As current and former World Bank employees, we have all worked to speed the development of African economies and have viewed Africa’s recent spectacular growth with mounting enthusiasm. Thus, we have followed with growing sadness and dismay the stories of human suffering emanating from Liberia, Sierra Leone and Guinea in the context of the Ebola epidemic. These horrifying stories of the effect of Ebola in West Africa are now overshadowing continued good economic news from the rest of the continent.

About a month ago we were asked – together with a much larger team – to estimate the economic costs of the outbreak for the West Africa region. The report, titled “The Economic Impact of the 2014 Ebola Epidemic: Short and Medium Term Estimates for West Africa,” was released yesterday.

Although there is still great uncertainty about the Ebola epidemic, our task was to produce best-effort estimates of its macroeconomic and fiscal impact using the best tools immediately available. But Ebola is quite different from standard shocks to developing countries, including slow-moving diseases like diabetes or hypertension. The standard approach to estimating economic impact of diseases is to compute the cost of medical care (the “direct” cost) and the loss of output from people who can’t work (the “indirect cost”).1 But given the rapid spread and high fatality rate of Ebola, this approach would not come close to capturing the third quarter 2014 impact already visible to the World Bank’s country teams.

Drawing on previous work on Severe Acute Respiratory Syndrome (SARS), we posit that a rapidly- moving, often fatal disease elicits “aversion behavior,” as economic agents withdraw from commercial interaction, shun what they perceive to be exposed assets, and postpone or divert investment from affected economies. Since “aversion behavior” appears nowhere in our economic models, we assume that aversion behavior leads to the withdrawal or reduced utilization of certain percentages of both labor and capital and to increased transaction costs on both domestic and international economic transactions.

Defining the size of the economic shocks

Epidemiological assessments and the latest on-the-ground economic data helped the World Bank’s country teams assess the impact of Ebola on projected GDP in the core crisis countries – Liberia, Guinea, and Sierra Leone. The effects of the crisis on a wider set of indicators (including trade, private consumption, and poverty), both in the core countries and beyond, were assessed with the help of available Computable General Equilibrium models and databases, both a country model for Liberia (MAMS) and a global model (LINKAGE) in which West Africa was singled out for special attention. The simulations drew on data from the country teams on crisis-related channels – workers stay home, leaving capital and natural resources idle; higher transaction costs constrain domestic and international trade; FDI dries up; and foreign grant aid for health and other interventions is boosted.For Liberia, the MAMS simulation results indicate that, if the policy response is immediate and effective, the economy may be able to quickly rebound, making up for the losses in 2015. However, a slow and ineffective response may create severe production losses. The impacts on household consumption may be particularly severe with poverty rates in 2015 climbing from current rates of 55-60 percent to 75-80 percent.

Analysis of countries other than the core crisis countries, where very few cases have been registered is more challenging. Gomes et al. (2014) predict the likelihood of an Ebola outbreak in the 16 most at-risk countries and the likely number of cases (conditional on a single case) using flight connections (as in the figure below). We multiply the two figures to estimate the expected number of cases for a given country. Then we divide the expected number of cases for each country by the square root of that country’s GDP; this accounts for the fact that richer countries have better health infrastructure to contain the epidemic. The result of this calculation is an “Ebola Impact Index”.

Likely spread of Ebola using flight connections as a proxy

Source: Gomes et al. (2014)

Next we scale down the factor and transaction cost shocks from Liberia (the hardest hit economy) by the Ebola Impact Index to get the expected shock on each country in the model. Gomes et al. model the spread over 1,000 micro simulations; we use probabilities from the low end of the resulting distribution to simulate a “Low Ebola” scenario (limited spread to other countries) and probabilities from the high end of their distribution to simulate a “High Ebola” scenario (extensive spread).

Impacts on West Africa

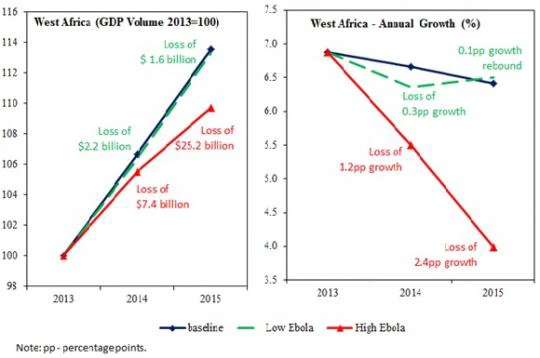

Applying the LINKAGE model to the Low Ebola and High Ebola scenarios permits the estimation of the impact of the Ebola epidemic on West Africa as a whole, capturing the spillover and feedback effects across different sectors and economic agents (households, firms, government) across multiple countries and regions.The result is that, in the Low Ebola case, there is only a modest difference in economic growth for West Africa as a whole for the year 2015. Growth takes a significant hit in the three core countries in 2014 but a much smaller hit for other countries in the region. This reflects a scenario in which the regional economic impact of the crisis is contained. In the High Ebola case, the economic impact on West Africa is much more severe, with projected GDP growth declining from 6.8 percent to 5.6 percent in 2014 and from 6.4 to 4.1 in 2015.

This slower growth translates into a moderate loss in GDP volume in the Low Ebola case, amounting to US$3.8 billion by the end of 2015 (2013 dollars) across West Africa. The loss in GDP in the High Ebola case is almost nine times larger, at about US$32.6 billion over the two years (see the figure below): That is 3.1 percent of what regional GDP would have been in the absence of Ebola in 2014. This is an enormous cost, not only for the most affected countries, but for the region as a whole. Ebola has the potential to be deeply destabilizing and requires an immediate response.

Impact of Ebola on GDP and Annual Growth Rates for West Africa

The economic impacts of Ebola are already very serious for the three hardest-hit countries. In broader regional terms, the economic impacts may be limited if immediate national and international responses succeed in containing the epidemic and mitigating aversion behavior. The successful containment, thus far, of the epidemic in Nigeria and Senegal is evidence that this is possible, given existing health system capacity and a resolute policy response.

A swift policy reaction by the international community is crucial. With the potential economic costs of the Ebola epidemic being so high, very substantial containment and mitigation expenditures would be cost effective if they successfully avert the worst epidemiological outcomes.

Join the Conversation