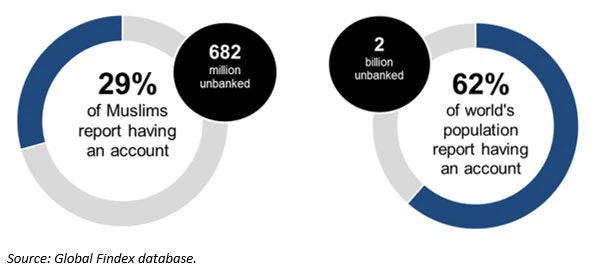

In the past decade, the Islamic finance industry has grown at double digits despite the weak global economic environment. By 2020, the Islamic finance industry is projected to reach $3 trillion in total assets with 1 billion users. However, despite its rapid growth and enormous potential, 7 out of 10 adults still do not have access to a bank account in Muslim countries. This means that 682 million adult Muslims still do not have an account at a banking institution. While some Muslim countries have high levels of account ownership (above 90 percent), there are others with less than 5 percent of their adult population who reported having a bank account.

At the Global Islamic Finance Forum that recently took place in Kuala Lumpur, Malaysia, global business leaders and policy makers met to discuss the challenges faced by the industry. This year, the Forum focused on technological innovations and how it can impact traditional financial services in terms of access to finance, expanding alternative delivery challenges and strengthening the regulatory environment to reflect new market developments.

Three main lessons emerged from the Global Forum:

1. The Need to Scale-up Financial Inclusion

Adults with an Account (%)

The use of financial services is still developing in Muslim countries. According to the 2014 Global Findex, 40 percent of adults reported having borrowed and saved any money in the past 12 months. And only 9 percent of adults saved at a formal financial institution. In comparison, in high-income OECD countries 52 percent of adults saved formally.

Thus, Islamic finance can play a significant role in narrowing the gap of financial inclusion in Muslim countries. Historically, Malaysia has been a leader in developing innovative savings, credit, and investment instruments that are Sharia-compliant for low-income households. Moreover, Malaysia has established specialized financial institutions offering only Islamic finance products, such as Bank Rakyat, the largest Islamic cooperative bank in the country.

2. Incorporating New Digital Technologies

Technology has the potential to drive change in the Islamic finance industry, especially for the 2.3 million Small and Medium Sized Enterprises (SMEs) located in the Middle East and North Africa (MENA).

Financial Technology (FinTech) companies are using innovative solutions to make access to financial services more efficient. Despite the fact that 76 percent of enterprises in MENA has a bank account, only 26 percent reported having a credit from a financial institution. Given this low credit penetration at the corporate level in Muslim countries, some solutions have been implemented to narrow the credit gap which is estimated to be more than US$140 billion.

In the case of Malaysia, an Investment Account Platform (IAP) was implemented in the beginning of 2016. Through this solution, Islamic banks match investors with projects in need of funding. The innovation of this approach is that after the bank screens the project, a credit rating is assigned, and then the project is uploaded to a platform where the investors can select the investment according to their risk appetite.

3. Addressing Regulatory Challenges

Authorities not only in Muslim countries but also in other jurisdictions are still addressing the challenge of revising regulatory standards in order to foster innovation in alternative finance platforms. The current debate is centered on how to regulate non-financial institutions that are receiving money from global investors and lend it to local companies or entrepreneurs through the Internet.

In July 2016, Bank Negara Malaysia launched a discussion paper on Fintech Regulatory Sandbox . The Sandbox will allow both FinTech companies and financial institutions to experiment with FinTech tools. The introduction of this initiative represents a progressive regulatory response that aims to foster the value of technology on financial services.

In the region, Singapore issued FinTech Regulatory Sandbox Guidelines in June 2016 to encourage more FinTech experimentations. Indonesia is also preparing its FinTech legislation that will be ready in December 2016.

Another challenge for Muslim countries is to upgrade their financial standards to common international principles that are applicable in all Muslim jurisdictions. There is still no consensus on whether a financial product such as an investment account or bond is compliant in all Muslim territories. This generates uncertainty to non-Muslim investors that are willing to finance infrastructure projects but are not sure that their investments are 100% compliant to the generally accepted principles of financial securities.

The Islamic finance industry is well positioned to seize the opportunities to embrace new market technological developments. The need to create new products to attend the unbanked population such as zero-fee accounts, small loans, or family insurance could open a new window to provide formal financial services to the unserved population in Muslim countries.

Join the Conversation