Financial inclusion is a topic of increasing interest on the international policy agenda. Last week the Universal Postal Union (UPU) hosted the 2013 Global Forum on Financial Inclusion for Development. With over a billion people using the postal sector for savings and deposit accounts and a widespread presence in rural and poor areas, post offices (or “posts”) can play a leading role in advancing financial inclusion. In Brazil more than 10 million bank accounts were opened between 2002 and 2011 after the post established Banco Postal in partnership with an existing financial institution. However, leveraging the large physical network of the post is not without challenges. Posts generally have little or no expertise in running a bank and the business model that a government pursues in providing financial services through the postal network may be critical to its success.

Until now, little was known about the types of clients that post offices reach through their financial service offerings and how they might differ from those of traditional financial institutions (such as commercial banks). In a new paper we — together with our co-authors Jose Ansón and Alexandre Berthaud from the Universal Postal Union — document and analyze account ownership patterns at post offices in comparison with traditional financial institutions, using data from the Global Financial Inclusion Indicators (Global Findex) database based on interviews with more than 65,000 adults worldwide in 60 economies with postal banking systems. The nationally representative survey was carried out over the 2011 calendar year by Gallup, Inc. as part of its Gallup World Poll. We also explore the degree to which different postal business models and the size of the postal network help explain differences in account ownership patterns, after controlling for individual characteristics and GDP per capita.

What Types of Formal Accounts Do People Have?

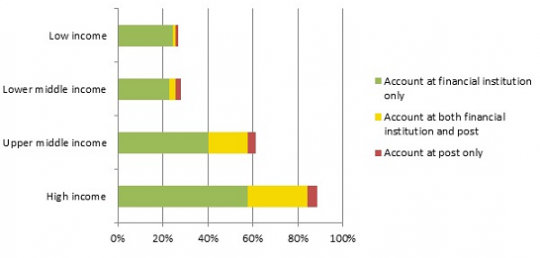

The Global Findex data make it possible to distinguish between three types of account ownership: adults with an account only at a financial institution only, at both a financial institution and the post office, and an account at only the post office. Account penetration varies widely between economies as figure 1 illustrates, but overall, within the sample of economies that offer postal accounts, 50 percent of adults have an account at either or both institutions, 12 percent have an account at the post office, and 3 percent (6 percent of all account holders) have an account at the post office only.

Figure 1: Account ownership by type and World Bank income group classification based on 60 sample countries, 2011

Share of adults with an account at a formal financial institution (%)

Source: Demirguc-Kunt and Klapper, forthcoming.

Who Is Most Likely to Have an Account at the Post Office?

In general, women, poor adults, and rural residents in developing economies are significantly less likely than their counterparts to have a formal account (Allen et al., 2012). Among account holders, we find that those who have an account at the post office tend to be significantly poorer, older, less educated, and less likely to be employed than those who have an account at a financial institution or both a financial institution and the post office. This suggests that post offices may play an important role in providing financial services to segments of the population that are particularly likely to be financially excluded. The results also suggest that posts could play an important role in bridging the gap in account penetration between rural and urban areas.

Financial Services at the Post Office

Using the postal network to deliver financial services is not a new idea. The first postal account was opened in 1861 when in the post of the United Kingdom established a postal savings bank to encourage poor people to save. Since then, many posts have followed suit in offering savings accounts and basic remittance services. For over a century, the business model of the postal savings bank remained essentially unchanged. However, the increasing use of digital communication technologies and falling mail volumes since the 1990’s are forcing post operators to rethink their overall business strategy and diversify their product offerings. As a result, posts in some countries have decided to leverage their existing network to expand the number of financial services they offer. The business model that posts pursue, however, varies.

In India, for example, the loss-making post currently collects deposits from over 150 million adults through its post savings bank and would like to apply for a full bank license to expand the number of financial services it can offer. However, the Indian Finance Ministry is strongly opposed to an application for a bank license on the basis that the business proposal is unlikely to be viable and argue that the post office has no experience or necessary expertise — at both the management and staff level — in running a bank, including handling credit and managing risk.

While some countries have decided — or plan — to convert their postal savings banks into fully-fledged postbanks, posts in other countries, such as Brazil and Indonesia, have chosen to partner with existing financial institutions to offer accounts and savings and credit products. In some countries, such as Benin and Ghana , posts provide cash-in and cash-out services on behalf of banks and micro-finance institutions (MFI’s), both as an access point to deposit and withdrawal from accounts, as well as to disburse and collect repayments on loans. Posts have also partnered with other financial service providers, to offer an expanded number of financial services, including insurance (Morocco) and mobile payments (Tunesia). Posts also often operate as cash merchants for utility and other bill collection, remittance service providers, and government payments.

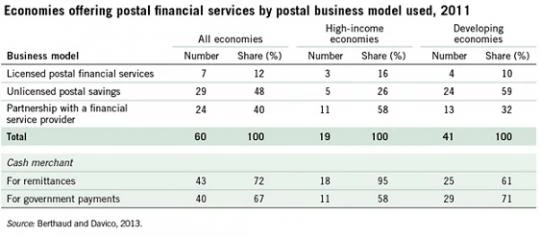

What Types of Business Models Do Posts Pursue?

The Universal Postal Union—a United Nations specialized agency that is the primary forum for cooperation between governments and postal sector players—created a database on post office business models around the world. According to its classification, the posts in 7 economies in our sample have a postal bank license and are under the supervision of the banking supervisor, those in 29 economies provide unlicensed postal savings (i.e. fall under the supervision of their line ministry or the postal regulators) and are usually referred to as post office savings banks, and those in 24 economies offer financial services through a partnership with a financial institution (table 1). In high-income economies the most common business model involves a partnership with a financial service provider. In contrast, in developing economies, unlicensed postal savings banks are the most common business model.

What is the Relationship Between Account Ownership Patterns and Postal Business Models?

Our regression results suggest that while partnership models between posts and other financial institutions are less likely than licensed or unlicensed postal banks to increase account ownership at the post office, partnerships are significantly related to greater account ownership overall. In addition, regardless of whether posts offer financial services on their own (as a licensed or unlicensed institution) or in a partnership with a financial institution, acting as a cash merchant for transactional financial services, such as electronic government and remittance payments, is related to higher account ownership. It is important to note that our data only allow us to establish correlation between account ownership and business models, not causality. However, this finding is in line with evidence from Brazil finding that in some municipalities, Banco Postal’s launch attracted other banks not previously present in these municipalities to open branches (Ansón and Bosch Gual, 2008). Our results are at least suggestive that the contribution to financial inclusion through the post is potentially larger than what we can measure with the share of post office accounts alone.

Going Forward

Given their widespread presence in rural and poor areas, post offices have played an important role in providing access points to financial services. Our new Findex data suggests that posts may be comparatively better at providing accounts to segments of the populations that are most vulnerable to financial exclusion such as the poor, the less educated, those out of the labor market, and those residing in rural areas. But more research is needed to better understand under what circumstances and under which business models posts can most effectively and responsibly expand financial inclusion.

Join the Conversation