Women in Khyber Pakhtunkhwa, Pakistan. Image Copyright: Waseem Niaz

Women in Khyber Pakhtunkhwa, Pakistan. Image Copyright: Waseem Niaz

“Transfer of property in my name was difficult. Men of my family said you would not go (to the government office), so it is still registered in my uncle’s name.” (A female taxpayer who participated in focus group discussions as part of the study).

Women in Pakistan face several constraints in economic empowerment and opportunities. Female labor force participation, at about 24.5 percent compared to 81 percent for men, (as of 2023) is one of the lowest in South Asia and globally. The gender gap in property ownership is also large with only 3 percent of women owning a house versus 72 percent for men and 2 percent of women owning land. Social norms, lack of women’s mobility and knowledge, and women’s limited access to government institutions contribute to low property ownership. Low female labor force participation and the lack of property rights can increase women’s vulnerability, reduce their opportunities to diversify income, and negatively affect their access to finance and wellbeing.

Progress is Underway

Increasing women’s access to property registration and tax services is a priority for the Khyber Pakhtunkhwa government. In addition to developing laws to support women, including the KP Women Empowerment Policy Framework and the Enforcement of Women’s Property Rights Act 2019, the government is also actively working to support women’s economic empowerment in the province. The Board of Revenue and the Excise, Taxation, and Narcotics Control Department – two of Khyber Pakhtunkhwa’s tax administrations – are considering setting up service counters specifically for women. Twelve female patwaris (government’s field staff assigned at the village level to maintain the property ownership record and collect land taxes) have been hired to facilitate women’s access to these services. Improving women’s access to services is part of a larger reform program for the Khyber Pakhtunkhwa revenue authorities - which includes establishing one-stop taxpayer facilitation centers (TFCs) and digitizing property records and tax services – with the support of the World Bank’s Khyber Pakhtunkhwa Revenue Mobilization and Public Resource Management Program (KPRMP). Once established, one-stop TFCs will facilitate registration and tax payments under one roof and will be closer to taxpayers.

Revisiting Tax and Property Reform

To assist the government’s efforts to identify ways in which property registration and tax service provision can be improved for women, a gender and taxpayer study was conducted in Khyber Pakhtunkhwa Province with the support of the Global Tax Program’s Gender Equality and Tax Reform project. The study interviewed 1,200 women and men, and conducted focus group discussions with female taxpayers and tax administrators.

How can women’s access to property registration and tax services be improved?

“My husband had all the information regarding the tax.” (Female taxpayer from a focus group discussion)

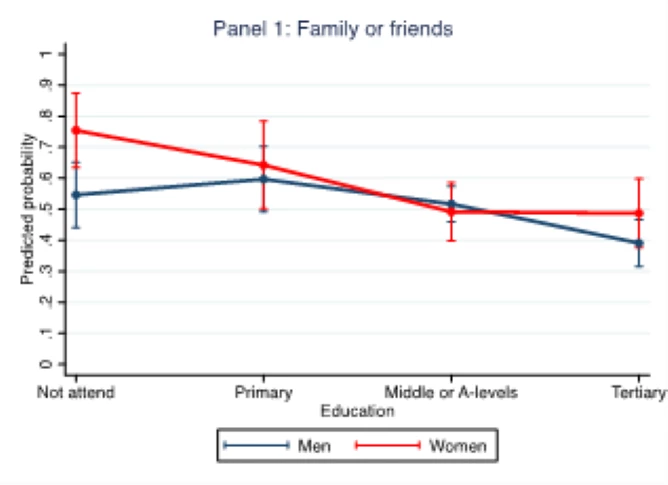

Addressing gender gaps in access to technology and tax information for both women and men is key. Women without schooling tend to rely on friends and family to obtain tax information. Women are also less likely than men to rely on social media (see figures 1.1 and 1.2). While women and men most often use in-person methods for tax payments, a larger share of men also use digital financial technologies and mobile banking applications. Digitization offers opportunities for women to better access property registration records and tax services by addressing constraints such as lack of mobility and in-person interactions. Yet, barriers in women’s access to digital technology and literacy must be addressed as well. Face-to-face service provision in the form of one-stop TFCs across the province and tailoring support services and information dissemination, are therefore important.

Figure 1.1: Sources of Tax Information

Figure 1.1: Sources of Tax Information

Figure 1.2: Sources of Tax Information

Figure 1.2: Sources of Tax Information

Notes: The graphs show the estimated probability of the important source of tax information from a linear probability model.

Availability of female tax officials is likely to improve services to women.

“Make an office specially for women, with only women staff so communication can be done easily. Women are unable to convey their message to the male staff, so then how will they resolve their issues?” (Female taxpayer from a focus group discussion).

