Corruption is one of the most vexing problems confronting us today: it causes misallocation of resources and holds back investment, innovation, entrepreneurship, growth and productivity. It can have important distributional implications as its effects may fall more heavily on some agents than others.

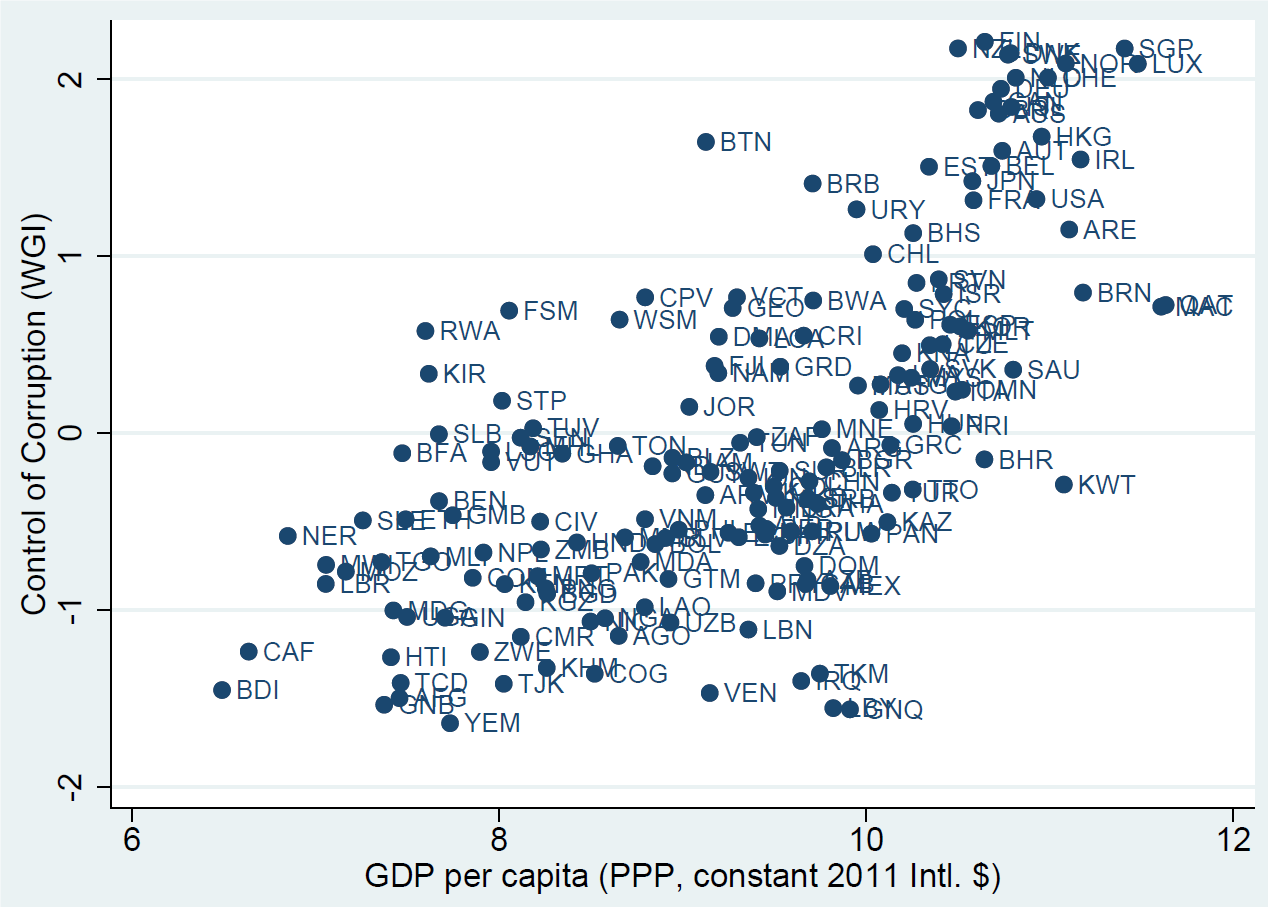

At the same time, levels of corruption vary across countries, even among ones at roughly the same level of economic development (figure 1). Why is corruption higher in some places than others? Answering this can help identify what leads to corruption. This is an essential first step in designing polices aimed at curbing this undesirable practice.

Figure 1: Control of Corruption and GDP per capita relationship

A recent study, Amin and Soh (2019), based on data from Enterprise Surveys, focuses on the size of a country (total population) as a possible explanation of why some countries are plagued with more corruption than others. Economic theory suggests that, when it comes to corruption, there are advantages and disadvantages to being a large country. Economies of scale in governance imply that larger countries have more efficient bureaucracies, better implementation of laws, more effective rule of law, and better institutional quality, all of which should serve to constrain corrupt politicians and bureaucrats. This suggests that corruption should be lower in relatively large countries. However, if administrative costs escalate with country size, reversing economies of scale, the quality of governance may be poorer and corruption could be greater. Further, as suggested in the broader literature, greater diversity in the larger countries implies that such countries may find it harder to reach a consensus on growth-enhancing anti-corruption reforms.

