Research illustration

Research illustration

This blog is a biweekly feature highlighting recent working papers from around the World Bank Group that were published in the World Bank’s Policy Research Working Paper Series. This entry introduces five papers published from February 1 to February 15 on various topics, including COVID-19, debt restructuring and the role of the business environment and firms’ characteristics.

The first two papers we introduce in February of 2022 are on topics related to the COVID-19 pandemic. In Scars of Pandemics from Lost Schooling and Experience : Aggregate Implications and Gender Differences Through the Lens of COVID-19, Asif Islam and coauthors quantify the long-term impact of disruptions in capital accumulation as a result of the pandemic. In Understanding and Predicting Job Losses due to COVID-19 : Empirical Evidence from Middle Income Countries, Theresa Osborne and coauthors utilize firm survey data to understand which formal private sector jobs are most at risk from COVID-19 or similar future crises, based on empirical evidence from two middle-income economies.

- Scars of Pandemics from Lost Schooling and Experience : Aggregate Implications and Gender Differences Through the Lens of COVID-19 takes a look at how pandemic shocks disrupt human capital accumulation through schooling and work experience. Specifically, this paper quantifies the long-term economic impact of these disruptions in the case of COVID-19, focusing on countries at different levels of development and using returns to education and experience by college status that are globally estimated using 1,084 household surveys across 145 countries. The results show that both lost schooling and experience contribute to significant losses in global learning and output. Developed countries incur greater losses than developing countries because they have more schooling to start with and higher returns to experience.

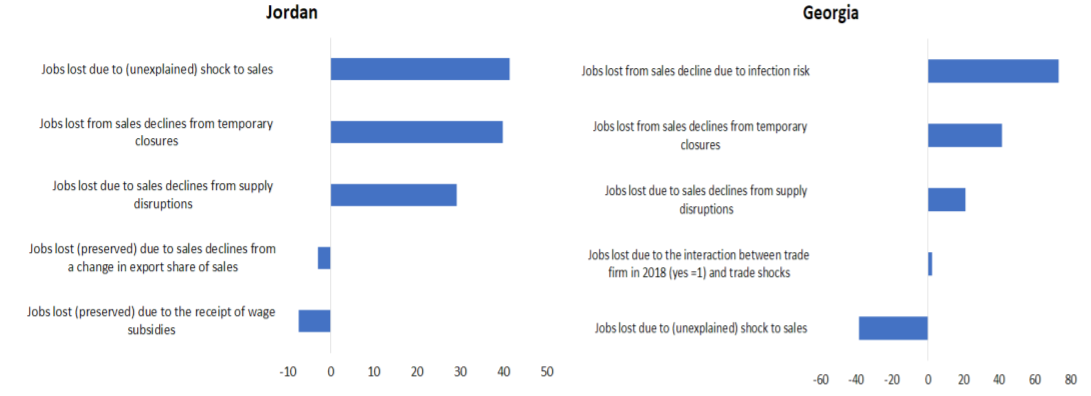

- Understanding and Predicting Job Losses due to COVID-19 : Empirical Evidence from Middle Income Countries uses survey data to understand which formal private sector jobs are most at risk from COVID-19 or similar future crises, based on empirical evidence from Jordan and Georgia. In particular, it estimates the importance for formal private sector job losses of various COVID-19 pandemic-related labor market shocks and mitigating factors, such as the closure of non-essential industries, workers’ ability to perform their jobs from home, infection risks to workers, customers’ infection risk, global demand shocks, input supply constraints, employers’ financial constraints, and government support, in determining the level and distribution of job losses. The results indicate that in these countries the level of job losses is predominantly due to a reduction in demand rather than a reduction in the supply of labor. Closures, global demand shocks, supply disruptions, and other unexplained demand-side shocks are significant determinants of jobs lost.

Figure 1: Contributing Factors to Jobs Lost (Average Percentage Effects on Total Jobs Lost)

The next three papers we introduce take us to the East Asia Pacific Region. In Bureaucrats, Tournament Competition, and Performance Manipulation : Evidence from Chinese Cities, L. Colin Xu and coauthors examine how the incentives of Chinese local bureaucrats shape their behavior in reporting GDP growth. In The Returns to Innovation in East Asia : The Role of the Business Environment and Firms' Characteristics, Francesca de Nicola and Pinyi Chen study the relationship between innovation efforts, innovation outputs, and productivity, using firm-level data from six East Asian countries. Finally, in Hidden Defaults, Carmen M. Reinhart and coauthors construct an encompassing dataset of sovereign debt restructurings with Chinese lenders.

