White paper swans and one black. | © shutterstock.com

White paper swans and one black. | © shutterstock.com

When a black swan event happens, such as the 2008 financial crash or the COVID-19 pandemic, vulnerabilities and inadequacies of insolvency systems become evident. This is due to the impact of high levels of indebtedness, large volumes of non-performing loans (NPLs), and default risks. During these events, judicial insolvency procedures tend to be time-consuming and expensive, either reducing the company's value (in the case of judicial reorganizations) or preventing an efficient reallocation of assets (in the case of in-court liquidations). Under such circumstances, some countries have promoted the implementation of out-of-court workouts (OCWs) as an alternative method of asset resolution when facing a potential crisis.

The World Bank B-Ready flagship report through the Business Insolvency Indicators will measure the regulatory treatment of OCWs in more than 180 economies under the premise that such mechanisms encourage greater entrepreneurial activity, a key aspiration of private sector development.

OCWs aim to prevent the liquidation of viable companies by providing a flexible mechanism to negotiate a business rescue plan, allowing them to continue operating while ensuring a higher rate of creditor repayment. OCWs represent an effective means of resolving insolvency in times of structural crisis because they are less expensive and faster than a formal judicial insolvency proceeding. The most common feature of the legal framework for OCWs is establishing a standstill period when creditors cannot enforce their claims. During the standstill period, creditors agree to take no action against the debtor and distribution priorities remain unchanged.

|

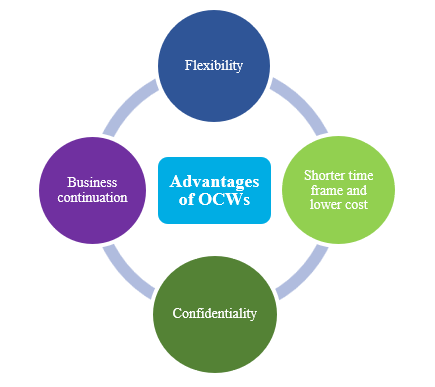

The World Bank’s Toolkit for Out-of-Court Restructuring, published in 2016 and updated in 2021, set guidelines on OCW policy design. As suggested by the toolkit, an informal OCW procedure has four main advantages: (1) flexibility to the specific needs of the debtor’s business; (2) a shorter time frame and lower cost than formal insolvency proceedings, (3) confidentiality and protection of the debtor’s reputation, and (4) business continuation.

Yet regulations governing OCWs vary in their application and scope across countries. Hybrid voluntary restructuring regulations are in place in some economies, with features typical for OCWs, but with tailored elements that go beyond the standard definition and with different degrees of court intervention. For example, in the United States, a debtor can file for bankruptcy after most of its creditors accept a reorganization plan and the court will confirm the plan. But the insolvency framework does not specifically regulate OCWs. In other jurisdictions, bankruptcy courts encourage workouts when the parties' interests might be better served by such mechanisms, such as in cases where the debtors are materially affected by COVID-19.

Figure 1. Advantages of Out-of-Court Workouts

Only a few countries have implemented OCWs, even with variations, including Australia, Belgium, China, Colombia, Croatia, France, Germany, Greece, Guatemala, India, Indonesia, Iceland, Italy, Japan, Latvia, Malaysia, the Netherlands, Peru, the Philippines, the Republic of Korea, and the United Kingdom. According to the Improving Access to Finance for SMEs report only 31 countries have a specific legal framework or legally binding guidelines for OCWs. Most of these are OECD high-income economies (45 percent). The remainder is distributed between East Asia and the Pacific (16 percent), Latin America and the Caribbean (16 percent), Europe and Central Asia (16 percent), South Asia (3 percent), and Sub-Saharan Africa (4 percent).

The lack of OCW implementation can be explained given its limitations. The contractual nature of OCWs makes enforcement very challenging. Since OCWs are purely voluntary, they are binding only through contractual terms. On the same note, financing distressed companies that undertake OCWs is challenging as the treatment of creditor priorities is often not. Therefore, an appropriate and clear legal framework related to enforcement that provides the necessary incentives to recapitalize insolvent companies is a condition for successful OCW implementation.

Given these considerations, it is critical for governments and entrepreneurs to act, rather than wait for an unpredictable 'black swan' event. Proactive regulatory measures and the implementation of essential policy instruments and safeguards, such as out-of-court workouts, are crucial steps in this direction. By doing so, they can navigate potential challenges more effectively and foster a resilient, innovative environment for growth and development.

Join the Conversation