A worker cleans an escalator at a mall on May 29, 2020 in Taguig, Metro Manila, Philippines. Photo: World Bank

A worker cleans an escalator at a mall on May 29, 2020 in Taguig, Metro Manila, Philippines. Photo: World Bank

Empirical evidence on the effect of the COVID-19 pandemic on international trade is still nascent, mainly covering developed economies and primarily descriptive.

A new World Bank Working Paper investigates the impact of lockdowns on the international trade of the Philippines, one of East Asia’s top traders, and one of the countries in the region most affected by the virus with the highest number of infections in East Asia between mid-August and mid-October 2020.

In response to this, the government imposed several measures to lessen the spread of the virus, the relaxation of which started in late May 2020. At the same time Philippine’s trading partners were imposing lockdowns as well. Using a monthly series of product-by-country data for the period from January 2019 to December 2020 and an event study design, the paper shows that domestic lockdown measures did not significantly affect international trade but external lockdowns affected both exports and imports . The combined drop in exports of goods and services was larger than in the Asian financial crisis in 1998 (-14.7%) and the global financial crisis in 2008-2009 (-11.8%).

Figure 1: Cumulative exports and imports and Lockdowns in the Philippines (2019 and 2020)

Note: Mild lockdown indicates the month when few restrictions were in place. Severe lockdown is the month when all measures were imposed. Relaxation is the first month when some lockdown measures were lifted

Source: The Impacts of Lockdown Policies on International Trade in the Philippines

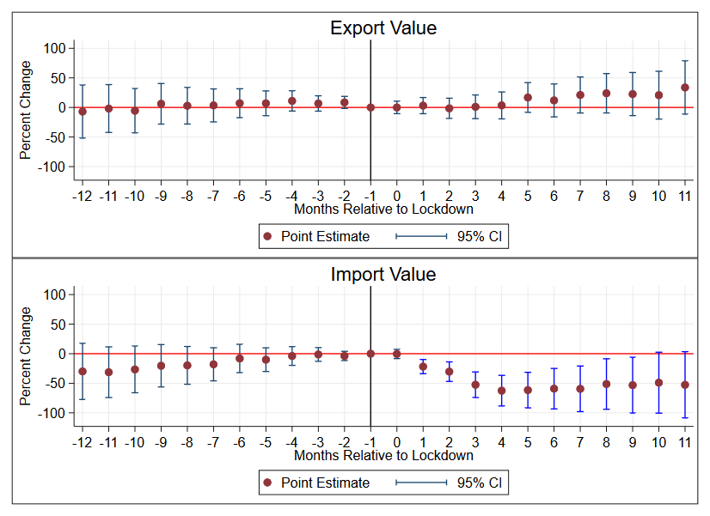

More Significant Impact on Imports Values

While both exports and imports dropped upon imposition of the lockdown by trading partners of the Philippines, these affected import values more (over 50 percent average monthly drop) than exports (less than 10 percent drop) . The slump in imports was driven by the bottom 90 percent of trading partners while the drop in exports was driven by the top ten trading partners. In terms of measures, the impact on imports were driven by workplace closures, stay-at-home requirements, restrictions on internal movement, and international travel controls by trading partners. For exports, restrictions on internal movements and international travel controls in partner countries were the key driver.

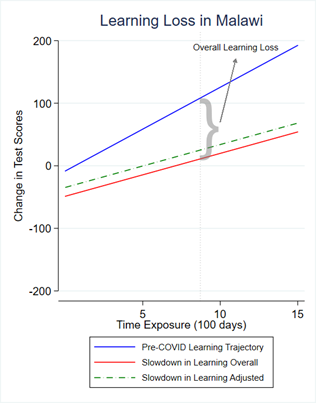

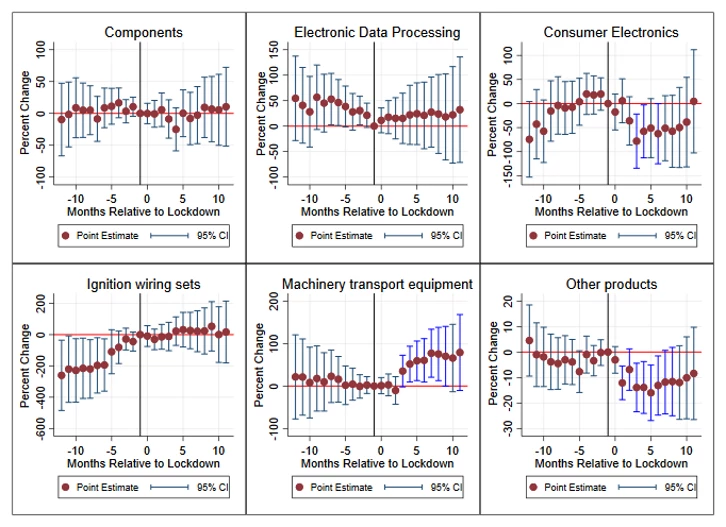

Exports of Intermediate Products Proved Resilient

The drop in exports was driven by all non-intermediate products,which implies that the forward linkages of GVC export trade was relatively resilient to foreign lockdowns (Figure 2). Among intermediate goods, the external lockdowns did not have an effect on exports of components, electronic dataprocessing and ignition wiring sets, while exports of machinery transport equipment actually improved (Figure 3). On the other hand, both intermediate goods (particularly consumer electronics, machinery transport equipment) and non-intermediate products were responsible for the decline in imports. This suggests that export value chain trade was relatively more robust to the lockdown while backward value chain trade declined during the pandemic. This is consistent with Mendoza (2021) who find that low backward GVC transactions in manufacturing were the driver of the decline in overall GVC trade that resulted from COVID-19.

Figure 2: Effects of lockdown policies on export and import trade of intermediate goods

Note: Blue spike means a coefficient is significant

Source: The Impacts of Lockdown Policies on International Trade in the Philippines

Figure 3: Effects of lockdown policies on the Philippines’ Intermediate export values by products

Note: Blue spike means a coefficient is significant

Source: The Impacts of Lockdown Policies on International Trade in the Philippines

Finally, both exports and imports were more affected at the extensive margin (number of exported products) than the intensive margin (average sales per product) when trading partners imposed lockdowns. This indicates that lockdown measures hindered interactions among people, in turn reducing the potential of businesses to create new relationships and launch new products in foreign markets.

No Statistical Evidence of Domestic Lockdowns’ Impact on Exports and Imports

Since lockdowns affected entire countries and regions, domestic production or regionally based supply chains would not have prevented the disruption to production systems. However, global value chains, through extensive supply chain networks with diversified and geographically dispersed suppliers, can help countries adjust better and contribute to a speedy recovery and possible resilience to future shocks , as several recent evidence has shown (e.g Miroudot, 2020).

Join the Conversation