Financing options to help smallholder farmers prepare for disaster risks in DRC

Financing options to help smallholder farmers prepare for disaster risks in DRC

An innovative contingent finance and response mechanism can safeguard the farmers’ investment contributions and ensure that they have resources available to restart production in case of extreme weather events.

Extreme weather events are commonplace in the Democratic Republic of Congo (DRC). Agriculture is particularly vulnerable to extreme droughts and flooding—which are expected to increase in frequency and severity due to climate change. But planning and preparing for crises and disasters is difficult in DRC, as in many other developing countries, even for common risks such as weather hazards . Typically, managing agriculture sector risks and emergencies happens after the crisis hits.

The World Bank Group (WBG) is helping DRC be better prepared to respond to crises with the National Agriculture Development Program (NADP). The US$500 million in financing will benefit 1.7 million farmers in five provinces for an initial period of 5 years. The WBG’s engagement will extend to a total of US$1.5 billion over 15 years for maximum impact and coverage of 16 provinces. The project, with funding from the Global Risk Finance Facility (GRiF), supports smallholder farmers to adopt climate and nutrition-smart agriculture practices and techniques that will improve agricultural productivity, market access, and overall resilience of farm income to climate change.

But to receive NADP support, smallholder farmers will need to contribute their own resources for the on-farm investment. For these farmers, this can be a risky proposition—if a disaster hits during the adoption period, they could stand to lose their agricultural products and their investment.

So, to reduce the farmers’ investment risk during this period, the NADP introduced an innovative contingent finance and response mechanism to safeguard the farmers’ investment contributions and ensure that they have resources available to restart production in case of extreme weather events.

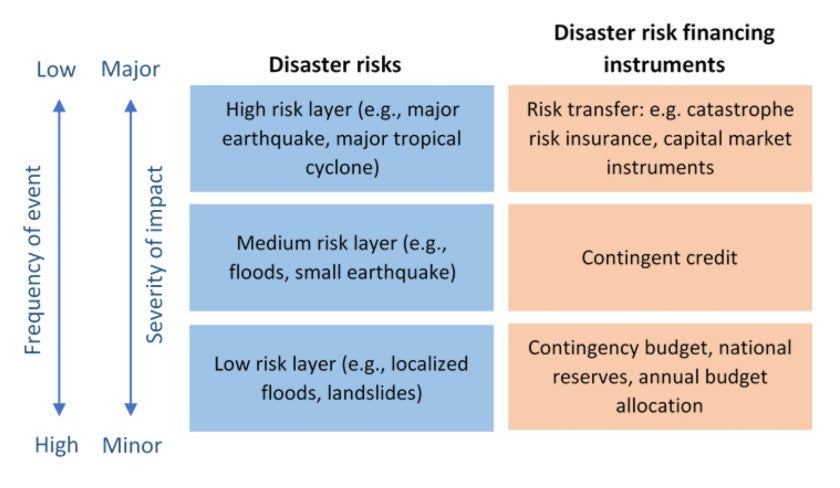

Lessons learned from other WBG agriculture projects in DRC and other countries show that when post-disaster financing is unavailable or access to it is delayed, the longer-term impacts are high. To address this, the World Bank has developed the Disaster Risk Financing (DRF) framework and applied it to the case of the agriculture sector in DRC with analytical work funded by the State and Peacebuilding Fund (SPF) . This approach provides for a risk-layering strategy to minimize costs and maximize benefits in managing post-disaster losses in the agriculture sector. The NADP used the DRF framework to design the contingent financing mechanism in the project with support from SPF.

DRF Framework

Source: Adapted from Ghesquiere and Mahul, 2010

Using the DRF approach for agriculture investments also allows for timely access to prearranged funding after a disaster, helping strengthen the fiscal resilience of the government to crises and disasters by improving the speed and quality of government’s public expenditures.

Before and After the implementation of the Innovative Contingency Finance Mechanism for PNDA

Source: World Bank (2021)

There are several benefits in using contingent financing to minimize the risks of adoption of agricultural innovations:

- Providing faster response time to the disaster without jeopardizing other aspects of the emergency response.

- Protecting beneficiaries’ investments by promoting adoption of climate and nutrition smart agriculture practices and technologies.

- Leveraging private capital to share extreme weather risks (through insurance/derivatives) faced by smallholder farmers.

- Incentivizing the DRC Government to prepare contingency plans to be better prepared for future crises.

“2020 was a very busy year responding to multiple crisis and disasters in the agriculture sector, preparing response plans for locust in the North East, floods, Ebola and conflict in the East, and a national COVID-19 emergency ”, said Augustin Baharanyi, Director of Planning and Studies at the Ministry of Agriculture.

For him, this financing approach is great news. Now, instead of reacting to emergencies, he can have a financial plan in place before disasters and crises happen, completely shifting the focus of his department towards a more proactive role in safeguarding the farmers’ future investments.

Join the Conversation