Receiving cash transfer payments. Photo © Dominic Chavez/World Bank

Receiving cash transfer payments. Photo © Dominic Chavez/World Bank

This blog is a biweekly feature highlighting recent working papers from around the World Bank Group that were published in the World Bank’s Policy Research Working Paper Series. This entry introduces five papers published in July 2022 on various topics, including cash transfers, the war in Ukraine, and migration among others.

The first two papers we introduce examine cash transfer programs. In Conditional Cash Transfers and Gender-Based Violence—Does the Type of Violence Matter?, Elizaveta Perova and coauthors examine the effects of a conditional cash transfer program in the Philippines on gender-based violence. In With or Without Him? Experimental Evidence on Gender-Sensitive Cash Grants and Trainings in Tunisia, Nausheen Khan and coauthors explore whether it is possible to stimulate women’s employment by relaxing their financial and human capital constraints.

- Conditional Cash Transfers and Gender-Based Violence—Does the Type of Violence Matter? uses a regression discontinuity design to examine the effects of a conditional cash transfer program in the Philippines on three types of gender-based violence: (i) intimate partner violence, (ii) domestic violence by non-partners and (iii) violence outside home. The study finds that while the grantees of the conditional cash transfer program did not experience any change in exposure to violence perpetrated by an intimate partner or non-family members, they did face significantly lower emotional violence perpetrated by non-partner family members. The study also examines mediating channels through which conditional cash transfers may affect gender-based violence, namely: (i) stress reduction due to higher income, (ii) increase in women’s empowerment, (iii) increase in women’s bargaining power, and (iv) strengthened social networks. The findings provide suggestive evidence of changes in all four mitigating channels.

- Using a randomized control trial in Tunisia With or Without Him? Experimental Evidence on Gender-Sensitive Cash Grants and Trainings in Tunisia shows that providing cash grants and financial training to women stimulates their income generating activities, but only when their partners are not involved. The program did not alter traditional gender roles. Instead, it encouraged employment of other household members and investments in small-scale agriculture and livestock farming—two activities traditionally undertaken by women at home. The impacts on household living standards are overwhelmingly positive and suggest that the program is highly cost-effective.

The next two papers we introduce in this roundup examine two very timely topics. In Quantifying War-Induced Crop Losses in Ukraine in Near Real Time to Strengthen Local and Global Food Security, Klaus Deininger and coauthors estimate direct and indirect effects of the war on area and expected yield of winter crops. In Fears and Tears: Should More People Be Moving within and from Developing Countries, and What Stops This Movement?, David McKenzie examines the evidence for different explanations given in the economics literature for the lack of movement of people and their implications for policy given the enormous gains in income possible through international and internal movement.

- Quantifying War-Induced Crop Losses in Ukraine in Near Real Time to Strengthen Local and Global Food Security quantifies war-induced direct and indirect impacts on area and expected yield of winter crops using a 4-year (2019-22) panel of 10,125 village councils. Satellite imagery is used to provide information on direct damage to agricultural fields; classify crop cover using machine learning; and compute the Normalized Difference Vegetation Index (NDVI) for winter cereal fields as a proxy for yield. The paper suggests war-induced loss of winter crop output of 20% if the current winter crop can be harvested fully.

Figure 1: Example of location of fields damaged by fighting

- Fears and Tears: Should More People Be Moving within and from Developing Countries, and What Stops This Movement? shows that both internal and international migration appear to offer large benefits for many individuals, and for the optimal allocation of labor within and across countries. Yet most people never move in their lives. There are many potential reasons for this lack of movement, including information failures, liquidity constraints, high costs and policy barriers, and risk. The author argues in this paper that there are two other reasons for lack of movement that have been less a part of economic theories of migration. This includes i) the fears people have when faced with the uncertainty of moving to a new place, and ii) the reasons behind the tears they shed when moving. While these tears reveal the attachment people have to particular places, this attachment is not fixed, but itself changes with migration experiences. Psychological factors such as a bias toward the status quo and the inability to picture what one is giving up by not migrating can result in people not moving, even when they would benefit from movement and are not constrained by finances or policy barriers from doing so.

