Worker assembles tractor in automobile industry in Pakistan.

Worker assembles tractor in automobile industry in Pakistan.

A lot has been said and written about the private sector, its inner workings, and internal dynamics in recent years in Pakistan. While most of the analytical work has been based on hard data, the data has often been limited to a subset of the private sector—for example, firms operating in the textiles sector or firms in the Sialkot export cluster. This makes the data less useful for informing policies to catalyze the growth and development of the private sector at large in Pakistan. The data problem has been particularly acute for smaller-sized firms. Their challenges are fundamentally different from larger-sized firms.

It was in light of data gaps related to the private sector that the World Bank, in close collaboration with the Pakistan Bureau of Statistics (PBS), and sponsored by the Foreign, Commonwealth and Development Office (FCDO), recently administered an Enterprise Survey in Pakistan. The objective of the survey was to obtain feedback from enterprises on the state of the private sector as well as to help in building a panel of enterprise data.

The survey was administered to a total of 1300 small (with 5-19 employees), medium (with 20-99 employees) and large (with 100+ employees) sized firms operating in the country’s four provinces and Islamabad Capital Territory, and across ten sectors. The Census of Manufacturing and Industries (CMI) complemented with data on firms collected by the Employees Old Age Benefit Institution served as the frame for firms operating in the manufacturing sector while a bespoke frame was constructed from secondary sources for firms operating in the services sector. A sampling frame is a list from which the sample is drawn. The frame also included the establishments interviewed in the previous round of WBES Pakistan (2013), which resulted in 560 panel interviews. The resulting sample comprises almost 20% exporters, direct or indirect.

| Figure 1: Distribution by Firm Size |

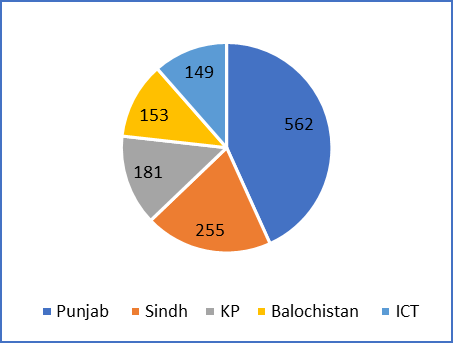

Figure 2: Distribution by Region |

| |

|

| Figure 3: Distribution by New Firms Vs Panel Firms |

Figure 4: Distribution by Exporter vs Non-Exporter |

| |

|

Lack of R&D spending linked to low efficiency

Summary statistics from the data have given us a fresh and incisive view into the private sector in Pakistan. The data projected on the private sector covered by the survey, for instance, shows that only 1.86% of the firms spent any money on R&D, either in house or contracted with other companies, in FY21.

Low R&D spending in turn has led to few firms innovating in recent years. Only 3.3% of the firms surveyed reported innovating over the past three years, with innovation defined as a firm introducing new or improved products or services. While these low rates could partially be explained by the pandemic outbreak, the lack of R&D spending and innovation is a cause of concern given that firm level innovation and technology adoption are key drivers of structural change and economic growth in an economy. Low levels of innovation leading to low growth in productivity are at the heart of Pakistan’s growth conundrum per the recently published Pakistan Country Economic Memorandum. The report states that aggregate productivity has been declining in Pakistan, on the back of firms losing efficiency.

Women underrepresented in the private sector

The estimates for the Pakistan private sector also show that women remain underrepresented in the formal private sector, whether it is as owners, managers, or formal workers. Only 4.9% of the firms reported having any female participation in ownership. The percentage of firms with a majority female ownership is lower still at 2.1%. The situation is similar when female participation is studied from the prism of management and employment. Only 3.4% of the firms reported having a woman as a top manager, while women only represented 3.3% of permanent full-time workers.

Access to finance is a challenge

Access to finance for the private sector has remained a perennial problem. It was identified as a significant constraint in the last ES, has been broached in every public-private dialogue centered on the growth of the private sector, and has once again emerged as a challenge in the most recent iteration of the ES. The numbers are telling. Firms indicate that only 1.4% of their investments in fixed assets and 2.1% of their working capital needs were financed by banks in the last fiscal year. Only 2.1% of the firms had a loan outstanding at the time of survey administration. Among other things, firms highlighted complex application procedures, high interest rates, and stringent collateral requirements as the primary reasons for not tapping into the financial sector. It is pertinent to note, however, that a sizable 47% of the firms surveyed reported not having any external financing requirements, and that there is significant heterogeneity in firms’ access to finance depending on their size. Larger firms indicate having greater access to finance while reporting significantly lower need for external financing. There is also a silver lining in the access to finance story. Over 92% of the firms reported having a checking or a savings account with a formal financial sector institution.

Overall, firms have reported political instability, access to finance and taxation as the three biggest constraints to their growth and development, a marked shift from the last ES when energy and corruption were identified as the leading causes impairing growth of the sector. While access to finance and taxation are often mentioned among the top obstacles in upper-medium economies around the world, the mention of political instability deserves more investigation.

Join the Conversation