Kolkata, India, 03/22/2020: Awareness of common people during COVID-19 in outbreak in city. A grocery owner with protective face mask. ©suprabhat/Shutterstock

Kolkata, India, 03/22/2020: Awareness of common people during COVID-19 in outbreak in city. A grocery owner with protective face mask. ©suprabhat/Shutterstock

The negative impact of the pandemic on small enterprises is well documented. In a two-month period, from February to April 2020, the number of active business owners in the US fell by 3.3 million or 22 percent, the highest change in recorded history. To mitigate the impact of these changes, economies implemented numerous crisis response measures, including in revising their procurement procedures to reach smaller firms and increase regulators’ discretion. World Bank data reveal that in the recovery phase countries support small businesses with a variety of measures.

A closer look at the data shows that extending short-term finance is the most widely used type of support. New lending under concessional terms, delayed repayments, restructuring and rescheduling, credit guarantees with new schemes, and capital buffer safeguards - such as lowering capital requirements on banks and central banks’ actions to induce commercial banks to increase lending to business - are some examples of finance instruments used by various economies. For example, the French government has attempted to increase the liquidity of companies through state-guaranteed loans or investments in minority equity positions (EUR 3.5 billion). These schemes go beyond the assistance provided in the EUR 16 billion loan guarantee program announced during the early crisis response period in April 2020.

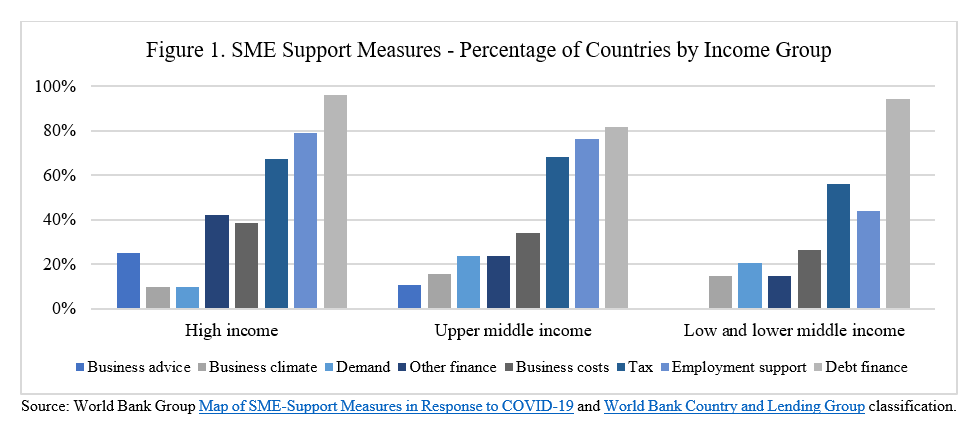

Figure 1 lists the most common measures adopted by countries at different income levels, displayed as the percentage of countries in that income group who have adopted at least one measure in each category. There is one clear difference between groups. As the second most commonly adopted set of policies, high and upper-middle income countries are relying on measures for job retention while low and lower-middle income countries favor tax-based measures. Wage subsidies, cash transfers to informal or self-employed workers, and financial support to digitization efforts and reskilling are some examples of employment support measures adopted so far. In Germany, for example, business support schemes boost cash balances through deferred import VAT and more flexible depreciation rules.

Such measures are less feasible in low and lower middle-income countries, where governments have instead focused on reductions in the corporate income tax rate and expedited tax refunds. In Honduras, for example, the government has announced the deferral of tax payments for SMEs, including the corporate income tax, individual income tax, solidarity contribution and net assets tax. In addition, taxpayers who chose to file on time obtained an 8.5% income tax discount.

Looking at regions, employment support is the most common measure adopted by OECD countries (100%), closely followed by debt finance. In other regions, priorities are different. In Mozambique, among other developing economies, more than 90% of jobs are in the informal sector. This can create a gap: governments adopt measures that end up not benefitting their firms. Recent data from Enterprise Surveys show that this gap can be huge in countries where informality is prominent. In Zimbabwe, only 3 percent of surveyed firms received or expect to receive national or local government assistance. As a contrast, in Italy, that number is brought to 57.2 percent, including 60.8 percent of small firms.

As country after country shifts government support from early crisis response measures to recovery plans to bolster the post-pandemic economic rebound, there is a clear pattern emerging in the type of measures adopted by high-income economies and emerging markets. The former use a mixture of supply and demand-boosting components in their recovery programs, reaching households and businesses alike. The latter group finds it more difficult to target households and small firms, as these are often in the informal sector. The focus is hence on promoting recovery in specific industries or through tax-reduction measures that benefit larger formal firms.

Join the Conversation