Picture of man at a wind power mill in Bangladesh

Picture of man at a wind power mill in Bangladesh

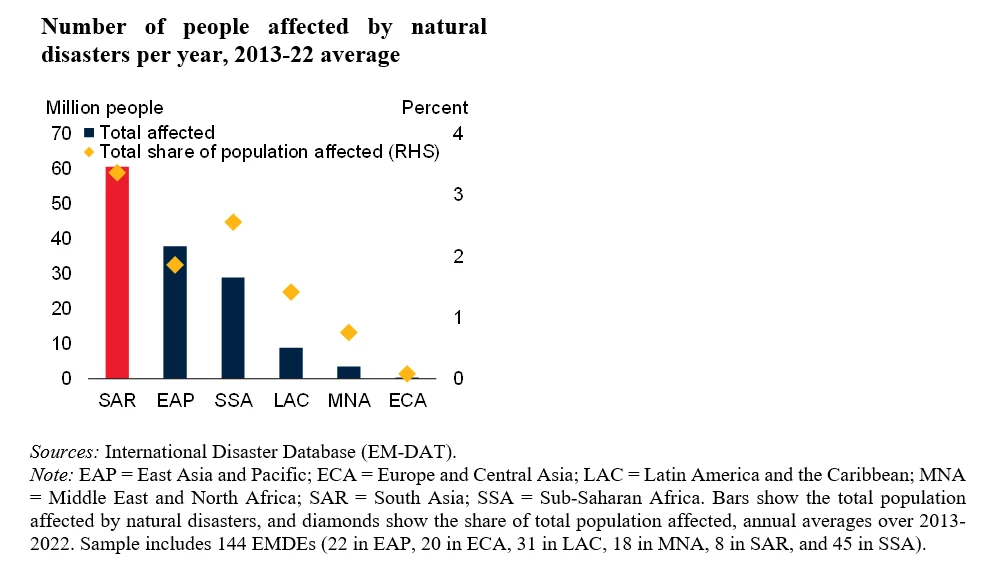

Output growth in South Asia is projected to remain stronger than in other regions, but is nonetheless not strong enough for most countries to reach high-income thresholds within a generation. A sustained acceleration would require stronger private investment growth, which has been weak in most countries. The scope for government support is limited owing to high debt and still large deficits, an important source of which is weak revenue collection. Addressing these shortcomings would free up resources to fund the region’s development priorities and support the growing number of people affected by natural disasters. Read more in the World Bank’s latest South Asia Development Update, Toward Faster, Cleaner Growth.

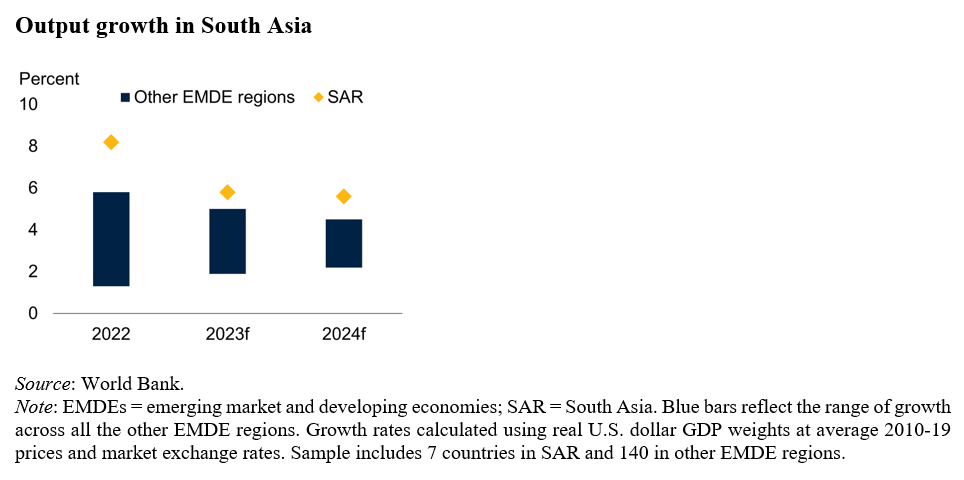

1. South Asia is growing faster than other regions

At just under 6 percent, output growth in South Asia is expected to remain stronger than in other regions in 2023-25, even with weak growth in the countries recovering from recent balance of payments crises. The outlook is subject to downside risks from weak financial systems and fiscal positions, and would also worsen in the event of a further economic slowdown in China or climate change-related natural disasters.

