Woman looking at shoe shop with "Closing Shop" sign on the window in Beirut, Lebanon, during COVID-19. (Photo: Mohamed Azakir)

Woman looking at shoe shop with "Closing Shop" sign on the window in Beirut, Lebanon, during COVID-19. (Photo: Mohamed Azakir)

Lebanon is facing three mega-crises all at once: an economic and financial crisis, the COVID-19 pandemic, and the aftermath of the Port of Beirut explosion – one of the largest non-nuclear explosions ever recorded. The Lebanon financial and economic crisis is likely to rank in the top 10, possibly top three, most severe crises episodes globally since the mid-nineteenth century.

These compounded crises led to an estimated drop in real GDP by 20.3 percent in 2020, which is expected to contract by a further 9.5 percent in 2021. There is triple digit inflation and a projected increase in poverty to 45 percent and in extreme poverty to 22 percent. Approximately 1.7 million people are estimated to fall under the poverty line, of which 841,000 people will be under the food poverty line.

How has all this affected industry and workers? Between October 2019-October 2020, a team at the World Bank interviewed business owners and managers of 379 registered firms, asking questions about sales, production, business closures, and future prospects. The team will conduct two additional waves of interviews with the same firms to track their coping strategies and impact of the crises on their firms’ performance – the results of which will be available between October – December 2021. Though a full report summarizing the findings across the three waves of interviews is forthcoming, this blog lays out some of the key findings from the first wave of interviews.

A bleak future with no recovery for most firms

As of November 2020, almost one out of five surveyed firms in Lebanon was confirmed or assumed to be permanently closed.

Of the firms surveyed, one out of four firms did not think recovery was possible. These firms expected to fall into arrears and default on liabilities in the next three months, projecting their survival at less than seven months, given current costs. In other words, according to firms’ reported expectations, one out of four firms will have closed down by June 2021. Such a result is expected to be validated during the second and third wave of interviews with firms.

The impact on jobs

The multiple crises have exacerbated unemployment, as one in five workers have lost their jobs since October 2019. The consequences of not working has been dire due to lack of unemployment benefits and limited social safety nets available for laid-off workers in Lebanon.

Data from the survey shows that 61 percent of formal firms decreased their permanent workforce by 43 percent on average (see Table 1). It is interesting to note that fewer smaller firms shrunk their workforce, compared to medium and larger firms. This could be due to the different nature of the relationship between managers and workers or because small firms may have less flexibility in scaling back production. The impact is expected to be worse among informal firms and micro-sized formal firms not included in the survey.

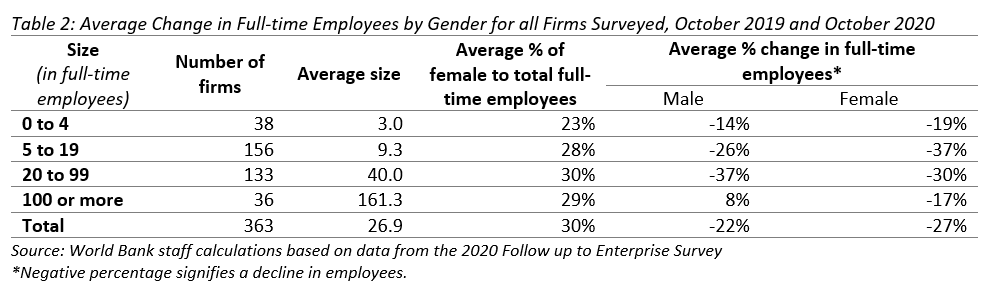

In addition, the multiple crises will likely set back previous gains in women’s economic empowerment, as is evident from the net job loss, which was on average 5 percentage points higher for women than for men (see Table 2). This is in a context where women represent less than a third of the total full-time workforce in surveyed firms. Crises can impact women’s access to economic opportunities in different ways. For example, school closures due to the pandemic have made it difficult for women to juggle work and care responsibilities. Female entrepreneurship has also taken a big hit in 2020 with many women owned businesses forced to close due to the pandemic.

Relatively few firms have resorted to other labor adjustment measures, such as reducing salaries, benefits, or working hours. Thirteen percent of firms have decreased salaries by around 45 percent, while 29 percent of firms have increased salaries of their employees by around 40 percent. This could be explained by employers’ willingness to offset the rapid currency depreciation and thus, the loss of value in salaries. These nominal increases were in fact negative in real terms, as inflation reached triple digits during this period. Given the free-fall of the Lebanese currency, the minimum wage of LBP675,000 (equivalent to US$450 using the official exchange rate), has fallen in value to the equivalent of $34 using the black-market exchange rate of $20,000 as of August 2021.

What happens next

Despite the dire situation in Lebanon, results from the survey suggest that some, not many, firms might be doing fairly well and creating jobs (see Table 1). Lebanon is one of the highest net importers in the world, and given the currency crisis, people have been forced to switch to locally made products. This has allowed firms –mainly in the food and agro-food industry to expand and/or diversify production to substitute for exports and increase hiring.

The World Bank team will be following up on its research with two more surveys to track how firms are continuing to cope. The next round of results is expected to be available in October 2021 and the third round by the end of 2021. We’ll also be analyzing the evidence to see how the government and policy influencers can support firms moving forward.

Join the Conversation