Apart from the community it creates, and the training programs connecting them to work, these young women rely on the fast and reliable internet connections at the center. Without it, they simply would not be able to work online.

However, many Malaysians do not have access to similar services in their homes or at their workplace. Only about a third of households have fixed broadband connectivity. The rest, which includes most of the country’s lower income or rural households, have either slower connections or need to use mobile connections. Those are sufficient for basic use such as social media and accessing services but it’s hard to write up a resume on a smart phone, and not easy to rely on a mobile connection to run a business.

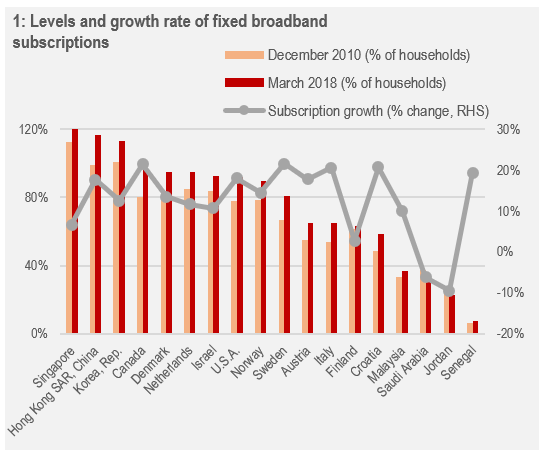

For a country looking to cement its digital future on growth in e-commerce, artificial intelligence (AI) and automated and digitized manufacturing, the high prices and low use of fixed broadband connections is worrying. Malaysia’s fixed broadband market has stagnated since 2010 in terms of subscription growth with household subscriptions rates increasing 10%, among the slowest in the world ( Chart 1).

Constraints and consequences

The World Bank recently launched a report discussing the reasons for this stagnation. We found that Malaysia has done well in the mobile broadband market. Subscriptions to 3G and 4G services equal about 116% of the population, as of June 2018. That market is competitive, with four major networks offering a range of packages to consumers across the country.

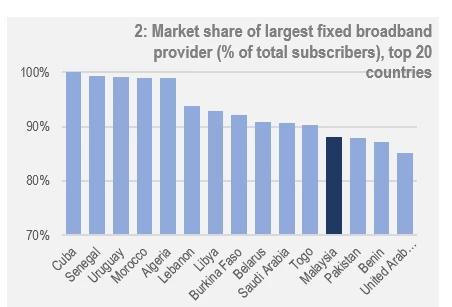

But the fixed broadband market is less competitive and is dominated by the incumbent Telekom Malaysia (TM). TM controls over 87% of the retail market and a significant part of the national backbone and international connectivity markets. Malaysia is among the most concentrated fixed broadband markets in the world ( Chart 2). International experience shows that concentrated markets tend to experience higher retail prices, lower levels of adoption, and less innovation in services. All of this applies to Malaysia, where prices might be unaffordable for many, further holding back adoption.

While households might tend to be more price-sensitive, businesses are often impacted by connection quality. Reliable connectivity is critical for businesses that coordinate logistics for e-commerce, manage a field-force, execute transactions, or need massive computing resources. Malaysia’s businesses have been slow to adopt digital tools, with quality and cost being decelerating factors.

Finding the lily pad

As an early pioneer in the digital economy with bold moves in the 1990s, Malaysia has many of the building blocks to leapfrog to a new digital future. In the past few months, the Government and the telecoms regulator, have been consulting with stakeholders to define measures to increase coverage and improve affordability. Our report proposed two measures to achieve these objectives:

- Malaysia should find ways to use its existing, extensive infrastructure more efficiently, and promote more competition in the fixed broadband market. Many of the needed rules exist; and implementing them to drive competition will likely pay off—as it has in the mobile market—and improve market outcomes. In recent months, the Government has begun to implement regulations that will increase competitive pressure in the market to improve the quality and affordability of services.

- A bold new policy and strategy for the sector can also help. The Government has begun to define a national fiberization and connectivity plan. As with other countries’ broadband plans, this could signal new targets for the future, attract greater private investment into network roll out, and identify specific market failures that Government support can address. Indeed, as part of its 2019 budget, the Government has proposed to allocate RM 1 billion (~US$235 million) to implement such a plan.

Join the Conversation