In the coming years and decades, China is expected to slowly relinquish its lead position in the global apparel market, opening the door to other competitors. This is a huge opportunity for South Asia to create at least 1.5 million jobs that are “good for development” – of which half a million would be for women – according to a new World Bank report Stitches to Riches? But those numbers could be much higher if the region moves quickly to tackle existing impediments and foster growth in apparel, which will also yield dividends for other light manufacturers (like footwear and toys).

How South Asia fits in the global apparel market

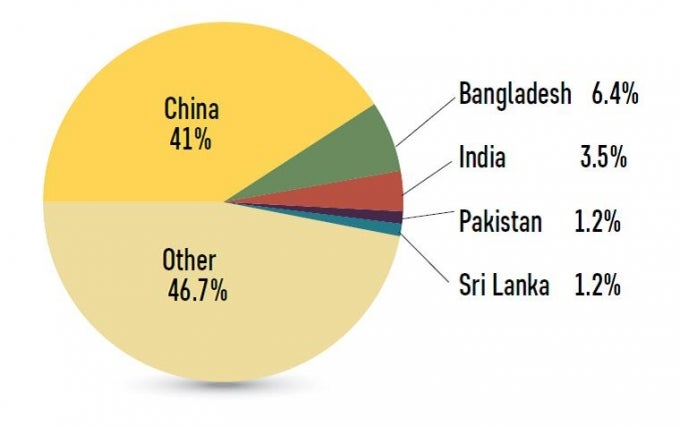

Currently, China holds by far the largest share of global apparel trade – at 41 percent, up from 25 percent in 2000, with about 10 million workers. But as China continues to develop, it is likely to move up the global value chain into higher-value goods (like electronics, and out of apparel) or switch production among sectors in response to rising wages. A 2013 survey of leading global buyers in the United States and European Union (EU) found that 72 percent of respondents planned to decrease their share of sourcing from China over the next five years (2012-2016).

Already, the top four apparel producers in South Asia – Bangladesh, India, Pakistan, and Sri Lanka – have made big investments in world apparel trade, now accounting for 12 percent of global apparel exports (see figure). In terms of apparel export value, Bangladesh leads the pack (at $22.8 billion), followed by India ($12.5 billion), Sri Lanka ($4.4 billion), and Pakistan ($4.2 billion).

(Country share of global apparel exports)

Source: Stitches to Riches?

Why apparel jobs are “good for development”

When we think of jobs that are “good for development,” the main yardstick is whether they will help translate growth into long-lasting poverty reduction and broad-based economic opportunities. Apparel fits the bill for numerous reasons.

Creating good jobs for women. The apparel sector appears to be a natural avenue for South Asia to create jobs, especially for women, because it is quite labor intensive. Apparel (along with textiles) already accounts for nearly 40 percent of manufacturing employment, and about one-third of those workers are women. Plus the region has a large pool of potential female workers, reflecting its low labor force participation rate compared to other regions – and we know that women with jobs are more likely to have fewer children and invest more in their children’s health and education. Another attraction for low-skilled women is that wages in apparel and textiles are higher (albeit slightly) than in agriculture.

Reaping knowledge spillovers. Workers with jobs in foreign-owned companies or with firms that are part of global value chains acquire new technical and managerial skills, spurring productivity. As a result they can help firms move up the global value chain (which includes the full range of activities needed to bring a product from its conception to its end use). For example, Sri Lanka has shifted from basic products to higher-value ones (like intimate apparel and swimwear), on top of dividing its exports into cotton and manmade fiber products (while most other South Asian producers focus on cotton).

A New Strategic Approach

So how can South Asia seize this opportunity to capture China’s displaced apparel production and create badly needed jobs, especially for women? Stiches to Riches? argues that the region has taken many steps in recent years to support the textile and apparel sector, but it now needs to step up its game by tackling inefficiencies that are undercutting its competitiveness. Indeed, our benchmark analysis shows that Southeast Asian countries (Cambodia, Indonesia, and Vietnam) are outperforming South Asian countries in terms of overall apparel export performance, product diversity, and non-cost related factors that are important to global buyers. Key recommendations include:

- Increase product diversity by reducing tariffs and import barriers to ease access to manmade fibers – through bonded warehouses, duty drawback schemes, cash subsidies, and export processing zones (EPZs). Also, enable the conditions to foster a domestic manmade fiber industry.

- Improve productivity by helping firms enter the formal sector and take advantage of economies of scale with less complex labor policies. Also encourage foreign direct investment for apparel by adopting clear and transparent policies on foreign ownership and within EPZs.

- Shorten lead times by using industrial parks to provide better infrastructure in a concentrated way, and improving road infrastructure to facilitate access to ports for exporting firms.

- Diversify markets y taking advantage of access to and trade with other emerging market economies.

- Improve compliance and reliability by ensuring that social policies are enforced (such as better safety conditions in establishments) and introducing better human resource practices.

Stayed tuned for our Facebook Live interaction with the author Thursday, June 16th in the evening on Facebook Bangladesh, India, Pakistan, and Sri Lanka

Join the Conversation