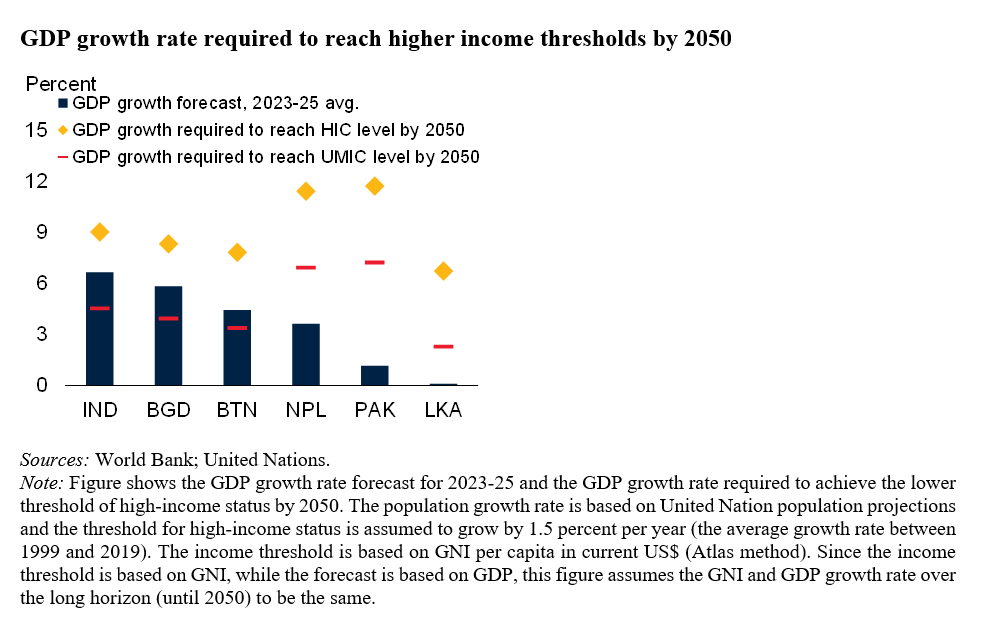

2. Growth is not strong enough for rapid convergence with high-income countries

Growth in the region is stronger than elsewhere, but it is nonetheless not strong enough for most countries to reach high-income status within a generation. Potential growth in the region averages about 5 percent, but would have to be 8 percent or higher in most countries to reach high-income status by 2050. To accelerate growth, it will be critical to strengthen private investment growth.

