Stormy skiy

Stormy skiy

The COVID-19 pandemic has dealt with the most severe blow to the global economy since 1929, with devastating, long-lasting effects on government balance sheets. While the impact of the pandemic has been unprecedented in scale and type, the systemic crises stemming from it are likely to happen more often in our modern, interconnected world. COVID-19 reminds us that shocks can cascade and compound in complex ways, with broad fiscal, economic, financial and social implications.

Understanding this trend is especially important considering the looming threat of climate change. In a recent report, the World Meteorological Organization reminded us of the “relentless” intensification of the climate crisis, with a record-breaking number and intensity of extreme weather events in 2020, along with the compound climate, health, and economic crises experienced in many countries.

So how can countries strengthen their financial resilience to more complex shocks? How can central banks and financial regulators adapt supervisory frameworks and practices to address compound risks posed by pandemics and climate change?

Recognizing these risks and embedding them within financial risk management frameworks are a crucial starting point. But shocks tend to be seen in isolation and our ability to measure, monitor, and anticipate them is currently limited. So how can we be better prepared for future crises?

Capturing compounding pandemic and climate shocks

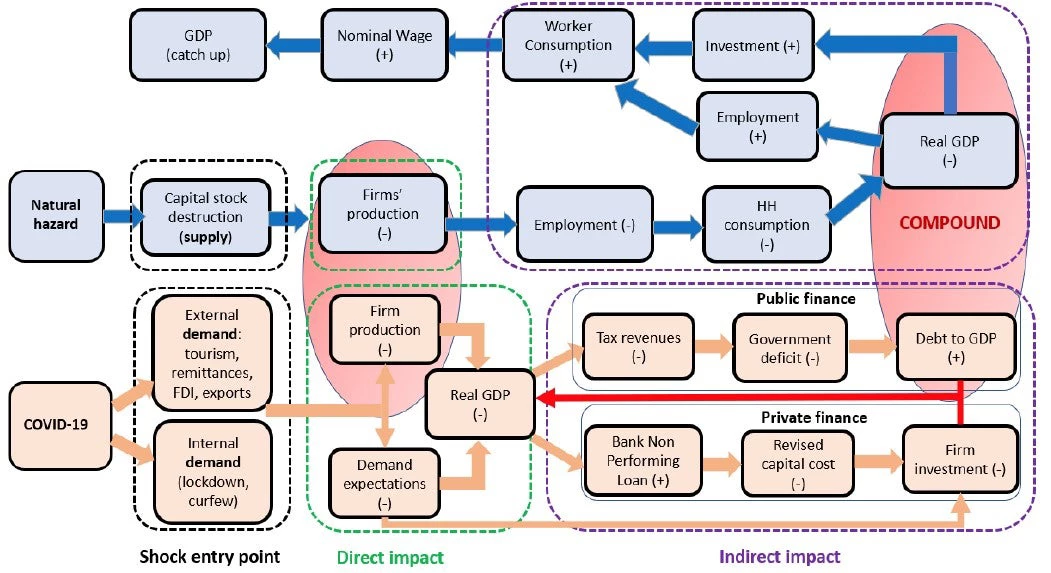

The World Bank’s Disaster Risk Financing and Insurance Program (DRFIP) has provided governments with risk analytics and advisory services to strengthen their financial resilience to disasters and climate shocks for over a decade. This is a critical part of a green, resilient and inclusive post-COVID recovery. The DRFIP partnered with Ca’ Foscari University of Venice in a project to explore the impacts of compound shocks. Under this project, we’ve added risk transmission channels for climate, economic, and health shocks, and developed a framework for capturing compound shocks within a macro-financial risk assessment. (Figure 1)

Figure 1: Compound risk transmission channels. The figure shows the COVID-19 and natural hazard shock entry points (black dotted boxes) and transmission channels to the main variables of the real economy, public and private finance. Direct impacts are identified by the light green dotted box, while indirect impacts are identified by the purple dotted box. The red arrow shows the reinforcing feedback loop, while the shaded red areas identify the compound effect.

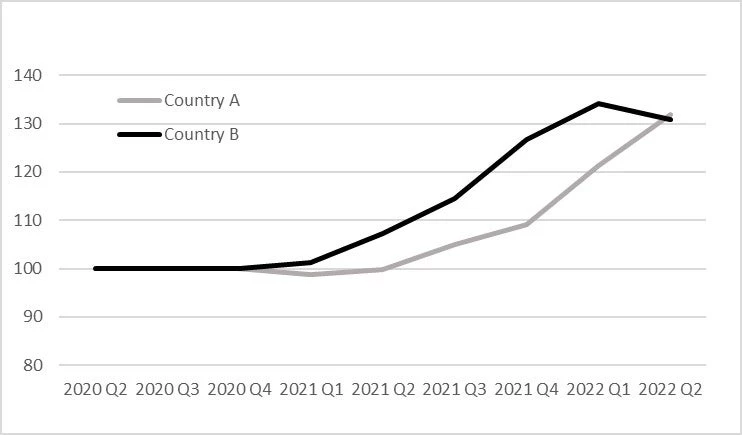

When pandemic and extreme weather events compound within an economy, they generate non-linear effects that can amplify economic losses (e.g., measured in terms of GDP): the compound impacts can be larger than the sum of the individual shocks. We measured this as a compound risk multiplier (Figure 2) and found that it can peak at over 150% in some cases; that is, compound impacts can be 50 percent larger than the sum of the individual shocks—which is a pretty big blind spot!

Figure 2: Compound risk multiplier for two example middle-income countries, where one is exposed to a flood shock (Country A) and the other a typhoon shock (Country B) during a pandemic. The compound risk multiplier is computed as the ratio between the GDP loss in the compound risk scenario and the sum of GDP losses in individual pandemic and climate risk scenarios. When the compound risk multiplier is higher than 100, this indicates non-linearities emerging that cause the shock triggered to be higher than the sum of the individual shocks.

For governments, compounding shocks have two different implications. They amplify the economic impacts of individual shocks and so will impact government revenues harder and for longer. They also increase the need for government expenditure post-disaster, particularly in areas like social protection and recovery finance for micro, small and medium-sized enterprises (MSMEs).

Building a more resilient future

Ignoring the potential of compounding risks could be a major blind spot in the COVID-19 recovery. Economic and financial risks, climate change, environmental damage, and public health emergencies are all interconnected. Disregarding these interlinkages and their compounding effects limit effective policy making and financial risk management. Building back stronger means taking a more integrated approach to risk management.

There are still questions to be addressed. For example, what does this mean for the design of climate-resilient financial instruments, such as contingent credit and insurance, to better manage these (compound) risks?

One conclusion is clear: Developing simple yet realistic scenarios and metrics and integrating them more explicitly within financial risk management frameworks could be a meaningful first step toward enhanced financial resilience. This would help limit the impact of future crises and incentivize economy-wide investments to reduce risks.

Acknowledgements: The research underpinning this blog included contributions from Antoine Bavandi and Fabio Cian from the World Bank, and Monica Billio, Stefano Battiston, Louison Cahen Fourot, Nepomuk Dunz, Arthur Hrast Essenfelder, Andrea Mazzocchetti and Malcolm Mistry from Ca’ Foscari University of Venice. The research was funded by the Global Risk Financing Facility.

This post is part of a series featuring the World Bank Group’s climate-related work in the Equitable Growth, Finance and Institutions practice group including the following Global Practices: Governance; Finance, Competitiveness and Innovation; and Macroeconomics, Trade and Investment.

Join the Conversation