Euro coin with national flag of Malawi on the Euro money banknotes background

Euro coin with national flag of Malawi on the Euro money banknotes background

What happens to prices of imports when exchange rates change? How about when the import duty rate changes? Trade prices are a principal channel through which movements in the exchange rate and changes in trade policy affect domestic variables for an open economy. The response of import prices to exchange rates can be used to predict the effect of changes in trade policy. The so-called symmetry hypothesis asserts that the effect of tariffs and exchange rates on prices are identical. The currencies in which transactions in international trade are invoiced reveal one of the key mechanisms that explain differences in how exchange rates and, by extension, tariffs, affect import prices. These issues are of particular relevance to developing economies given that most trade takes place in the partners’ currency or a vehicle currency such as the U.S. dollar. Further, tariffs remain relatively higher than in developed countries. The question is, does this symmetry hold when we account for invoicing currencies and what we now know is their role in exchange rate pass-through (ERPT) to prices?

How we look for the answers

Some answers can be sought by investigating the role of the euro and the U.S dollar in affecting import prices. We use transaction-level data of Malawian imports from the European Union (EU) over a 12-year period. The imports are separated by: Economic and Monetary Union (EMU) members and non-members and across various sectors.

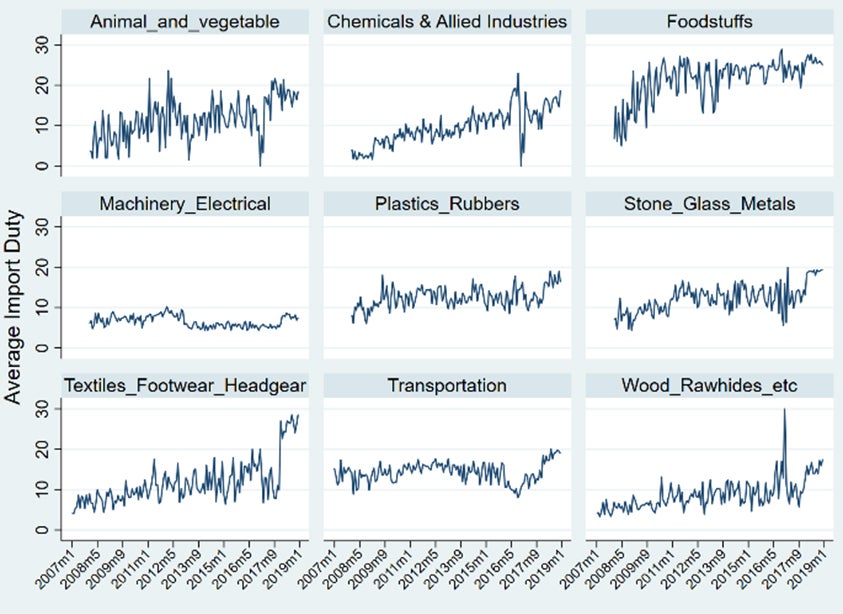

The differences in both the tariff rates and the invoicing currency patters across products indeed display a case for a disaggregated analysis. For instance, import duty rates on imports from the EU are lower for machinery and electrical products compared to food products (Figure 1A). Changes are also more frequent in products such as animal and vegetable products and textiles compared to other sectors. On the other hand, the data shows the dominance of dollar invoicing in imports from the EU with the exception of a machinery and electric products, where the euro dominates (Figure 1B). These patterns already signal that the same change in exchange rates and tariffs may lead to different effect on prices.

| Fig 1. A: Average Import Duty |

Fig 1. B: Euro and U.S share |

|

|

|

| Source: Montfaucon, A.F., (2021), “Invoicing Currency and Symmetric Pass-Through of Exchange Rates and Tariffs : Evidence from Malawian Imports from the EU”, World Bank Policy Research Working Paper Series No. 9577. |

|

The contribution of this analysis is twofold. First, it provides evidence on pass-through rates on products from high-income to low-income countries, namely from various EU countries to Malawi. Second, it does so using detailed data that allow identification of i) country of origin and product being exported, ii) the exchange rate and also the tariff duty affecting the good’s price in the destination country, and iii) the currency of invoicing for the good.

What are the findings?

