Photo: PradeepGaurs/Shutterstock.com

Photo: PradeepGaurs/Shutterstock.com

New energy-saving technologies offer South Asian countries an opportunity to modernize their economies, and will be an integral part of their energy transition. The energy intensity of output of South Asian economies is almost twice the global average—despite a decline over the past decade that is largely attributable to firm-level, within-sector cuts in energy intensity. While the region’s firms have been early adopters of basic energy-saving technologies, they have lagged in the adoption of more advanced technologies, with smaller firms lagging particularly far behind. A multi-pronged policy approach that includes market-based regulation, more reliable access to grid electricity, the dissemination of accurate information on energy savings, and financial support can help accelerate the diffusion of energy-efficient technologies among South Asian firms. Read more in the World Bank’s latest South Asia Development Update, Toward Faster, Cleaner Growth.

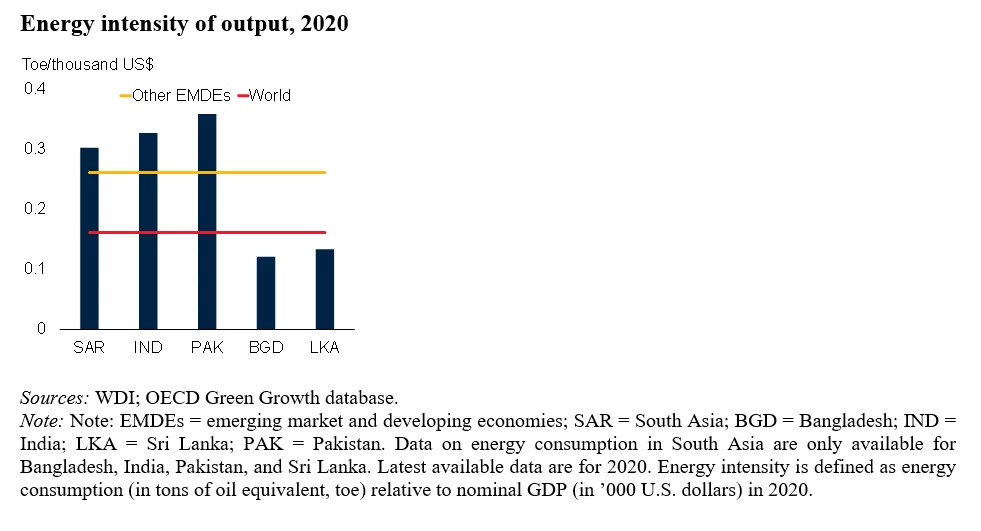

South Asia’s energy intensity of output is high, despite a decline over the past decade

South Asia’s energy consumption per unit of output is twice the global average. Energy consumption per unit of output has declined since 2010, but not at a pace rapid enough to offset the impact of economic growth on total energy consumption, which has increased by about 3 percent per year over the past decade. Slower growth in total energy consumption, enabled by faster declines in energy intensity, would help South Asian countries meet their climate commitments and reduce air pollution. This is because the energy sector is a major source of greenhouse gas (GHG) emissions and particulate matter pollution in most South Asian countries.