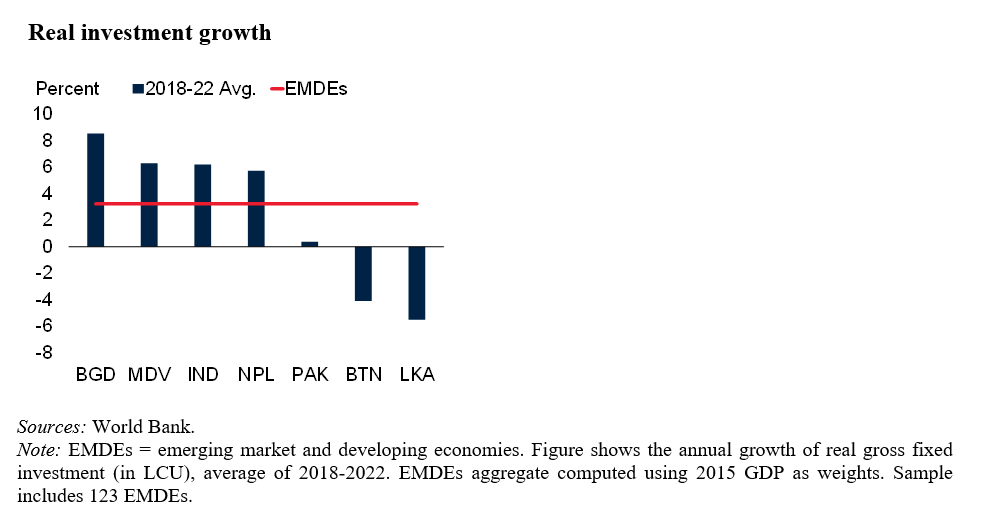

3. Private investment has been weak

In the past five years, investment growth has generally followed two contrasting patterns in South Asia. In Bhutan, Pakistan, and Sri Lanka, growth has been negative or near zero. In India, Maldives, Bangladesh, and Nepal, investment growth has been robust and well above the emerging market and development economies (EMDE) average. In India and Bangladesh, this rapid growth has been supported by public investment growth of around 10 percent per year—triple the EMDE average. Sustaining this pace of public investment growth may become increasingly challenging as government debt and borrowing costs rise. Strengthening private investment across the region will depend on many factors. These include the presence of complementary infrastructure, a supportive institutional and business environment, access to finance, and less distortionary policies affecting markets.

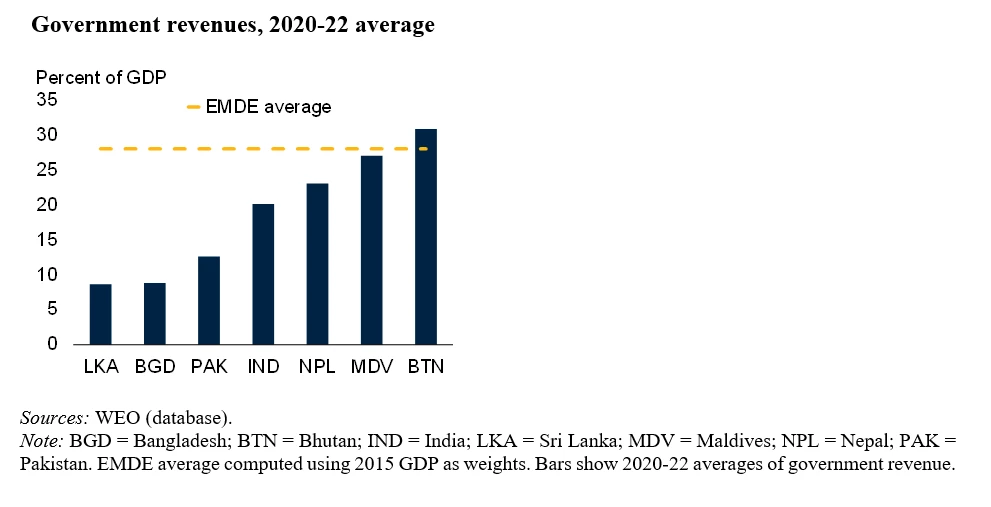

4. Fiscal positions are fragile

All countries in South Asia have had persistently large fiscal deficits, resulting in government debt burdens in the region rising more quickly than the EMDE average since 2010. Slowing the rise in debt burdens will likely require continued strong growth as well as reforms to limit financing costs, improve spending efficiency, and address the region’s unusually low government revenue collection. All countries but one (Bhutan) collect less revenue than the EMDE average of nearly 30 percent of GDP, with revenues in Sri Lanka and Bangladesh below 10 percent of GDP.

5. South Asia is vulnerable to climate risks

South Asia is the EMDE region most vulnerable to climate risks, with the largest numbers of people affected by natural disasters in the past decade. Much of the region’s population lives in dense river valleys which are increasingly subject to severe floods, such as those that submerged one-third of Pakistan last year. Bangladesh’s losses from tropical cyclones alone are estimated to average 0.7 percent of GDP per year. Afghanistan is among the countries most at risk from heat waves. Coastal areas and the entirety of Maldives risk being covered by rising water levels. Changing weather patterns associated with climate change could make some areas unsuitable for agriculture or entirely uninhabitable.

This blog is part of a series on the World Bank's latest South Asia Development Update, Toward Faster, Cleaner Growth.

Join the Conversation