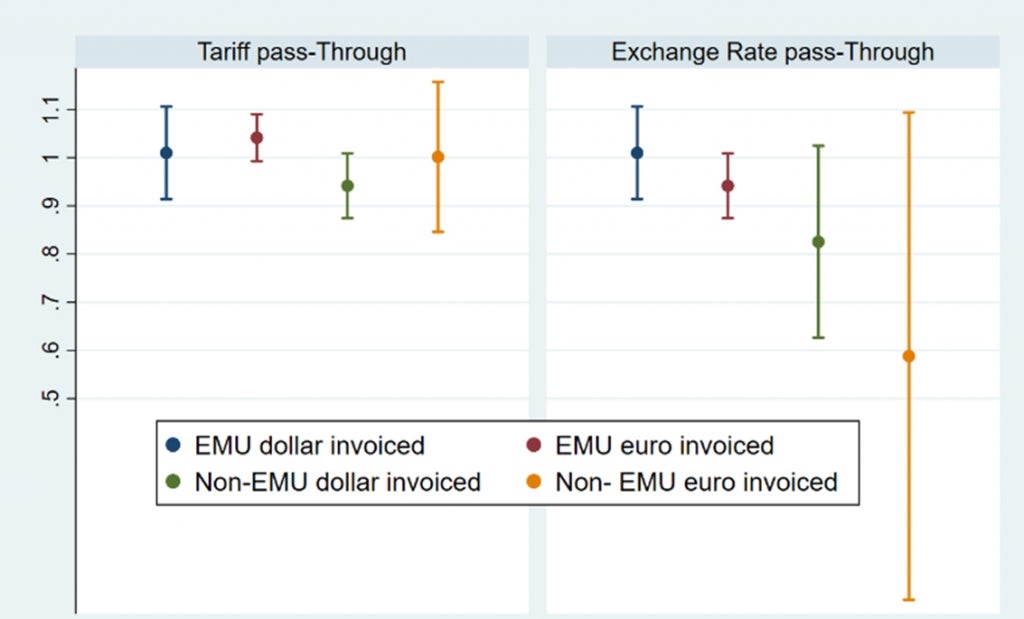

The findings show that when bilateral exchange rates are used, the effect of exchange rates and tariffs on prices are the same (i.e. symmetry holds). However, when the invoicing currency is considered, there are deviations from symmetry. In general, the dollar has the highest invoicing share in Malawian imports from the EU (Figure 2A), although there is higher euro invoicing among EMU products. For imports from the EMU, the exchange rate pass-through (ERPT) to the prices of euro-invoiced goods is lower compared to their tariff pass-through (TPT) (Figure 2B). However, symmetry does hold for U.S. dollar invoiced goods. For the non-EMU countries however, there is no difference in the pass-through of the exchange rate between euro- and dollar-invoiced products, since both the euro and the dollar are vehicle currencies for the non-EMU states, and the symmetry hypothesis holds for both.

The tariff pass-through to dollar invoiced products does not differ from that of euro invoiced imports, either from EMU or non-EMU countries. When either the euro or the dollar exchange rates are used, again, tariffs account for most of the changes in import prices of EMU products, but there is clarity on which exchange rate matters. The symmetry assumption holds with the euro exchange rate in EMU products, but tariffs affect import prices more than the U.S. dollar exchange rate. However, symmetry holds with both the euro and the dollar exchange rates in imports from non-EMU countries.

| Figure 2. A. % Share of euro and U.S. dollar invoicing |

Figure 2. B % Change in Import price from 1% Change in Tariff and exchange rate |

| |

|

| Source: Montfaucon, A.F., (2021), “Invoicing Currency and Symmetric Pass-Through of Exchange Rates and Tariffs : Evidence from Malawian Imports from the EU”, World Bank Policy Research Working Paper Series No. 9577. |

|

What does it all mean?

On average, the pass-through of exchange rate and tariff shocks on to Malawian consumers is high but not necessarily equal when the currency of invoicing is considered. Where there are deviations from symmetry, tariff pass-through is higher than the exchange rate pass-through. This means that the costs of Malawian tariffs are paid by Malawian importers. There are however, important differences across countries, currencies and sectors and trade policy changes should account for these. Finally, in order to predict the effects of trade policy based on import prices' responses to exchange rates, bilateral exchange rates are not suitable for capturing exchange rate pass-through for small developing countries, especially import-dependent ones such as Malawi.

This blog post is based on Montfaucon, A.F., (2021), “Invoicing Currency and Symmetric Pass-Through of Exchange Rates and Tariffs : Evidence from Malawian Imports from the EU”, World Bank Policy Research Working Paper Series No. 9577.

Join the Conversation