In the wake of the Global Financial Crisis (GFC), many wondered whether the strong pre-crisis trend toward greater internationalization in banking would be reversed and, more immediately, whether local state-owned banks had to assume a larger role in restoring banking stability and ensuring the delivery of credit. We revisit those conjectures in the light of new data on bank ownership and research on the post-Crisis period (Cull, Martinez Peria, and Verrier, 2018).

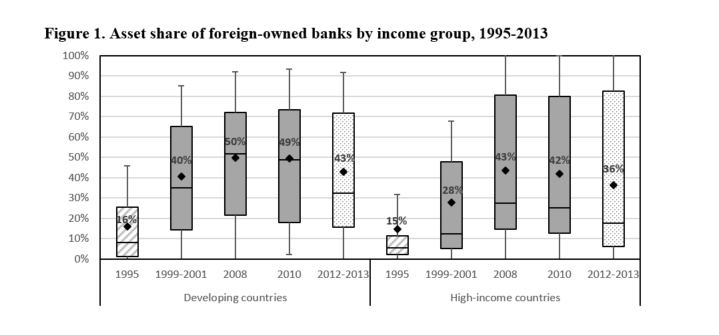

Between 2008 and 2010 the median share of assets held by foreign-owned banks fell by 3.1 percentage points in developing countries and by 2.2 percentage points in high-income countries (Figure 1). This retrenchment at the onset of the crisis can be explained in part by the propagation of shocks across borders by global banks, but also by the fact that many financial institutions from crisis-affected countries repatriated their funds from abroad to make up for capital losses and meet higher capital requirements that were imposed on them. In contrast, so called South-South cross-border investments in banking not only held up during the GFC, but subsequently grew. That is, banks from non-OECD countries recorded positive net foreign entries in every year between 2009 and 2013 and more than doubled their presence abroad, mostly in their own regions (Claessens and Van Horen, 2015).

Note: See page 42 in the working paper for more information on calculations and sources

Conversely, there was greater emphasis on the role of government-owned banks, as many high-income and developing countries recapitalized or nationalized troubled banks following the GFC. Notable cases included Iceland, Kazakhstan, the United Kingdom, and Venezuela, where the share of assets held by the government in the banking sector increased by more than 10 percentage points between 2008 and 2010. General trends for government bank ownership were milder, but also positive – the average share of banking sector assets held by government-owned banks increased by 1 percentage point in developing countries and two percentage points in high-income countries.

While there was some aggregate post-crisis retrenchment and advance on the part of foreign and government-owned banks, respectively, the average banking asset shares mask important variation, especially across geographic regions. For example, asset shares of government-owned banks increased slightly in Latin America and high-income countries, but only in Europe and Central Asia was the increase substantial, from 9% of banking sector assets in 2008 to 14% in 2010 (Figure 2). Not surprisingly, increases in government ownership of banking assets coincided with commensurate declines in the share of assets held by foreign banks. High-income countries and Latin America witnessed modest declines (2-3 percentage points) while the only substantial decline was in Europe and Central Asia (from 60% of banking assets in 2008 to 48% in 2010).

Note: See page 42 in the working paper for more information on calculations and sources

Across most regions, therefore, declines in foreign bank presence were modest, or foreign banks maintained (East Asia, South Asia) or increased (Sub-Saharan Africa) their shares of banking assets. Even in Europe and Central Asia ownership of banking sector assets by foreign banks had largely rebounded by 2012-2013. In that sense, retrenchment by foreign banks in the wake of the GFC was more muted than many observers had feared.

But that doesn’t imply that there were no important structural changes in the banking sectors of developing countries. Subsidiaries of banks headquartered in high-income countries accounted for most bank exits during this period, while entries were concentrated among subsidiaries of banks headquartered in developing countries, and their destinations tended to be neighboring developing countries (Claessens and Van Horen, 2015). Thus, the increase in South-South entry coincided with greater regionalism in banking. As described in World Bank Global Financial Development Report (GFDR) 2017/2018: Bankers without Borders, while foreign banks from neighboring countries may be more inclined to extend credit to typically underserved market segments, they can also increase a country’s exposure to shocks within the region. And if those banks face lax regulation and supervision in their countries of origin, the host countries face amplified risks in terms of credit booms and busts.

Finally, in revisiting the evidence on banking stability and outreach, it should be acknowledged that government-owned banks played a key role in shoring up faltering banking sectors with liquidity and capital during the GFC, particularly in Europe and Central Asia and advanced economies. But those interventions were ad hoc and one-off, and are not likely to signal a shift to greater reliance on state ownership to ensure stability in banking. GFDR 2017/2018 emphasizes that greater cross-country coordination among supervisors and ex-ante agreements about burden sharing in the event of failures of international banks are key to enhancing the stability of the global banking system.

Even in the wake of the GFC, the literature remains decisive on the advantages of foreign banks in terms of spurring technological advancement and efficiency in developing countries, and the resultant improvements in banking sector competition. Enhanced competition among private banks (domestic and foreign) ultimately benefits consumers of financial services. The emphasis should not, therefore, be on carving out a larger role for state-owned banks in developing countries in the name of enhancing stability. Rather, it should be on cultivating the growth-enhancing benefits of competitive private banks while mitigating the attendant risks through effective bank regulation and supervision. Fortunately, bank regulation and supervision is the topic of the next GFDR.

This working paper was co-authored by Bob Cull, Maria Soledad Martinez Peria and Jeanne Verrier.

Join the Conversation