Women watering mukau sapplings in Kenya's arid Eastern Province. © Photo: Flore de Preneuf / World Bank

Women watering mukau sapplings in Kenya's arid Eastern Province. © Photo: Flore de Preneuf / World Bank

According to the Uppsala Conflict Data Program (UCDP) Georeferenced Event Dataset (GED), in the last ten years, 184,201 fatal violent events have taken place worldwide, resulting in the loss of 1,097,697 lives. This human toll, which does not account for indirect deaths, surpasses the estimated number of battle-deaths from the 1980-1988 Iran–Iraq War or the 1978-2002 Afghan Civil War. By 2030, up to two-thirds of the world’s extreme poor are expected to live in countries affected by violence and conflict. In other words, the combined situations of extreme poverty and exposure to conflict will become more frequent in the future. It is important to understand how income levels and economic prospects can affect the risk of conflict at the local level in order to develop sound policy recommendations for low- to intermediate- income countries concerned about “conflict traps” and that are exposed to income shocks from climate change and commodity price disruptions.

There is little doubt that conflict has a detrimental effect on development. But the influence of local economic conditions — such as incomes and economic prospects for active or potential warring groups and individuals—on the risk of conflict, and how these can be modelled, is a subject of discussion amongst researchers. Since the 2010s, the use of conflict location data and satellite imagery has provided new tools to better understand in which local contexts violence develops. Empirical frameworks based on small spatial units, especially grid-cells, and georeferenced data introduce key sources of heterogeneity at the local scale. These variations can then use quasi-experimental frameworks to isolate and test the validity of one mechanism compared to another.

The sub-groups in our paper

Our study is one of the first meta-regression analysis (MRA) that examines the local effect of income shocks on the risks of conflict. In contrast to simple meta-analysis, this statistical method highlights one or more study characteristics that can explain heterogeneity among estimates from selected studies. In other words, the MRA objective is to summarize and ``make sense” of statistical heterogeneity, such as the true effects in each study not being identical in the literature. Previous MRAs have examined how the risk of conflict responds to natural resource endowment, commodity price shocks and climate change. This MRA reconciles all these different approaches through the prism of income shocks. As highlighted by recent literature reviews, natural resource endowment, commodity price shocks and climate change could affect the risk of conflicts through income shocks both for active or potential warring groups and individuals.

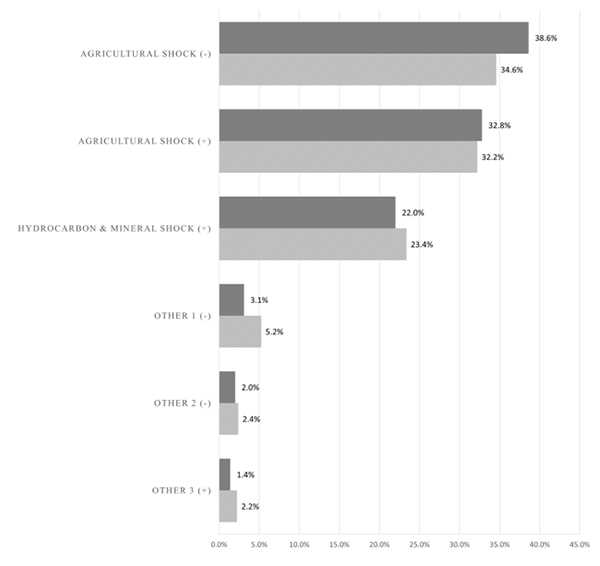

The 2,462 estimates from 64 studies test the relationship between the risk of internal conflict and different types of positive or negative shocks. As a result, our meta-sample is heterogeneous in terms of the variables of interest and the transmission channels implicitly tested by the authors. Analyzing this raw sample would complicate the interpretation of the MRA’s results and limit our contributions to two central debates in conflict economics, namely, what economic mechanisms are at play and how to test them. We split the collected estimates into four meta-regression subgroups that differ in the direction of the shock —income increasing or decreasing — and the sector of activity that is affected — agriculture, extractive or other sectors.

The first group, Negative Agricultural Shock (AS-), contains all estimates of negative transitory agricultural shocks, such as droughts, floods, and rain deficiencies. The second one, Positive Agricultural Shock (AS+), includes all estimates of positive transitory agricultural shocks, such as increased demand and international prices for the cultivated goods, and environmental conditions particularly suitable to its production. The third group, Positive Hydrocarbon/Mineral Shock (HS+), contains all estimates of transitory shocks on extractive goods, such as hydrocarbon and minerals, including increases of the international price of the resource and subsidies to mining concessions. The other estimates fall into the heterogeneous category, Other Shocks, which includes estimates of positive or negative pure climatic shocks that are not explicitly related to agriculture, labor market shocks, financial crisis, or shocks to the drug sector (Figure 1).

Figure 1: Distribution of Estimates According to their Meta-Regression Subgroup

Source: Authors construction. Notes: Shares in the total sample of 2,464 estimates are represented by solid bars. Shares in the baseline sample (i.e., excluding interactive models) of 1,391 estimates are represented by hatched bars. OTHER 1: estimates of negative pure climatic shocks. OTHER 2: estimates of labor market shocks, financial crisis and shocks to the drug sector. OTHER 3: estimates of positive pure climatic shocks.

Local asymmetries

When decomposing for the nature of main income shocks, our results show that positive income shocks in the agricultural sector genuinely reduce the risk of conflict locally. They also indicate that income-increasing and decreasing shocks do not have a symmetric effect on conflict, supporting non-income-related factors, including grievances and state capacity, as motives of conflicts. Finally, our results show that researchers’ expectations on the theoretical mechanisms at play — above all, opportunity cost and rapacity — distort statistical inference and the resulting understanding of research on the local causes of conflict. For instance, our findings indicate that the local relationship between climatic events and conflict may be more complex than previously thought, with indirect channels beyond changes in local agricultural income potentially playing a role.

Overall, our meta-analysis highlights the importance of caution in overgeneralizing the results of studies on income shocks and their relationship with local conflicts, particularly when recommending policies to countries outside the studies areas. The real effect that positive agricultural shocks have on reducing risks of conflicts and the associated asymmetries, suggests that peacemaking mechanisms linking income shocks to local risk of conflict, should be further analyzed to more effectively inform policies that alleviate conflict risk.

Join the Conversation