include institutional arrangements, uncertain or lacking mandate, coordination between institutions, data availability, and valuation of assets.

If the roles, objectives, and resources of institutions involved in SALM are clearly defined and consistent, this approach could significantly enhance the coordination in the management of assets and liabilities across institutions while maintaining each institution’s independence. Full implementation of ALM in the public sector or for the sovereign is rare. However, we did find examples of partial implementation, generally when the same entity is responsible of both assets and liabilities, and one obvious area of implementation was the management of the cash buffer by government debt offices. Some examples include:

- Canada — The Bank of Canada acts as the fiscal agent for the federal government and works with the Department of Finance on the funding and investment policy for Canada’s foreign exchange reserves. The Bank of Canada developed an ALM portfolio model that determines the combinations of assets and liabilities with the same duration and currency that maximizes the returns (net of funding costs) for each possible level of portfolio risk, while satisfying liquidity policy requirements.

- Denmark — Danmarks Nationalbank manages the government debt on behalf of the Ministry of Finance. The central government financial assets and liabilities in local currency are managed on a consolidated basis. The duration and risks of the financial assets are included in the consolidated risk management of the central government debt.

- Uruguay — In a market lacking Foreign Currency hedging instruments, the Ministry of Finance and the Central Bank identified exposures under a sovereign ALM balance framework and implemented strategies to reduce balance sheet vulnerabilities in the consolidated public sector, through joint issuance and exchange of public securities, selling of dollar forwards to state-owned companies and a reduction in the currency mismatches associated with annuities payments.

Also, there are cases where key stakeholders (i.e. ministry of finance and central bank) discuss recent developments in financial markets and produce reports or use the budget process to review government assets and liabilities. In the U.K., HM Treasury compiles the whole government accounts. In Chile, the ALM approach is used to support the decision on the currency composition of the assets of the Fiscal Stability Fund. In countries such as Poland, South Africa, Switzerland and Turkey — the annual debt reports prepared for the parliament may include financial tables and performance indicators of other assets such as state-owned enterprises and/or sovereign wealth funds.

These partial implementations highlight the usefulness of evaluating both sides of the balance sheet while making economic decisions. The development of sound practices for SALM could benefit governments and facilitate the implementation of a holistic approach to the management of their balance sheet and its risks, increasing their resilience to shocks.

Join the Conversation