ونتيجة للصعوبات الاقتصادية حول العالم وتعطل سلاسل القيمة العالمية سينخفض الطلب على السلع والخدمات التي تنتجها دول مجلس التعاون الخليجي، وعلى الأخص النفط.

ونتيجة للصعوبات الاقتصادية حول العالم وتعطل سلاسل القيمة العالمية سينخفض الطلب على السلع والخدمات التي تنتجها دول مجلس التعاون الخليجي، وعلى الأخص النفط.

Countries in the Gulf Cooperation Council (GCC) face a dual shock — from both the COVID-19 pandemic and the collapse in oil prices. Authorities should focus first on responding to the health emergency and the associated risk of economic depression and postpone fiscal consolidation linked to the persistent drop in oil prices until recovery from the pandemic is well underway.

The Effects of the Dual Shock on the GCC

The Gulf Cooperation Council (GCC) countries — Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates (UAE) — face the dual shock of a pandemic caused by the novel coronavirus and a collapse in oil prices.

The virus has affected GCC and other Middle East and North Africa (MENA) countries. As of April 16, 2020, Saudi Arabia had reported 6,380 cases; Qatar, 4,130; Bahrain, 1,700; Kuwait, 1,524; the UAE, 5,825; and Oman, 1,019 (Worldometers). Other countries in MENA have also reported infections, of which Iran has been hardest hit.

The virus will not only claim lives. Its spread will confront GCC with both a negative supply shock and a negative demand shock. The negative supply shock comes first from a reduction in labor — directly because workers get sick with COVID-19, the disease caused by the virus, and indirectly due to travel restrictions, quarantine efforts, and workers staying home to take care of children or sick family members. Supply will also be affected by a reduction in materials, capital, and intermediate inputs due to disruptions in transport and businesses.

The negative demand shock is both global and regional. Economic difficulties around the world and the disruption of global value chains will reduce demand for the GCC’s goods and services, most notably oil. Domestic demand will also decline as a result of the abrupt reduction in business activity and as concerns about infection reduce travel. In addition, uncertainty about the spread of the virus and the level of aggregate demand will hurt the domestic investment and consumption. Collapsing oil prices further depress demand in the GCC, where oil and gas is the most important sector. Finally, potential financial market volatility could further disrupt aggregate demand.

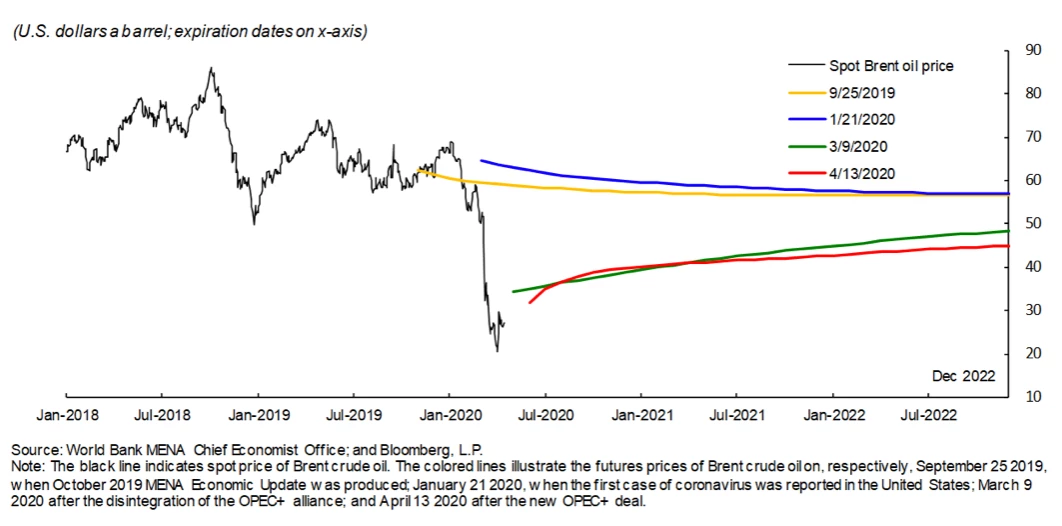

In addition to the shock from COVID-19, the breakdown in negotiations between the Organization of the Petroleum Exporting Countries (OPEC) and its allies in the first week of March led to a collapse in oil prices. At the end of March, the benchmark Brent crude oil price was $22 per barrel — less than half the price at the beginning of the month. In April 12, 2020, OPEC+ struck a deal to cut production by 9.7 million barrels a day in May and June. The deal, while sizable, may still be smaller than the shortfall in oil demand (Reuters, 2020). The futures curve suggests that the market expects oil prices to recover slowly — not reaching $45 per barrel until the end of 2022 (Figure 1). This would bring a large income decline to the GCC.

