Dignity factory workers producing shirts for overseas clients, in Accra, Ghana | © Dominic Chavez/World Bank

Dignity factory workers producing shirts for overseas clients, in Accra, Ghana | © Dominic Chavez/World Bank

Small businesses can play an impactful role in fragile and conflict affected situations (FCS). They can create jobs and directly provide necessity goods and services such as food, water, health, education, and transportation. They can also contribute to the resilience of local populations during periods of conflict.

However, small businesses operating in FCS countries endure numerous setbacks to their activity, from frequent electricity cuts to bribery to armed attacks. Surviving and growing in these situations is difficult. Navigating daily challenges without access to affordable credit is almost impossible.

As it turns out, access to bank credit is consistently reported as a key business environment constraint for small- and medium-sized enterprises (SMEs) in FCSs countries. True, access to finance is a problem for SMEs in every country, including in advanced economies, but it is particularly acute in FCS countries (figure 1).

Figure 1. Access and use of financial services by SMEs

Source: Author’s elaboration on WBES data

What drives SME financial exclusion in FCS countries vis-à-vis non-FCS countries? In a recent paper we examine this question, focusing in particular on the role of economic fundamentals and institutional factors. Economic fundamentals matter for SME financial inclusion. Higher incomes and better physical infrastructure increase savings and the pool of funds in the economy and improve access to finance while macroeconomic and financial stability can positively affect credit and other financial services to SMEs.

Institutions—the rules of the game in a society—matter too. Institutions influence the development of entrepreneurship and can support SME financial inclusion by improving the information environment and strengthening contract enforcement, as well as supporting equal treatment of firms in access to financial services.

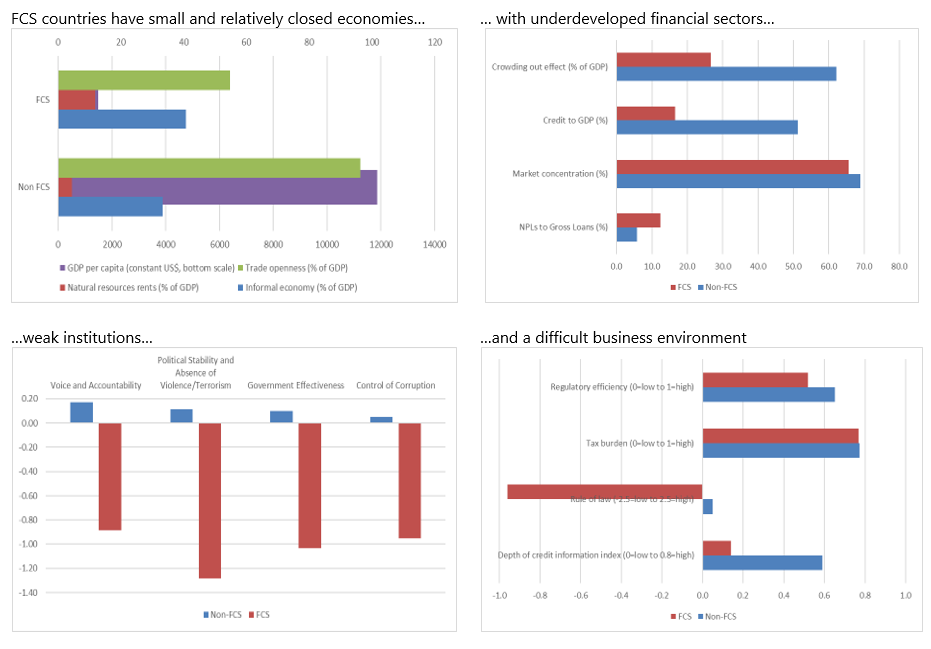

On both counts, FCS countries generally lag behind non-FCS countries, especially, as would be expected, in terms of institutional development (figure 2). But what do we find in the data?

Figure 4. Macroeconomic, financial sector, institutional and business environment features

Source: Author’s elaboration on WDI, GFD, WGI, WDI, Heritage Foundation

The results of our analysis show that output growth has a negative impact on SME financial inclusion in FCS countries, probably reflecting demand for countercyclical finance — typically backed by the government — by financially constrained SMEs that otherwise tend to resort to internal funds to finance their operations and investment.

On the other hand, price stability, a key sign of macroeconomic stability, is associated with higher SME financial inclusion in FCS countries. Moreover, access and usage of financial services by SMEs in FCS countries tends to increase with economic development, for example, income levels.

Other economic fundamentals also play a role in SME financial inclusion in FCS countries. Economies with large informal sectors tend to face tighter constraints on SME financial inclusion. Similarly, the lack of economic diversification also has a significant impact. Financial sector characteristics also affect SME access and usage of finance. The quantity of financial intermediation, such as deeper credit markets, helps enhance SME financial inclusion, and this is particularly important in FCS contexts.

The quality of financial intermediation is equally important because government and state-owned enterprise financing can crowd out credit to the private sector, including SMEs. In our sample of FCS countries, available credit tends to go proportionally more to the public sector than the private sector compared to non-FCS countries. Our analysis suggests that a significant role is played by crowding out effects in FCS countries. A lack of competition among banks reduces SME financial inclusion in FCS countries. Reducing banking market concentration is found to have a positive impact on SME access and usage of formal financial services in FCS countries. Finally, banking sector soundness, as measured by the quality of lending (NPL ratio), significantly and strongly supports SME financial inclusion.

Turning to institutional factors, strong governance and stable institutions exert a significant influence on SME access and usage of formal financial services in FCS countries. Voice and accountability, political stability, government effectiveness, and control of corruption are all positively correlated with SME financial inclusion. The importance of government effectiveness and control of corruption is particularly strong for FCS countries.

Credit information is also a key factor for SME financial inclusion. Rules affecting the scope, accessibility, and quality of credit information available through public or private credit registries can greatly facilitate banking relationships, and they are especially important for FCS countries.

Constraints to the quality of contract enforcement, property rights, and the effectiveness of courts, as well as to the ability of the authorities to formulate and implement policies and regulations that permit and promote private sector development, are negatively correlated with SME access and usage of formal financial services. Their impact is significantly stronger for FCS countries, suggesting that improvements in the overall business environment can have relatively sizable effects on SME financial inclusion in those countries.

Our analysis shows that the macrofinancial and institutional constraints that affect SME access and usage of formal financial services are similar across FCS countries and non-FCS countries, with differences in degree rather than in kind , that is, the relative importance of constraints is greater in FCS countries, particularly in middle- income FCS countries. Accordingly, to advance SME financial inclusion it is important to designing and implementing comprehensive strategies that take into account proper macroeconomic and financial policy frameworks and conducive governance, institutional and regulatory arrangements, tailored to country contexts.

Join the Conversation