The countries of Europe and Central Asia have made undeniable, if uneven, progress in expanding financial inclusion in recent years. The well-developed microfinance industry and relatively widespread use of wage accounts in some countries are signs of success, though low savings rates and high levels of mistrust in the formal financial sector signal that much work remains to be done. The exclusion from the formal financial system of more than 175 million adults—disproportionately located in Central Asia—presents particularly difficult challenge for policy makers in the region. Our recently published Findex note takes an in-depth look at financial inclusion in the ECA region.

After 25,000 interviews in 23 ECA economies, a subset of the larger Global Financial Inclusion (Global Findex) database , we now know that 45 percent of adults in that region have an account at a formal financial institution. This is on par with the rest of the developing world. But of course we know that there is more to financial inclusion than account ownership, it is equally important to have data on how accounts – and other basic financial tools - are used. Account holders in ECA are much more likely to use their account to receive wages or government payments, as compared to account holders in the rest of the developing world (77 percent vs. 41 percent). This is an interesting insight as to what mechanisms are already working to engage adults with formal financial systems, and something to keep in mind when we think about how to move forward.

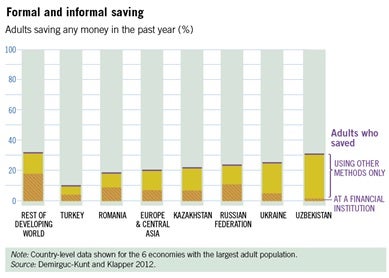

But the data also tell us that among developing regions, adults in ECA are the least likely to report having saved during the past year at a formal financial institution. Just 7 percent of adults in ECA report having saved formally, which is a function of both a lower overall savings prevalence, as well as relatively lower use of formal institutions to save among those who have an account. The data makes a compelling case that the receipt of wage payments is a compelling reason for adults in ECA to open an account, but that it is either too difficult or too unappealing to use these accounts to save. So an important challenge for policymakers might be to find ways to make it easier for adults to save using their wage accounts.

But the data also tell us that among developing regions, adults in ECA are the least likely to report having saved during the past year at a formal financial institution. Just 7 percent of adults in ECA report having saved formally, which is a function of both a lower overall savings prevalence, as well as relatively lower use of formal institutions to save among those who have an account. The data makes a compelling case that the receipt of wage payments is a compelling reason for adults in ECA to open an account, but that it is either too difficult or too unappealing to use these accounts to save. So an important challenge for policymakers might be to find ways to make it easier for adults to save using their wage accounts.

Who are the 175 million unbanked adults in ECA? They are disproportionately women, young, poor, rural, and living in Central Asia. Account penetration is less than 5 percent of the adult population in Kyrgyz Republic, Tajikistan, and Turkmenistan. Men are 25 percent more likely than women to have a formal account, with the largest gender gaps found in Albania, Bosnia and Herzegovina, Kosovo, and Turkey. And consistent with the high rate of use of accounts to receive wages, account penetration is significantly higher among adults who report working full time for an employer (65 percent).

Why do these adults not have formal accounts? This, of course, is a complex question but we figured a good starting point would be to ask them. As in the rest of the developing world, the most frequently cited reason for not having a formal account is lack of enough money to use one: this is the response given by 65 percent of adults in the region without a formal account, with 25 percent citing it as the only reason (multiple responses were permitted). But Europe and Central Asia stands out for the relatively large share of respondents citing trust as an important barrier: about 31 percent of respondents in the region without a formal account report not having one because of lack of trust, compared with 11 percent in the rest of the developing world. In Ukraine, which experienced a run on banks in 2008, 55 percent of adults without an account report lack of trust as an important barrier. In contrast with other barri¬ers (cost, distance, documentation requirements), lack of trust is an entrenched issue with no mechanical solution, making the expansion of financial inclusion in the region particularly challenging for policy makers. But it does point to the importance of developing and enforcing effective consumer protection legislation as well as educating consumers about responsible finance.

The Global Findex data were collected by Gallup, Inc. using the Gallup World Poll Survey. The Bank’s Development Research Group is building the database with a 10-year grant from the Bill and Melinda Gates Foundation. The ECA note is available in English and Russian. Visit the Global Findex homepage to access related reports, the questionnaire, and country- and micro-level databases.

Join the Conversation