Young women being taught to use sewing machines

Young women being taught to use sewing machines

Recently expanding research on COVID-19 emphasizes the disproportionate impact the pandemic has had on certain groups and sectors of the economy, potentially amplifying their pre-existing vulnerabilities and worsening inequalities. A recent World Bank working paper uses the World Bank’s Business Pulse Survey covering over 130,000 firms in 50 countries. It reports three key findings for South Asia: first, firms in the South Asia region suffered disproportionately more from the economic brunt of the pandemic. Second, even within the region, COVID-19 did not affect all firms equally. Although exporters remained resilient by some metrics, firms that are smaller, female-led firms and those in vulnerable sectors suffered higher rates of closure. Third, while digital technologies are taking the center stage as the pandemic continues to unfold, the South Asia region lags in the adoption of these technologies.

The impact of COVID-19 is disproportionately higher for South Asian firms

Governments around the world implemented mobility restrictions to avoid the rapid expansion of Covid-19 during the first weeks after it was declared a global pandemic. About 34% of South Asian firms were temporarily closed compared to 20% in other non-high-income countries. Moreover, average sales declined significantly more for South Asian businesses – 64% from 2019 level compared to 52% in Sub-Saharan Africa and 46% in other developing countries. The pandemic also elevated the financial fragility of firms, and more so in South Asia. During the first wave of the survey held from May – July 2020, two out of three firms in South Asia was either already in arrears or expected to fall into arrears in the next six months. This measure of financial fragility is higher compared to Sub-Saharan Africa (52%) and other developing countries (43%). See Figure 1.

Figure 1. Firms in South Asia are more severely impacted relative to those in other regions

Notes: All Regressions presented in this note control for size, sub-sector and country fixed-effects, along with the timing of the implementation of BPS relative to the peak of the crisis (measured using google mobility data). See working paper for more details.

Perhaps due to the above massive impact on sales and financial health, South Asian firms’ outlook towards the future changes in sales and employment is also quite negative. Surveyed South Asian firms expected their future sales to decline by about 20% compared to their 2019 level. This expectation on drop in sales in six months following the survey is larger compared to Sub-Saharan Africa (1%) and other developing countries (8%).

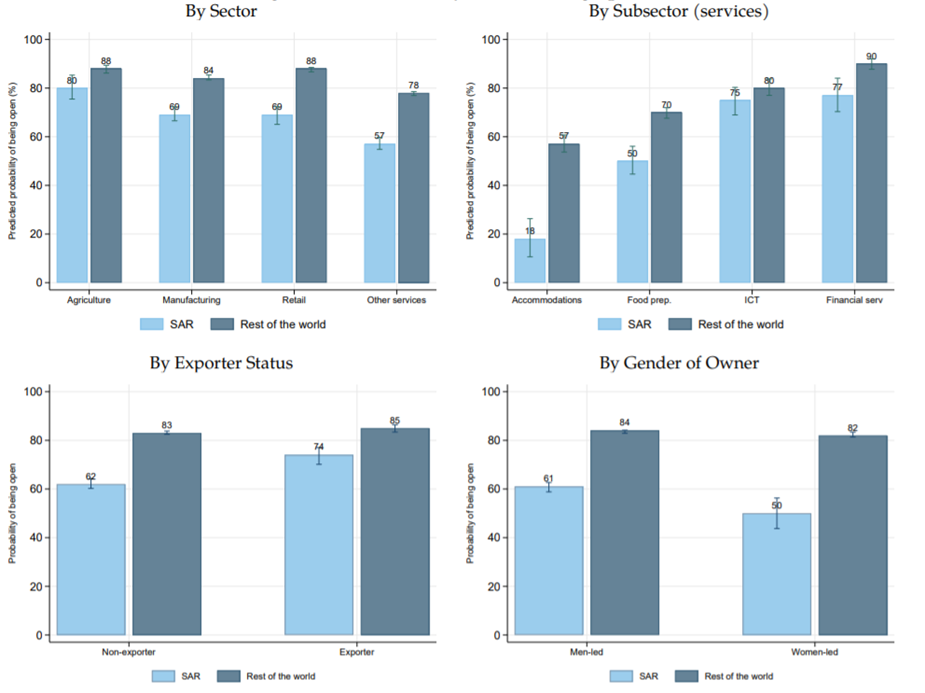

Within the South Asia region, COVID-19 did not affect all firms equally

Micro and small firms and those led by women have generally suffered more in terms of business closures. The probability of being open for micro and small firms stood at about 70% (compared to about over 80% for medium and large firms) and for female-led firms is at 50% compared to 61% for male-led firms in South Asia. The probability of being open was lower for South Asian firms in accommodation services (18%) and food preparation (50%) compared to ICT and financial services (over 75%). Micro and small firms and those in manufacturing and accommodations subsector also suffered the largest declines in sales.

Meanwhile, exporters had a higher probability of remaining open (83%) compared to non-exporters (76%). In this sense, exporters were able to navigate the crisis slightly better: exporting firms were also less likely to fall into arrears. This result shows the importance of diversifying markets, especially during a crisis environment. The fact that smaller and non-exporting firms represent over 80% of the region's employment and employ a large share of the region's female workforce suggests that the pandemic can aggravate the existing vulnerabilities and inequalities.

Figure 2. Relative to non-exporters, South Asia exporters are slightly resilient. Female-led firms are more severely hurt than their male counterparts.

Notes: See Figure 1. The breakdowns may not match the overall averages by some dimensions (e.g. on exporter status and gender of owner) because the underlying data is slightly different, given that not all firms report these attributes.

Given the uniqueness of the shock, many viable and productive firms might close or reduce their human capital stock in the absence of public support. Notwithstanding, the response by governments in the region has been lagging relative to other regions, albeit the shock of the pandemic has been much more severe in South Asia. South Asian governments possibly have limited fiscal resources compared to high income countries and perhaps even other developing ones. For example, only 11% of firms had received some type of public support at the time of the survey, compared to 18% and 59% in other developing and developed countries, respectively. While micro small firms and female-led firms were usually the most disadvantaged in terms of receiving public support, exporters in South Asia had slightly better coverage (Figure 3). Lack of information is the most common reason for poor access to support.

Figure 3. Access to public support for firms is among the least in South Asia compared to other regions

Due to the surging needs and lack of time to prepare, governments around the world used firms’ size and sector to target their support. Size and sector, for instance, explains about 30 percent of the probability of receiving access to credit (Figure 4). While this approach may prevent widespread mass layoffs and business closures in the short run, this might not be the best strategy to address the needs of firms as they strive to recover from the crisis. The type of shock suffered alone explains about 22 percent of the preference for access to credit, while size and sector together explain less than 9 percent. Given the limited resources, customizing support programs to help firms recover based on the shocks suffered is crucial in helping resilient recovery.

Figure 4. The type of shocks suffered explains the preference for policy on access to credit, while beneficiaries seem to be targeted by sector

Join the Conversation