The world has entered a period of elevated volatility after the global financial crisis, underpinning the need for policy tools to stabilize economies in the short term. In that context, monetary policy has become an increasingly important tool. However, there is often skepticism about its efficacy in developing economies, despite the central role it plays in advanced economies. A natural question for those who study and monitor economies in East Asia and Pacific (EAP) is: how effective is monetary policy in the region? This blog, based on our latest economic report East Asia and Pacific Economic Update, October 2017, intends to shed some light on this.

Our analysis first identifies a particular monetary policy transmission channel as a basis for measuring monetary policy effectiveness—the bank lending channel. This relates to how changes in monetary policy affect banks’ lending. More specifically, an economy’s monetary policy is considered more effective if a monetary expansion can elicit a larger reduction in banks’ lending rates, thus lowering the financing cost for business. And lower financing cost is expected to encourage lending and stimulate the economy.

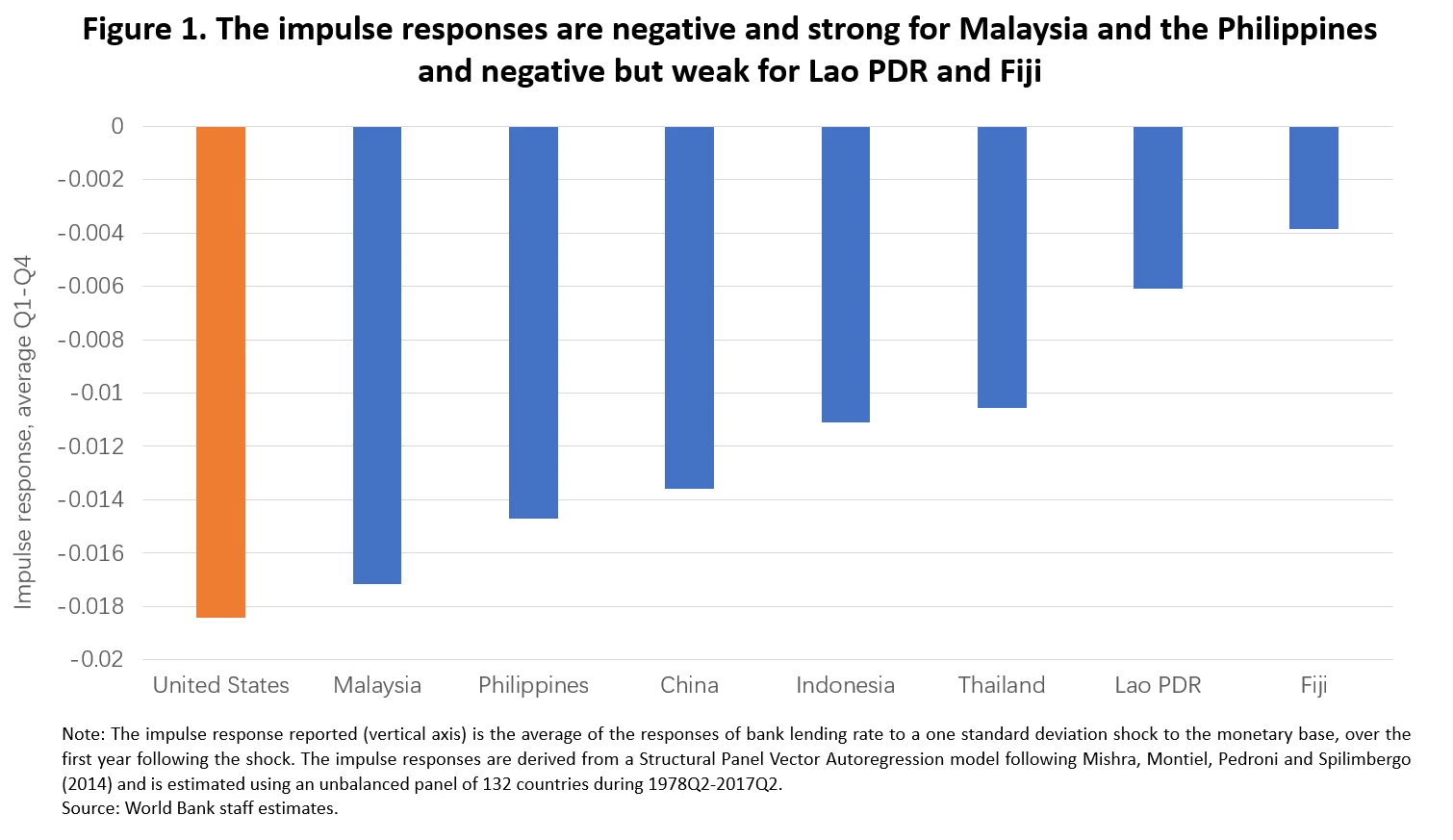

Based on a methodology developed by Mishra, Montiel, Pedroni and Spilimbergo (2014), Figure 1 shows the strength of the bank lending channel in EAP: after a monetary expansion, Malaysia and the Philippines exhibit sizeable negative responses—reductions in bank lending rates, which indicate greater effectiveness of monetary policy through the bank lending channel, while Lao PDR and Fiji have much weaker responses, thus their monetary policy is less effective.

In terms of the overall effectiveness of monetary policy, developing EAP lies between the advanced economies and the rest of developing economies: Figure 2 illustrates a stronger (or more negative) median response of bank lending rates for developing EAP than for other emerging and developing countries, but weaker (or less negative) than for the advanced economies. The dispersion across the responses proxied by the distance between the 25th and 75th quantile is wide, compared to the dispersion of responses for other emerging and developing countries.

This analysis also identifies a set of contributing factors for monetary policy effectiveness. In particular, monetary policy is more effective in countries with larger and deeper financial markets, more competitive banking sectors, stronger institutional and regulatory environment, and more transparent central banks. But higher degrees of integration with international financial markets, which make countries more exposed to global shocks, limit the role of monetary policy and dampen the effect.

Going forward, monetary policy is set to play a bigger role for developing EAP. In recent years, central banks in the region have adopted new instruments and procedures, improved their existing frameworks, and generally gained greater autonomy to conduct monetary policy. But to achieve greater monetary policy effectiveness, governments need to continue their efforts to enhance central banks’ transparency and refine policy and operational frameworks. More broadly, structural reforms need to be advanced to strengthen institutional and regulatory structures, allow greater competition in the banking sector, and deepen financial markets.

Related:

• Download the full report

• View the key findings and press release

• Read the first blog post of this series here

Join the Conversation