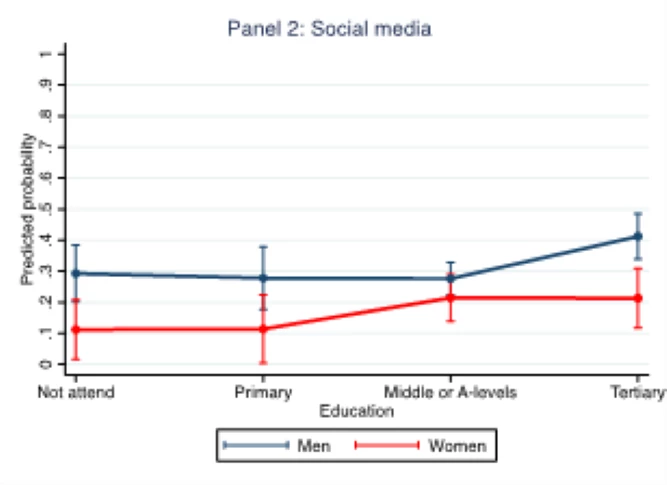

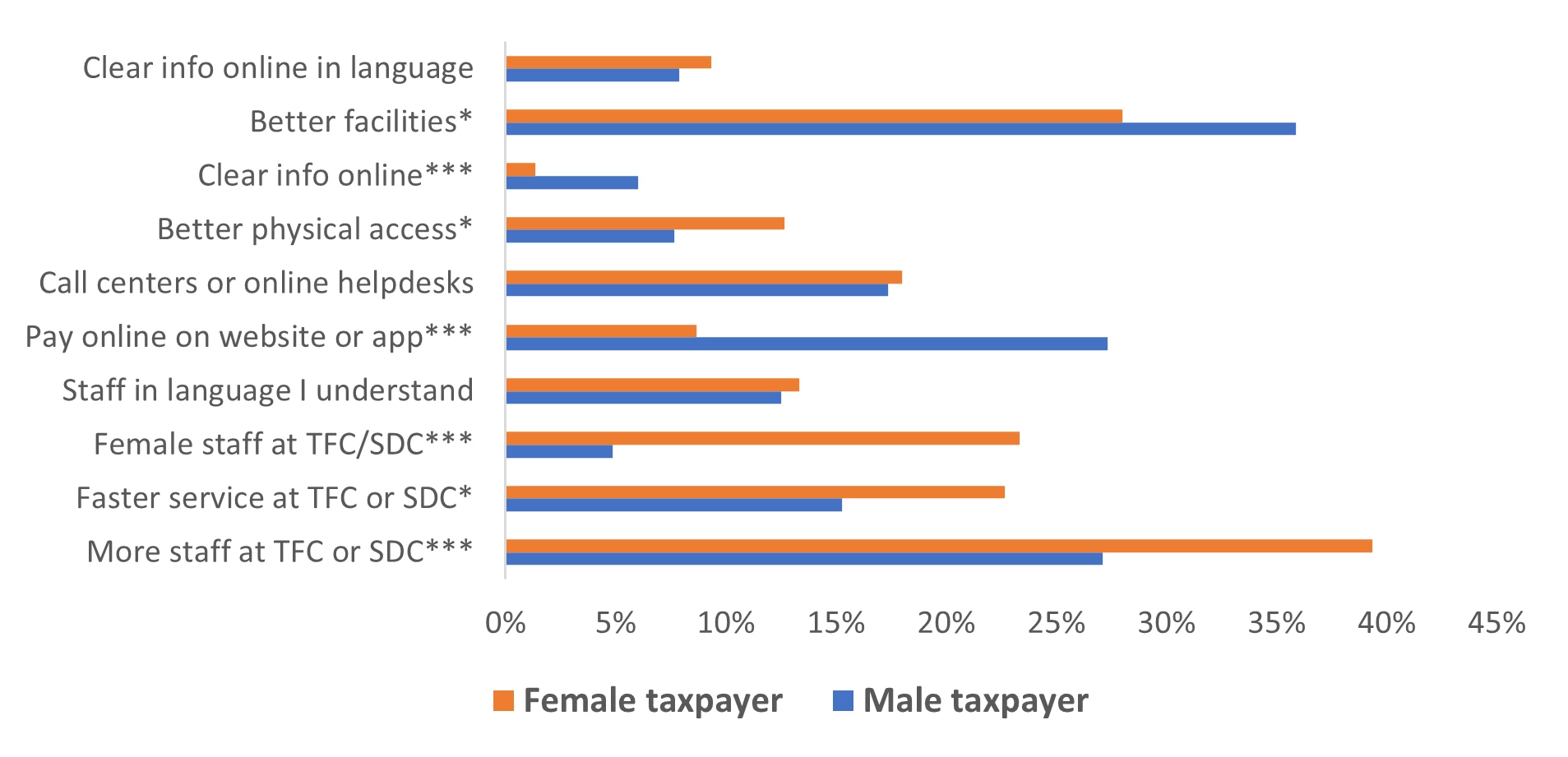

Women believe that having more staff, especially female tax officials at the TFCs, would make it easier for them to register property and pay taxes, while men believe online payment would improve their experience (see figure 2). Availability of female tax officials dedicated to serving women is likely to make it easier, but it is important to create a safe and equitable work environment for female staff, including providing equal training opportunities and separate spaces for women, such as female washrooms. “We do not have any space to pray, and we don’t even have a washroom.” (Female staff in the Excise, Taxation, and Narcotics Control Department).

Figure 2: Measures that Would Make it Easier for Property Registration or Tax Payment

Figure 2: Measures that Would Make it Easier for Property Registration or Tax Payment

Source: Authors’ calculations based on the Taxpayer Survey.

Notes: Respondents chose up to two main measures. The gender difference is significant at: ***1%,**5%,*10%.

Simplification of registration processes and terminologies would improve taxpayer experience.

“The language being used during the (property registration) process is extremely difficult. Either easy Urdu or Pashto should be used.” (Female taxpayer from a focus group discussion).

Women pointed out that existing guidance forms for property registration and tax payments were difficult to understand and emphasized the need for easy-to-understand terminology. The property registration process also required making multiple visits to different service counters. A more streamlined registration process would improve taxpayer experience.

As revenue authorities digitize property registration processes and tax services, it is important to account for women’s constraints where there are large gender gaps in access to digital technologies and literacy. Field-level education campaigns (through TV or radio programs) and social media to disseminate information on women’s property rights and tax can be used to create awareness. During focus group discussions, female taxpayers showed willingness to visit government offices to seek services if they were served by female staff. At the same time, female government staff highlighted the need for a safe and equitable environment, which is integral to help women’s economic empowerment in the long run.

Join the Conversation