South Asia is the least integrated region in the world. Intra-regional trade in South Asia is less than 2% of GDP compared to over 20% in East Asia. Labor mobility and regional travel is minimal, with few exceptions. Even remote communication is low – only 7% of international telephone calls in South Asia are to countries within the region, compared to 71% for East Asia. The case for closer integration has remained strong for a while now, and it is refreshing to see that some movement, albeit watchful, in addressing some of the region's deep rooted political economy issues, particularly between India and Pakistan.

South Asia is the least integrated region in the world. Intra-regional trade in South Asia is less than 2% of GDP compared to over 20% in East Asia. Labor mobility and regional travel is minimal, with few exceptions. Even remote communication is low – only 7% of international telephone calls in South Asia are to countries within the region, compared to 71% for East Asia. The case for closer integration has remained strong for a while now, and it is refreshing to see that some movement, albeit watchful, in addressing some of the region's deep rooted political economy issues, particularly between India and Pakistan.

The discussions around closer integration have centered on energy, trade, connectivity and stability. All of these offer strong potential to enhance growth in the region. However, financial sector integration overall, and access to finance in particular, hardly ever make it to the agenda of regional integration forums and deliberations. This is unfortunate, because the region has a long way to go in providing adequate access to financial services and insurance products, especially to the vulnerable segments of the population. Given that South Asia is home to more than half a billion of the world’s poor, this becomes a poverty reduction goal as much as a financial inclusion goal.

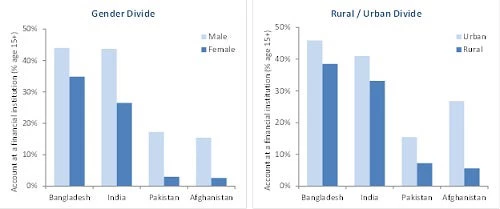

According to the Global Financial Inclusion database, there is considerable disparity in financial inclusion indicators across South Asia. Pakistan and Afghanistan have the lowest financial penetration with only about 10% of the population having an account at a formal financial institution. In contrast, India and Bangladesh have penetration levels of 35% and 40% respectively. Both Pakistan and Afghanistan also have the lowest number of people who have saved at a financial institution in the past year. Only 1% of the population in Pakistan and 3% in Afghanistan saved at a financial institution in the past year. In India and Bangladesh, the comparative indicators were 12% and 17%. Figure 1 illustrates how gender and rural-urban differences are more pronounced in Pakistan and Afghanistan than in India and Bangladesh.

Figure 1: Financial penetration indicators in South Asia

Source: Global Financial Inclusion Database (Data as of 2011).

Despite a high proportion of the population being vulnerable to economic and environmental shocks, insurance penetration is relatively low across the region. The insurance density (premium) per capita is $13.40 against a world average of $470, while insurance penetration (premium as a % of GDP) is less than 3% compared to the world average of 8%. Nonetheless, countries such as India have an insurance penetration of 5.1% while Pakistan is at 0.7%.

Institutional structures also differ greatly across South Asia. For example, private participation in the banking sector in Pakistan, Afghanistan, and Bangladesh is over 60%, while in India it is less than 25%. India and Bangladesh both have EXIM banks, while Pakistan and Afghanistan do not. Institutional models in the microfinance sector also vary considerably, with seemingly more innovation and experimentation happening in Bangladesh and India. Even though insurance is largely concentrated with the public sector in both India and Pakistan, the penetration level in India is almost seven times higher.

Finally, countries in the region have adopted various different policy and regulatory frameworks for the financial sector. The most notable policy choice has been that of state-ownership vis-à-vis liberalization. For example, liberalization in Pakistan’s banking sector since the late 1990s, complemented with a well-balanced regulatory environment has contributed towards attracting international investors into the sector and creating viable as well as stable financial institutions. The other major policy decision has been the regulation of the microfinance industry. India favored a loosely regulated microfinance sector until the Andhra Pradesh crisis in 2011, which then led to the Malegam Committee Report (pdf), Reserve Bank of India Microfinance Regulations in 2011 and the Microfinance Institutions (Development and Regulation) Bill 2012 (pdf). In contrast, Pakistan was among the first South Asian countries to introduce regulations for the sector in 2001, but chose to focus on regulating microfinance banks only. Other microfinance institutions are still largely unregulated, even though some of the larger ones have either evolved in to or created microfinance banks.

Though contextual differences exist (for example, Afghanistan has been grappling with a fragile and conflict-affected country environment), most financial sector challenges transcend national boundaries across South Asia. Additionally, development priorities such as reducing poverty, limiting economic vulnerability of the poor, creating jobs and productive opportunities and women empowerment remain applicable across most of South Asia.

There is a whole range of regulatory approaches and institutional models within South Asia. More importantly, development outcomes vary considerably, with some countries doing well in terms of financial penetration (e.g. India) while other countries doing well on financial sector operating performance (e.g. Pakistan). Regional integration within the financial sector offers significant potential for South Asian countries to work together in improving access to finance. Such a collective approach needs to move beyond mere learning and replicating towards a more integrated knowledge-sharing approach which encourages regulators, institutions, and people to collaborate on designing policies, implementing programs, and achieving results.

Join the Conversation