By Stewart Elgie, Professor of Law & Economics at University of Ottawa and Chair of Sustainable Prosperity; Ross Beaty, Chairman of Pan American Silver Corp. and Alterra Power; and Richard Lipsey, Professor Emeritus of Economics at Simon Fraser University.

We often hear claims that a carbon tax would destroy jobs and growth. Yet the evidence from a Canadian province that actually passed such a tax – British Columbia – tells a very different story.

The latest numbers from Statistics Canada show that B.C.’s policy has been a real environmental and economic success after six years. Far from a “job killer,” it is a world-leading example of how to tackle one of the greatest global challenges of our time: building an economy that will prosper in a carbon constrained world.

Implemented on July 1, 2008, B.C.’s tax covers most types of fuel use and carbon emissions. It started out low (C$10 per tonne of carbon dioxide), then rose by C$5 each year, reaching C$30 per tonne at present (about 7 cents per litre of gas). "Revenue neutral" by law, the policy requires equivalent cuts to other taxes. In practice, the province has cut $760 million more in income and other taxes than needed to offset carbon tax revenue.

The result: taxpayers have come out ahead. B.C. now has the lowest personal income tax rate in Canada (with additional cuts benefiting low-income and rural residents) and one of the lowest corporate rates in the OECD. You don’t need an economist and a mining entrepreneur to tell you that’s good for business and jobs.

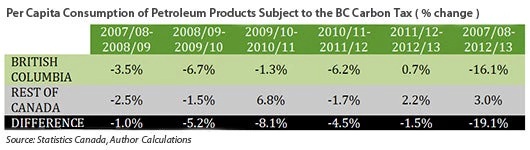

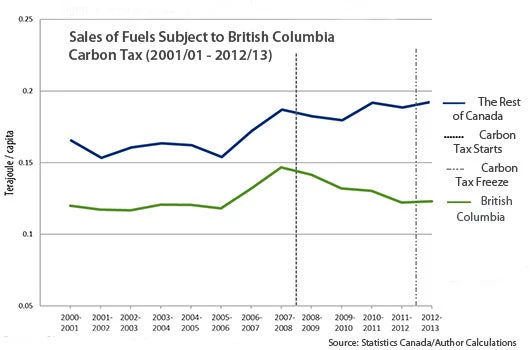

At the same time, it’s been extraordinarily effective in tackling the root cause of carbon pollution: the burning of fossil fuels. Since the tax came in, fuel use in B.C. has dropped by a whopping 16 percent (counting all fuels covered by the tax). To put that accomplishment in perspective, Canada’s Kyoto target was a 6 percent reduction in 20 years.

And the evidence points to the carbon tax as the major driver of the change. B.C.’s big drop in fuel use …

- Was not due to the global economic downturn. Other provinces also went through that, and yet their fuel use went up by 3 percent from 2008-13.

- Was not due to cross-border gas buying. Two researchers (the Sightline Institute and Andy Skuce) have estimated that this factor probably accounts for just 1-2 percent of B.C.’s 16 percent decline in fuel use since 2008. Moreover, B.C. outpaced the rest of Canada (by a lot) on every type of fuel subject to the tax since 2008. (And people didn’t take their home heating oil tanks across the border!).

- Was not due to a pre-existing trend. From 2000-08 B.C.’s fuel use was actually rising by 1.1 percent/year relative to the rest of Canada; after 2008 it fell by 4 percent/year.

In other words, the evidence indicates that B.C.’s carbon tax has been very effective in spurring fuel efficiency gains. (For more details, see www.sustainableprosperity.ca )

Further, while some had predicted the tax shift would hurt the province’s economy, in fact B.C.’s GDP per capita has slightly outperformed the rest of Canada’s since 2008.

With these impressive results, B.C.’s carbon tax has gained widespread global praise as a model for the world – from places like the OECD, the World Bank, and The Economist. But within Canada (outside B.C.) it is less heralded, which is a shame. Because when you look beyond the political rhetoric and examine the facts, B.C.’s experience offers powerful, positive lessons for the world.

In particular, it shows that countries can be competitively ambitious in shaping a 21st century economy that internalizes the real costs of pollution. And that is important, because carbon and other emissions from burning fossil fuels impose heavy costs on us all, as B.C. knows well. The mountain pine beetle infestation, resulting from warming winters, has devastated its interior forest industry, closing mills and costing thousands of jobs. Similarly, air pollution – caused mainly by burning fossil fuels – costs thousands of lives and over $8 billion per year to Canada’s economy. These problems will only get worse if we don’t get serious about tackling the causes of carbon emissions.

B.C.’s example shows that we can do that, while strengthening the economy, if we use smart policies. In particular, carbon tax shifting encourages employment and investment (by cutting income taxes) and discourages pollution (by taxing emissions). It also promotes energy efficiency and clean innovation – both critical to success in the greening global marketplace.

Building a prosperous, low carbon economic future is one of the great challenges of our time. With such strong evidence of how to do that, it’s time to park the political rhetoric and act.

Photo: Brian Fagan/Flickr Creative Commons

Join the Conversation