Figure 1: Spot and Forecasts of Brent Oil Price

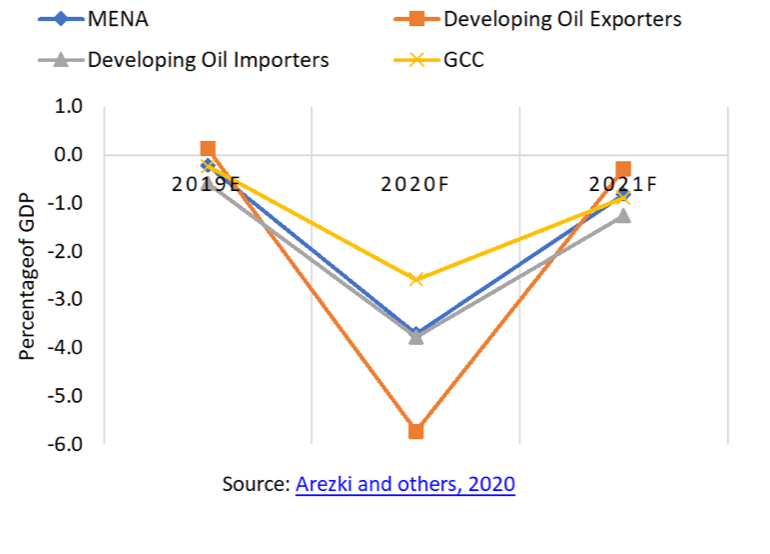

Because of the dual shock, the growth downgrade for GCC as a whole is 2.6 percentage points in 2020 (Arezki and others, 2020). This can be considered as the cost of the dual shock. In U.S. dollars, this amounts to about $41 billion. Note, though, that despite the oil price collapse, the growth downgrades for GCC countries are the smallest among MENA country groups (Figure 2). This shows the importance of public health systems, which are more advanced in the GCC, and of policy responses.

Figure 2: Costs of the dual shock – Growth Downgrades (April 2020 versus October 2019)

Source: Arezki and others, 2020

On the Policy Responses in the GCC

GCC countries have put unprecedented policy responses in place[1], which helped soften the effect of the dual shock. The authorities could also consider the following:

- Tailoring policy responses: To deal with the dual shock, authorities in the GCC should order and tailor their responses to the severity of the shock. They should focus first on responding to the health emergency and the associated risk of economic depression. Authorities should postpone fiscal consolidation associated with the persistent drop in oil price and its spillovers until the recovery from the pandemic is well underway. Instead, current emphases should be on budget reallocation and more efficient spending. In responding to COVID-19, authorities should boost spending on health — including producing or acquiring test kits, contact tracing technology, mobilizing and paying health workers, adding health infrastructure, and preparing for vaccination campaigns. Scaling up of testing and contact tracing for COVID-19 are especially important to determine the scale of the infection, detect and isolate cases which will be a factor in deciding whether and how to reopen the economy without causing a second wave of infections.

- Supporting the private sector: A combination of bailouts, eased credit condition and monitoring is needed to support the private sector, including small- and medium-sized enterprises. The support, with relevant conditions, will help firms survive the income crunch and prevent mass layoffs. Prioritization on strategic sectors — most notably network industries and services such as transport, logistics, distribution and finance — is critical to protect production capacity and support a future recovery. Governments should focus on elements of business environment regulation, especially out of bankruptcy work out and bankruptcy reforms (see Lyadnova and others, 2019) to resolve corporate difficulties and associated corporate debt restructurings. The role of sovereign wealth funds, money printing where inflation is low (Gali, 2020) and international borrowing can all be utilized to support the private sector and soften corporate distress. Bailout measures of strategic firms and sectors could be also considered while ensuring it does have lasting impact on market contestability.

- Supporting vulnerable households including expatriate workers. Cash transfers to vulnerable households would help protect them and support consumption. This is relevant for the large expatriate labor force in the GCC countries. Making expatriate workers eligible for government cash transfers is not only an act of solidarity with the workers but also would enhance the reputation of the GCC as a good place to work. As importantly, supporting the expatriate labor force especially the low skilled would speed up economic recovery and prevent further spread of COVID-19 when the workers return to their home countries or when they come back to the GCC for work. Successful models of quickly deploying technology, including digital, to fight COVID-19 and target assistance should be analyzed and replicated[2].

- Supporting regional and global effort to contain the crisis. Many MENA countries including Bahrain and Oman face large balance of payments and fiscal gaps. Many also carry high sovereign-risk premiums. For those countries, additional foreign borrowing on private markets will be difficult. Many other countries in the region will need much international support to help it navigate an extremely rough patch. The GCC—considering the importance of its bilateral aid—has an important role to play to further the initiative to limit the ballooning of future cost and the risk of failed states entailed by delaying the rapid response to COVID-19. The G20, currently under Saudi Arabia’s Presidency, has agreed debt relief to low-income countries to help free up funds to fight the pandemic (Financial Times, 2020).

[2] See Foreign Affairs (2020) for the experience of East Asian countries.

Join the Conversation