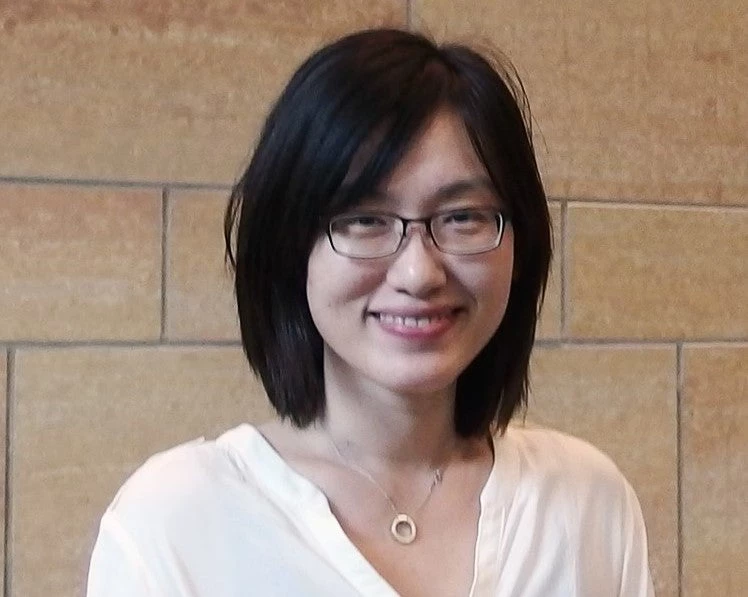

As the price of edible oil in Bangladesh has increased as a result of the war in Ukraine, sellers are tying oil gallons with iron chains in shops to prevent theft.

As the price of edible oil in Bangladesh has increased as a result of the war in Ukraine, sellers are tying oil gallons with iron chains in shops to prevent theft.

This blog is part of a series centered around the latest edition of our South Asia Economic Focus (SAEF)- Reshaping Norms: A New Way Forward.

As the gusts of the COVID-19 pandemic quieten, South Asian economies, left fragile and uneven in their recovery, are facing renewed headwinds : high inflation, rising fiscal deficits, and deteriorating current account balances are disrupting growth. These are further exacerbated by the war in Ukraine, which has led to skyrocketing global commodity prices. Yet, the region is expected to grow by 6.6 percent— although a full percentage point below the forecast in January—reveals the World Bank’s latest South Asia Economic Focus (SAEF), Reshaping Norms: A New Way Forward. In this blog, we analyze the overarching trends highlighted in the SAEF—informed by feedback from the bi-annual survey of the South Asia Economic Policy Network (SAEPN), a group of policy makers, academics, and macroeconomists across the region.

Experts cast bearish outlook

The bi-annual survey of the SAEPN network reveals an overall view for the region that is less optimistic than six months ago:

- Fifty-one percent believe that GDP growth will increase in the next six months, compared to 56 percent last fall.

- Forty-four percent believe that economic activity has recovered to at least 85 percent of the pre-pandemic level, compared to 36 percent of respondents last fall.

- Only 11 percent of experts think that another COVID wave is the biggest risk to the economy, compared to 57 percent six months ago.

- Seventy-nine percent of surveyed experts believe that inflation will increase in the next six months, and 38 percent believe that higher inflation will be the biggest risk to the economy.

Inflation: The new COVID

Even before the war in Ukraine, consumer prices of edible oils rose by 20 percent in most of South Asia, with the price of fuel for transportation reaching double digits in some countries. Higher commodity prices led by the war have further added to inflationary pressures. The global wheat price rose by 20 percent, and Brent crude oil price increased by 15 percent as of early April. With Ukraine supplying nearly half of the world's sunflower oil, cooking oil prices have spiraled: India’s average retail price of sunflower oil increased by 12 percent in the first three weeks after the war started.

Although the effect of global oil prices is relatively weak on consumer prices, it yields a strong influence on producer prices. In India, Pakistan, and Sri Lanka, the wholesale price of crude petroleum and petroleum products is highly correlated with global oil prices historically. Higher global energy prices can (1) raise the prices of fertilizers, which will in turn push up food prices and (2) increase the operating and transportation costs for the manufacturing sector, thus squeezing the profit margins of producers.

Governments in the region use fuel subsidies to reduce the burden of global energy prices on consumers. However, as we argue in Reshaping Norms, a better alternative may lie in policies that discourage the use of dirty fossil fuels and enhance green transition.

Financial sector stress

Seventy-three percent of SAEPN experts believe that stresses in financial sectors will increase over the next six months, and close to half believe that asset quality will deteriorate. Loan forbearance programs during the COVID-19 pandemic supported businesses and allowed the financial sector to continue lending while low lending rates also encouraged borrowing. But as the latest World Development Report highlights, the programs may have created a lack of transparency about the health of the balance sheets of banks. And as the support measures unwind and advanced economies hike policy rates, vulnerabilities in the financial sector can resurface. Our findings in Reshaping Norms show that asset quality fell immediately following the ending of support programs in some countries, which suggests that the programs indeed masked some prior deterioration of asset quality.

Micro, small, and medium enterprise (MSMEs), which account for 99.6 percent of all enterprises, 76.6 percent of the workforce, and 33.9 percent of South Asia’s gross domestic product (GDP) on average, were hard hit during COVID. The absence of credit record and audited financial statements made the credit risks of MSMEs difficult to assess and made it harder for these businesses to get access to financing. Even with the lending support programs, the financing conditions of the MSMEs are worrying. Among the surveyed experts, 47 percent believe that financing conditions have worsened for micro-enterprises over the past year, compared to only 18 percent who believe that conditions have deteriorated for large firms. The ending of support programs can hit these businesses particularly hard. In Pakistan, for example, non-performing loans among microfinance borrowers were up 42.7 percent after the support programs ended, compared to a year ago.

Countering headwinds with new norms

As South Asia charts a new way forward to address rising inequality, accommodate energy transition, and unleash new growth potential, an essential part of the economic recovery lies in reshaping norms to make the economies more conducive to growth and progress. Two notable approaches in this area include:

Greening of tax policies

The war and its impact on fuel prices can provide the region with much-needed impetus to reduce reliance on fuel imports and transition to a green, resilient, and inclusive growth trajectory. A quarter of the SAEPN experts surveyed believe that a carbon tax should have been implemented a long time ago, while 37 percent are in favor of a gradual phase-in of a carbon tax.

Reshaping gender norms

Economic development is intrinsically related to gender outcomes. A challenge facing South Asian countries is the disproportionate economic impact the pandemic has had on women. Reshaping Norms includes in-depth analysis of gender disparities in the region and recommends policies that support gender outcomes for inclusive growth.

Creative rethinking of policies will help South Asia counter external shocks, protect the vulnerable, and keep headwinds at bay during its economic recovery, while also laying the foundation for a green, inclusive, and resilient growth.

Join the Conversation