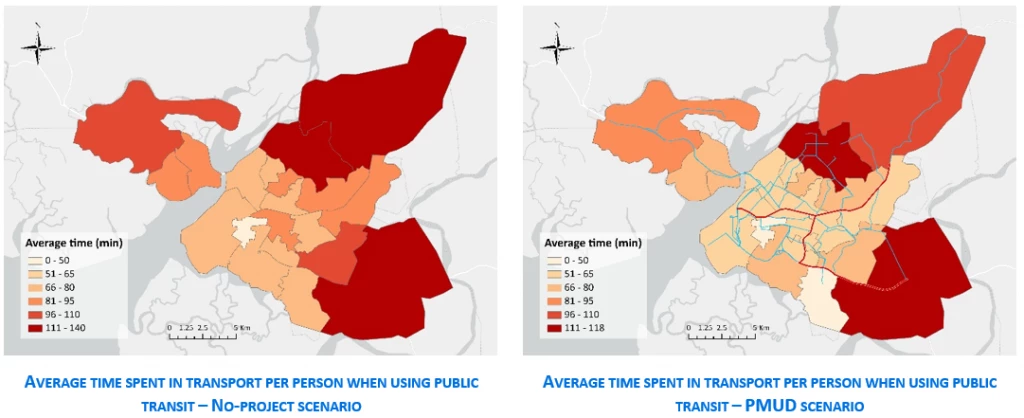

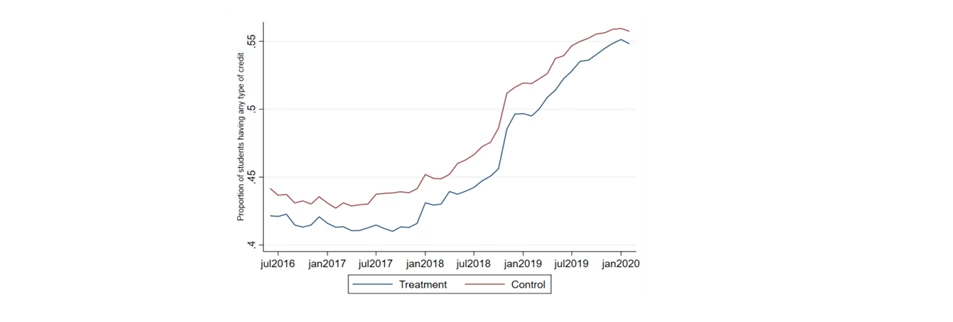

Finally, the last paper we introduce takes us to South America. In The Long-Term Impact of High School Financial Education: Evidence from Brazil, Miriam Bruhn and coauthors study the long-term effects of a comprehensive high school financial education program in Brazil. In 2011, the impact of a comprehensive financial education program was studied through a randomized controlled trial with 892 high schools in six Brazilian states. Half the schools were randomly selected to receive teacher training and financial education textbooks, which they integrated into the existing curriculum during the two last years of high school. Control group schools did not receive training or materials but participated in the surveys. Using administrative data, this paper followed 16,000 students for the next nine years. The short-term findings were that the treatment students used expensive credit and were behind on payments. By contrast, in the long-term, treatment students were less likely to borrow from expensive sources and to have loans with late payments than control students. Treatment students were also more likely to own microenterprises and less likely to be formally employed than control students. Figure 2 below shows the proportion of students with a positive credit balance for each year from 2016 to 2020.

Figure 2: Credit Usage over Time

Notes: This figure shows the proportion of students in the authors’ sample that have positive credit balances, using monthly administrative data from the Credit Registry System (SCR), housed at the Central Bank of Brazil (BCB).

The following are other interesting papers published in the second half of June. Please make sure to read them as well.

- Poverty-Adjusted Life Expectancy: A Consistent Index of the Quantity and the Quality of Life

- Labor Informality and Market Segmentation in Senegal

- A Gendered Fiscal Incidence Analysis for Ethiopia: Evidence from Individual-Level Data

- Labor Market Transitions in Egypt Post-Arab Spring

- Putting a Price on Safety—A Hedonic Price Approach to Flood Risk in African Cities

- Private but Misunderstood? Evidence on Measuring Intimate Partner Violence via Self-Interviewing in Rural Liberia and Malawi

- Will the Developing World’s Growing Middle Class Support Low-Carbon Policies?

- Life Cycle Savings in a High-Informality Setting—Evidence from Pakistan

- The Dog that Didn’t Bark: The Missed Opportunity of Africa’s Resource Boom

- Welfare Analysis of Changing Notches: Evidence from Bolsa Família

- Beyond Political Connections: A Measurement Model Approach to Estimating Firm-level Political Influence in 41 Economies

- Transactional Governance Structures: New Cross-Country Data and an Application to the Effect of Uncertainty

Join the Conversation