Empirical analysis in Amin and Soh (2019) is based mainly on firm-level survey data for 135 mostly developing countries. These data were collected by the World Bank’s Enterprise Surveys (ES) between 2006 and 2018. Other data sources such as World Development Indicators (World Bank) were also used. The ES asked firms how much in bribes (as a percentage of annual sales) firms like theirs needed to pay public officials to “get things done”. The motivation for this question is that firms are most likely to report their own experience with bribery. This constitutes the overall corruption measure. The ES also contains information on instances of corruption that firms experience in soliciting the following: obtaining an electricity connection, obtaining a water connection, obtaining a construction permit, obtaining an import license, obtaining an operating license, and inspections or meetings with tax officials. Based on this information, the ES compiles two separate measures of petty corruption. The first measure is the incidence of petty corruption, defined as a dummy variable equal to 1 if a firm experienced a bribe payment or request in one or more of the six transactions listed above and 0 otherwise. The second measure is the depth of petty corruption, defined as the proportion of six transactions for which the firm experienced a bribe payment or a request for one.

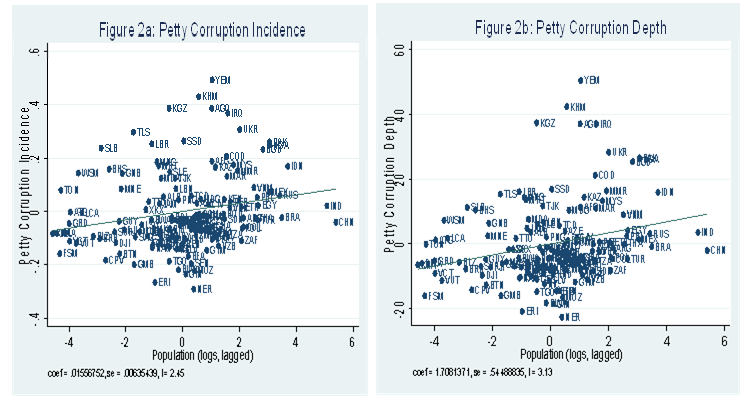

The study finds that corruption is indeed higher in relatively larger countries. Figure 2 illustrates the point graphically for overall corruption; figure 3 does the same for petty corruption (incidence and depth). The empirical results confirm that the positive relationship in figure 2 and 3 survives even after controlling for several firm- and country-level variables and is robust to the alternative measure of country size (surface area). According to a conservative estimate, an increase in country size from the level of Namibia (25th percentile value for population) to the level of Nepal (75th percentile value for population) is associated with an increase in overall corruption by a large 0.37 percentage points, or about 31 percent of its mean value. The corresponding increases in the incidence of petty corruption and depth of petty corruption equal 3.6 percentage points (mean of the variable is 18 percent) and 4.2 percentage points (mean of the variable is 14.1 percent) respectively.

Figure 2: Overall corruption and country size controlling for GDP per capita

Figure 3: Petty corruption and country size controlling for GDP per capita

One issue that comes to mind is that if diseconomies of scale are indeed affecting corruption, we should find corruption rising with country size more in poorer countries than richer countries. The reason is that richer countries have more resources and are therefore likely to be more able to counter at least some of diseconomies of scale associated with being large. Another possibility is that the weaker capacity of institutions to check corruption in large economies affects relatively capital-intensive industries more than others. Firms in more capital-intensive industries have larger sunk costs that reduces their outside options and mobility, perhaps making these firms more susceptible to corruption. Amin and Soh (2019) confirm both of these theories, providing credence to the causal impact of larger country size on corruption via the diseconomies of scale route.

Of course, country size is not easily addressed by policy change. Nevertheless, the findings above have important implications for policymakers. The higher costs of combatting corruption in larger countries implies that these states must look for alternative methods of controlling bribery. For instance, the study above reports that the effects of country size on corruption can be countered at least to some extent by strengthening the democratic institutions. Other such remedial measures can be explored.

Understanding the causes of corruption, both at the country and firm-level, is a fruitful area for research. For instance, Amin and Soh (2020) studied if heavier regulation on businesses impact the level of corruption experienced by private firms. Several interesting avenues remain to be explored: how effective are democratic institutions in controlling corruption? Do firms and industries that rely more on institutions and public infrastructure face higher levels of corruption than others? We hope that future research can help answer these and related questions.

Join the Conversation