- Bureaucrats, Tournament Competition, and Performance Manipulation : Evidence from Chinese Cities studies how the performances of top local bureaucrats are measured and manipulated, and the underlying incentives of such behavior, using data of Chinese cities from 2001 to 2013. The paper provides evidence that GDP, the key performance measure of local top bureaucrats, is sometimes subject to manipulation, which could be explained by political incentives stemming from the tournament competition system, a framework through which the local top bureaucrats compete for promotions.

- The Returns to Innovation in East Asia : The Role of the Business Environment and Firms' Characteristics uses firm-level data to find evidence that firms are more likely to invest in innovation when they use technology licensed by a foreign company, are part of a large group, and have a more educated workforce. Investment in research and development can significantly boost both product and process innovation. Product innovation yields significant productivity gains. However, productivity gains from process innovation are not detectable in the sample.

- Hidden Defaults finds that restructurings on Chinese debts are more frequent than restructurings involving the private sector or Paris Club official creditors. The paper also provides evidence that many restructurings with Chinese state-owned creditors are preceded by a lengthy spell of default involving payment arrears, according to data from the World Bank’s Debtor Reporting System (DRS). Finally, the authors show that Chinese lenders only grant limited debt relief, which can result in lengthy debt overhang spells and “serial restructurings”. Figure 1 below reveals that restructurings of China’s overseas loans now account for a major fraction of sovereign credit events in developing countries. Since 2008, the authors record 71 restructuring operations involving Chinese loans, but only 21 on external bonds or loans involving private creditors

Figure 2: Sovereign debt restructurings: Chinese creditors vs. private external creditors

The following are other interesting papers published in the first half of February. Please make sure to read them as well.

- Estimating the Economic and Distributional Impacts of the Regional Comprehensive Economic Partnership (Estrades Pineyrua,Carmen,Maliszewska,Maryla,Osorio-Rodarte,Israel,Seara E Pereira,Maria Filipa)

- The Distribution of Crisis Credit : Effects on Firm Indebtedness and Aggregate Risk (English) (Huneeus,Federico,Kaboski,Joseph P.,Larrain,Mauricio,Schmukler,Sergio L.,Vera,Mario)

- Private Cities : Implications for Urban Policy in Developing Countries (Li,Yue -ETIIC,Rama,Martin G.)

- Relevance of the World Bank Group’s Early Response to COVID-19 : A Cross-Country Sector Analysis (Naeher,Dominik,Narayanan,Raghavan,Ziulu,Virginia)

- Addressing Gender-Based Segregation through Information : Evidence from a Randomized Experiment in the Republic of Congo (Gassier,Marine,Rouanet,Lea Marie,Traore,Lacina)

- Life out of the Shadows : Impacts of Amnesties in the Lives of Refugees (Ibáñez,Ana María,Moya,Andres,Ortega,María Adelaida,Rozo,Sandra V.,Urbina,Maria Jose)

- What Do We Know about Poverty in India in 2017/18 (Edochie,Ifeanyi Nzegwu,Freije-Rodriguez,Samuel,Lakner,Christoph,Moreno Herrera,Laura Liliana,Newhouse,David Locke,Sinha Roy,Sutirtha,Yonzan,Nishant)

- Debt Vulnerability Analysis : A Multi-Angle Approach : Debt Vulnerability Analysis : A Multi-Angle (Doemeland,Doerte,Estevão,Marcello,Jooste,Charl,Sampi Bravo,James Robert Ezequiel,Tsiropoulos,Vasileios)

- A Dynamic Model of Fiscal Decentralization and Public Debt Accumulation (Guo,Si,Pei,Yun,Xie,Leiyu)

- Institutional Voids, Capital Markets and Temporary Migration : Evidence from Bangladesh (Bossavie,Laurent Loic Yves,Görlach,Joseph-Simon,Ozden,Caglar,Wang,He)

- When Promising Interventions Fail : Personalized Coaching for Teachers in a Middle-Income Country (Amaro Da Costa Luz Carneiro,Pedro Manuel,Cruz-Aguayo,Yyannu,Intriago,Ruthy,Ponce,Juan,Schady,Norbert Rudiger,Schodt,Sarah)

- Anatomy of Brazil’s Subjective Well-Being : A Tale of Growing Discontent and Polarization in the 2010s (Burger,Martijn,Hendriks,Martijn,Ianchovichina,Elena)

- Resource-Backed Loans in Sub-Saharan Africa (Mihalyi,David,Hwang,Jyhjong,Rivetti,Diego,Cust,James Frederick)

- Demand and Supply Shocks : Evidence from Corporate Earning Calls (Ruch,Franz Ulrich,Taskin,Temel)

Join the Conversation