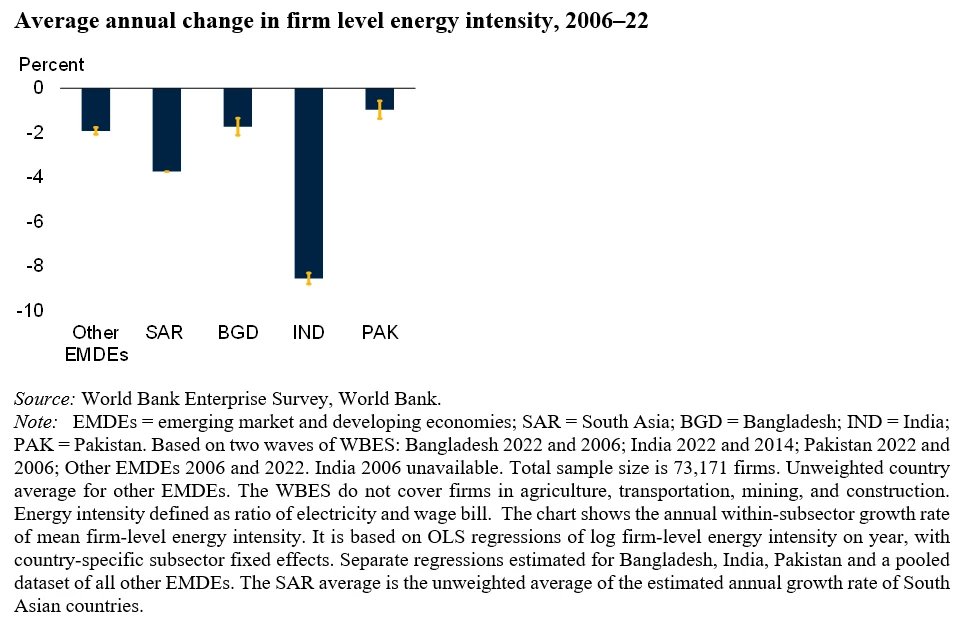

Energy intensity of output has declined mainly within sectors, among firms

South Asia’s energy use per unit of output in manufacturing and services has declined largely due to cuts in energy intensity within subsectors, among firms, and not shifts in activity to less energy-intensive subsectors. The region’s firm-level energy intensity declined by 4 percent per year between 2006 and 22, faster than in other emerging markets and developing economies (EMDEs). The fastest decline occurred in India, where the average manufacturing firm’s energy intensity halved between 2001 and 2018.

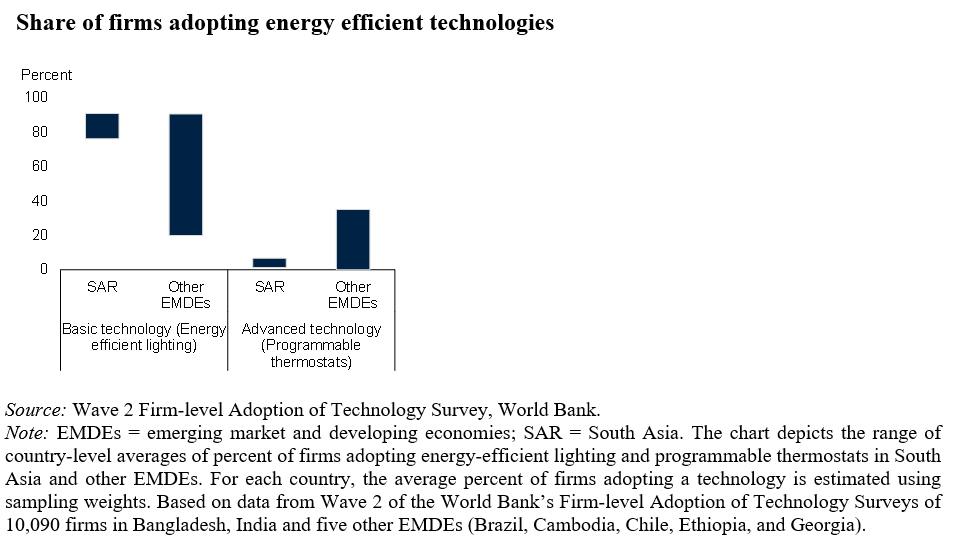

South Asian firms lag in the adoption of advanced energy-efficient technologies

The diffusion of new energy-efficient technologies among firms offers scope for accelerating the decline in the energy intensity of output in South Asia. While South Asian firms are relatively rapid adopters of basic energy-efficient technologies, they lag in the adoption of more advanced technologies. For example, a recent survey finds that more than three-quarters of South Asian firms have adopted basic energy-efficient lighting, a larger share than in other EMDEs. In contrast, fewer than 7 percent of firms have installed a more advanced technology, programmable thermostats—a rate in the lower half of the range across other EMDEs.

