Kazakhstan chart

Kazakhstan chart

Compared with Kazakhstan’s domestic financial markets, the offshore (meaning international) financial markets are more sensitive to environmental risks, the “E” in ESG. That’s because of the broader policy and corporate actions around the greening of investments, including ESG corporate governance actions (such as the 2021 Glasgow Financial Alliance for Net Zero, with more than 550 members across different parts of the financial sector) and the response of financial regulators to the challenges posed by climate change (the 2022 Principles for effective management and supervision of climate-related financial risks issued by the Basel Committee).

Interestingly, the Kazakh economy, which is dependent on its extractive enterprises, is to a large extent financed in the offshore markets—about as much as by the domestic banking system. This raises an important question: what happens if Kazakh national champions from “brown” sectors—such as oil and fossil fuel extractive industries–cannot refinance their debt in the greening offshore markets? And what could be the implications of that for the country’s just transition from fossil fuels and MSME financing? The bunching repayments of international bonds and loans issued by Kazakh brown champions in 2030 bring about a looming deadline for early action.

Digging into the data

To shed some light on these questions, we delve into data from the National Bank of Kazakhstan and Bloomberg on loan and bond issuance to classify Kazakhstan corporate bond and loan financing in the offshore (international) and compare it to the financing from onshore (local) markets. We exclude state financing and state funds but keep state-owned enterprises among the corporations in our scope. Economic activities are classified according to their degree of exposure to physical and/or transition risks.

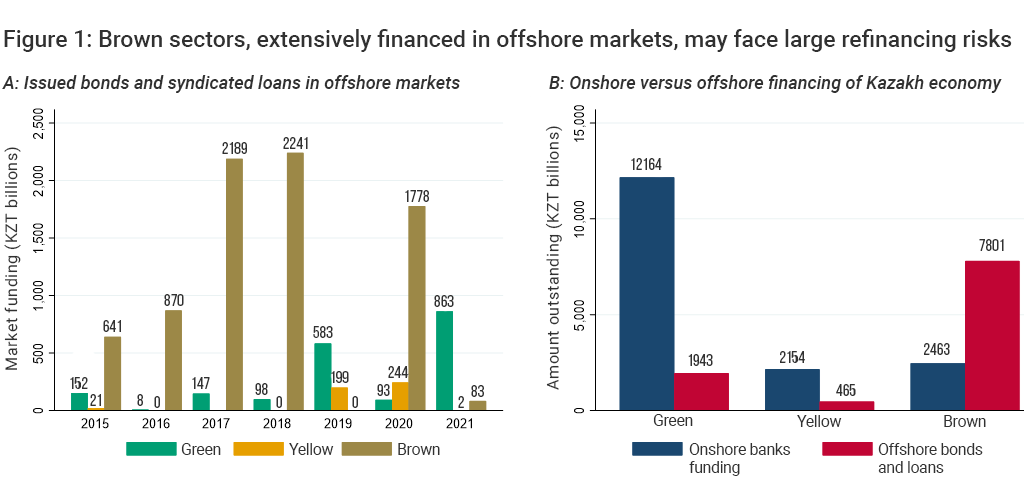

The data shows that as of 2015 a greater share of the financing from offshore markets went to brown sectors of the Kazakh economy (Figure 1, Panel A), a trend that peaked in 2017-18 The gap between green and brown sector financing from offshore markets also widened and peaked in 2017. Since then, that gap narrowed. 2021 marks a possible reversal from majority-brown to majority-green financing and highlights the heightened refinancing risks for brown sectors in offshore markets that are more progressive in responding to climate change than Kazakhstan’s domestic market. If the refinancing risk materializes, brown sectors could be forced to return to the domestic bank market for financing and Kazakh banks would directly or indirectly take the brunt of such unexpected credit demand.

Note: (billions KZT). Economic activities are classified in brown, yellow, and green, corresponding to high, medium, and low exposure to physical and/or transition risks respectively. Panel A reports the amount of market funding (outstanding, both loans and bonds) raised over the period 2015-2021. Market funding raised by government and government funds is excluded from the computations. Funding in USD, Euro, Ruble, Swiss Franc and Chinese Renminbi are converted using the average official foreign exchange rates published by the National Bank of Kazakhstan. Panel B reports the sum of market funding by green category over the period 2015-2021 and the amount of bank loans outstanding as of November 2021 by green category.

Offshore financing of the Kazakh economy is almost as large as domestic financing but is tapped mostly by brown sectors. We compared the volumes and structure of onshore and offshore financing in relation to green, yellow, and brown sectors (Figure 1, Panel B). While domestic banks finance mostly green sectors, offshore markets finance mostly brown sectors.

Most offshore loans and bonds of the brown sector mature before 2030. If brown champions of the Kazakh economy are not refinanced by offshore markets, large financing needs will have to be accommodated by the domestic financial market or public resources—triggering fiscal contingent liabilities to protect systemically important production and employment at the expense of health and education. Otherwise, brown champions will need to downsize with repercussions for their local supply chains and the local services economy that developed around them—especially in mono-industry towns, districts, and counties.

A hidden risk to the just transition

What does this mean for the domestic financial market and banks, which represent the main channels of local financial intermediation? Banks will have to meet the additional financing needs demanded by the returning brown champions by massively increasing deposit mobilization or attracting large credit lines from abroad. If this is not feasible, they will not be able to uphold their current portfolio allocation. And because banks traditionally perceive them as the riskiest segment of their loan portfolios, Kazakh SMEs are the likeliest candidates to see reduced capital allocation—being crowded out from bank lending. This would follow an already difficult environment where credit to SMEs has been declining since late 2016 despite various public financial support programs. Further depriving SMEs of market-driven credit may be one large risk for the just transition in Kazakhstan.

International financial institutions (IFIs) can help Kazakhstan cope with this challenge in at least two ways:

- IFIs can develop co-financing products for the transition of brown champions with greening conditions and private capital participation as built-in features. To this end, adopting a green taxonomy identifying the conditions under which different economic activities can be considered green is paramount.

- IFIs can help scale up the existing market-friendly financial products and develop new financial products that would de-risk the Kazakh MSME sector for bank, microfinance, and capital market financing—this can include expanding market-friendly guarantee schemes or promoting smooth graduation of MSMEs from microfinance to SME bank to universal bank financial services. On the MSME side, urgent gaps in capabilities to address include financial management, adoption of green and digital technologies, and integration into supply chains.

Join the Conversation