The share of government-issued sustainable instruments is significantly lower for upper-middle-income and lower-middle-income countries .Photo by Shutterstock

The share of government-issued sustainable instruments is significantly lower for upper-middle-income and lower-middle-income countries .Photo by Shutterstock

The economic stress caused by the COVID-19 pandemic led to an expansion of sovereign sustainable bond issuances. This trend accelerated as both developed and developing economies saw the need to keep essential industries afloat , mitigating the pandemic’s damaging economic and social effects.

Social bond issuance jumped sevenfold in 2020, primarily targeting health care, education, and small and medium enterprises. Most of these bonds originated from governments and multilateral development agencies. Although public issuers, unlike private ones, have a direct mandate to provide social services, private social bond issuance has also accelerated. Private issuers of social bonds have aimed to finance programs to support stakeholders, employees, customers, and local communities. Such bonds give firms a welcome opportunity to broaden investor pools. Overall, sustainable debt reached a new peak in 2020 across bond and loan varieties raised with environmental and social purposes for a resilient post–COVID-19 recovery .

There is ample room for sustainable finance growth with international development agencies leading the way

Despite significant growth in recent years, sovereign green, social, and sustainable bonds account for only 0.5 percent of the global sovereign bonds market . The first green bonds, issued in 2007 by the European Investment Bank and in 2008 by the World Bank, were issued under the Climate Awareness Bonds label with the proceeds dedicated to renewable energy and energy efficiency projects. In 2013, the International Finance Corporation (IFC) issued a green bond worth $1 billion to support climate-friendly projects in emerging economies.

These pioneer bonds defined eligibility criteria and introduced impact reporting as an integral part of bond issuance processes. In addition, the World Bank issuance piloted a new model of partnership and collaboration among stakeholders, including investors, development agencies, banks, and private sector players. Currently, the green model is applied to bonds that are raising financing for the 17 Sustainable Development Goals. Multilateral development banks were the sole issuers of green bonds until 2012, when the first corporate green bonds emerged. Subsequently, in 2017, Poland issued the first ever sovereign green bond.

High- and low-income sustainable divide continues to persist

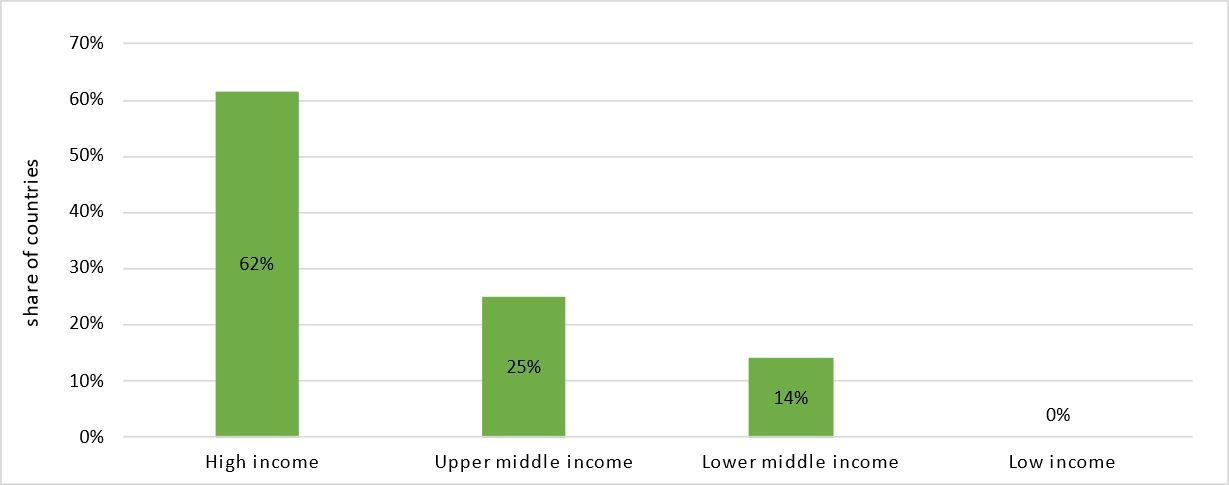

Almost a third of governments worldwide, led by the high-income countries, have issued sovereign green, social, and sustainable instruments through a mix of local and national entities . About 60 percent of all high-income countries have government-issued sustainable instruments. This share is significantly lower for upper-middle-income and lower-middle-income countries (Figure 1). Governments in low-income countries have so far not issued any sustainability instruments.

Figure 1: Share of countries with government-issued sustainability instruments, by income group, 2020–21

Sources: Climate Bond Initiative 2020/21; International Finance Corporation 2021; Refinitiv 2021

Note: the data cover 190 economies

Overall, the economies with robust capital markets have more sovereign sustainable bond issuances as compared to regions with underdeveloped ones.

Tools to overcome challenges to “greening” of capital markets

As of today, there are no universally agreed-on definitions of green, social, or sustainable bonds, and the Green Bond Principles (GBPs) do not provide concrete details on what qualifies as such bonds—those definitions are largely left up to issuers. The World Bank and IFC use their own criteria and definitions for eligible sustainable projects. In turn, the Climate Bonds Initiative provides separate categories of sector-specific green definitions and criteria.

To ensure transparency and accuracy of information disclosed by issuers to stakeholders, the GBPs recommends pre- and post-issuance external reviews. For any proposed thematic bond, issuers should appoint external review providers to assess the alignment of their bond or bond framework with the core components of the GBPs. After issuance, the GBPs recommend that an issuer’s management of proceeds be reviewed by an external auditor to verify allocation of funds from green bond proceeds to eligible projects.

Ways to increase green financing

To meet green goals and help channel more financing to sustainable activities, countries need to actively advance sustainable finance markets . A growing number of high- and middle-income countries have developed sustainable regulatory frameworks, and some emerging markets have made significant progress in implementing sustainable policies. However, much more progress is needed worldwide.

In addition, the private sector should adopt sustainable investment practices outside of regulatory mandates. Stock exchanges can help issuers to determine what types of climate-related risks and opportunities need to be disclosed to investors and should have a say on disclosures required by law. By developing sustainability listing requirements in collaboration with regulatory authorities, stock exchanges can help to ensure compliance among listed companies, setting the standard for non-listed ones. Plus, exchanges should work closely with listed companies to ensure accuracy and consistency of reported data. Implementation of global standards and policy frameworks would help further mobilize capital directed at sustainable economic activities.

Join the Conversation