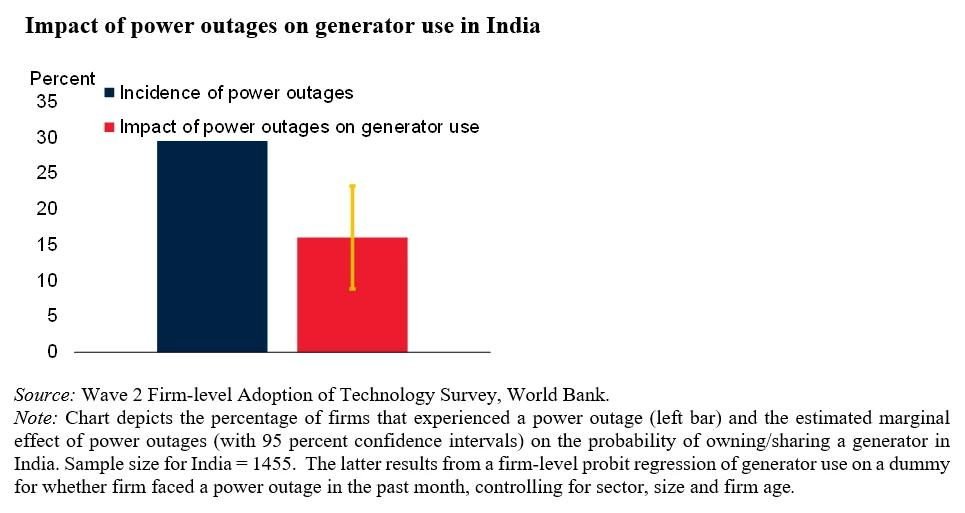

Unreliable grid energy perpetuates the use of inefficient backup power sources

Firms in South Asia are still reliant on inefficient and polluting backup power generators. An estimated three-quarters of firms in India and Bangladesh use diesel generators, three times as many as the one-quarter of firms, on average, in other EDME regions. In India, firms that have experienced outages are significantly more likely to be using a generator, suggesting that unreliable electricity supply prompts firms to use such inferior in-house energy-generation technologies.

Inadequate information is another constraint to energy-efficient technology adoption

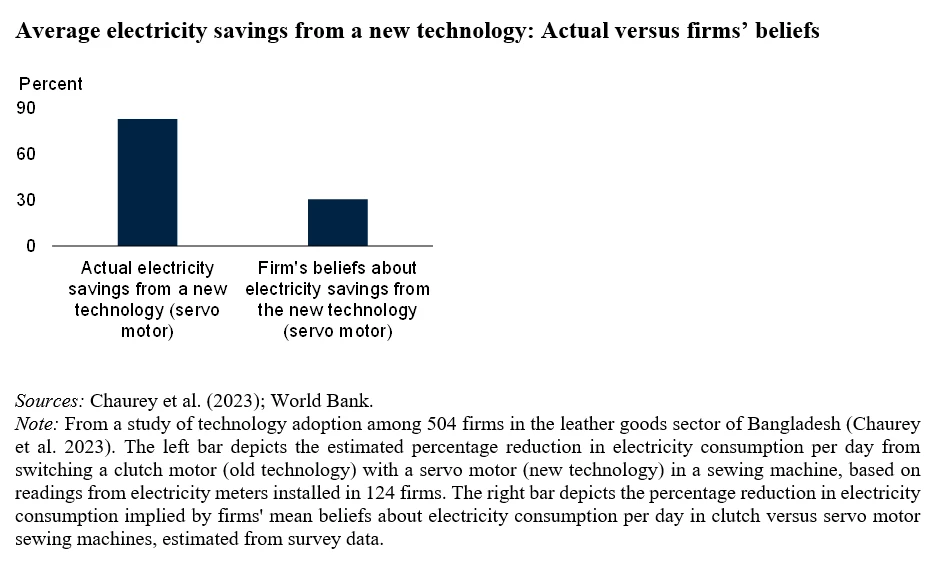

The slow adoption of energy-efficient technologies by South Asian firms may also, in part, reflect limited access to information on new technologies. In a study of leather goods firms in Bangladesh, the actual energy savings from a new technology--a more energy-efficient motor for stitching machines used in the leather goods industry-- were more than twice those initially expected by firms. Perhaps as a result, the firms’ average willingness to pay for this technology was only 56 percent of its market price.

This blog is part of a series on the World Bank's latest South Asia Development Update, Toward Faster, Cleaner Growth.

Join the Conversation