Производство традиционной одежды, Казахстан.

Производство традиционной одежды, Казахстан.

“Productivity isn’t everything, but, in the long run, it is almost everything.” (Paul Krugman, 1994)

Around the world, productivity—the efficiency with which firms combine labor and capital to produce goods and services—is a crucial driver of economic growth. It is also a major factor in global inequality. In fact, productivity is so important, it accounts for nearly half the difference in per capita income among countries.

This is true also of Kazakhstan, where a more widespread jumpstart in productivity growth beyond extractive industries could be the restart button to a lethargic growth engine that brings prosperity to all.

Kazakhstan needs to work hard to boost its productivity to reach its ambition of high-income status by 2050, and to join the ranks of the 30 most developed countries. To do this, businesses in Kazakhstan have to improve how they combine people skills with financial and physical resources to produce quality goods and services for domestic consumption and export.

How has productivity fared in Kazakhstan so far?

Although productivity growth features prominently in Kazakhstan’s economic strategies, including its 2025 Strategic Development Plan, the country largely relies on the extractive industry to generate any productivity offshoots.

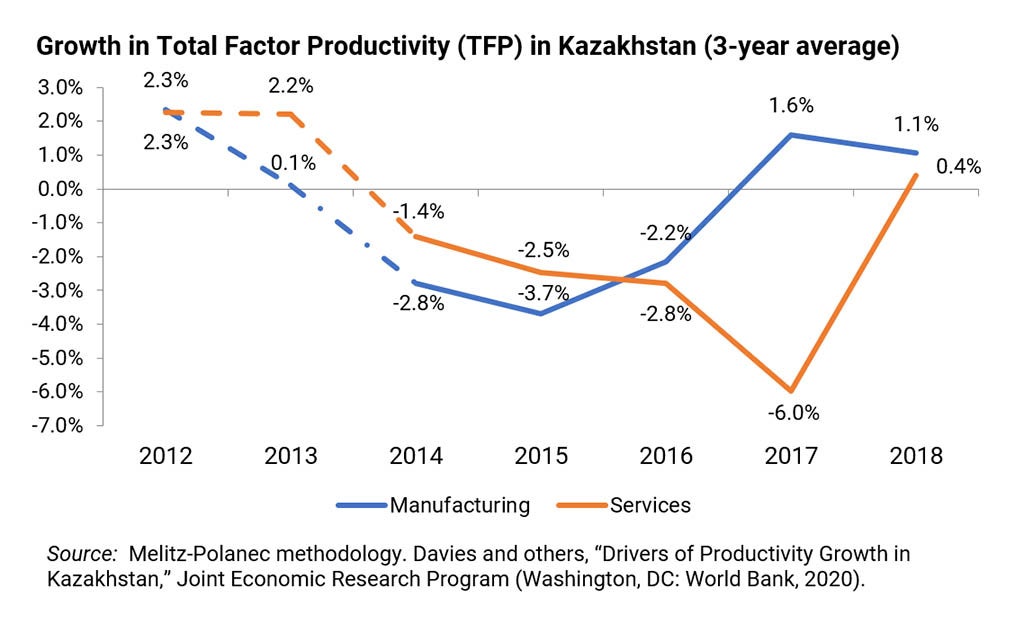

Between 2015 and 2018, manufacturing and services experienced only a slow growth in productivity, averaging just 1.1 and 0.4 percent, respectively. Before the 2014 economic crisis, productivity growth in Kazakhstan was hovering around 2.3 percent, a more decent level and not too far behind the 2.8 percent productivity rate that fast-growing China had been experiencing before the 2008 global financial crisis.

There are three main dimensions to understanding productivity. First, we look at how well firms are upgrading through innovation, technology adoption, and better management, such as monitoring production to identify and fix persistent problems, promoting employees based on performance (rather than, for example, family connections), and retraining or even removing incompetent workers.

Second, productivity is about the more creative firms getting the right resources—the needed funding, skilled people, and suitable land—to produce more or better, and to grow.

Finally, firms with new ideas about how to perform more effectively and efficiently, and on a larger scale should be helped to enter the market, and poorly performing firms should be forced to make their exit so their human and capital resources can be deployed more productively elsewhere. In other words, unproductive firms should shut down and productive ones should grow.

When analyzing productivity growth in Kazakhstan in the past decade, the picture is rather bleak across all three dimensions.

The financial market is a crucial link to firm productivity. Taking a risk on swiftly developing new innovative projects and seizing new business opportunities both require funding that can work with uncertain business outcomes in the short term. One such option is new equity capital. In contrast, financing through credit is cheaper and more suitable for scaling up existing business ideas in response to increased demand.

The costs of financial operations, such as fees for payment of services, interest on credit financing for production inputs, or insurance premiums to safeguard facilities, are all essential costs of doing business the way that boosts firm productivity. Moreover, pressure from competitors encourages banks to provide credit only to the most promising projects, which helps to eliminate the unpromising ones and thus raise aggregate productivity at the country level.

Unfortunately, banks in Kazakhstan often fail to boost their country’s productivity because they pass on firms that could turn credit into growth. In a nutshell, businesses in Kazakhstan are starved of financing. The little credit that does flow increasingly goes to non-viable businesses, thereby hurting productivity.

Overall, well-intended state lending programs have discouraged banks from seeking out the more productive projects and instead have perpetuated the survival of ineffectual zombie firms. By end-2018, every eighth corporate loan was provided under a state program, and every fifth corporate borrower was subsidized.

Clearly, the COVID crisis has been a huge blow to firms’ viability and some will never recover; however, the state’s blanket financial support programs must learn to target viable businesses that fit the new post-COVID economy: more digitalized, greener, and sustainable.

What will it take to restart Kazakhstan’s growth engine?

Boosting firm capabilities and reforming state financial programs should be the first steps in policy reform. To increase productivity, Kazakhstan needs to reform multiple areas and remove distortions in the business environment—such as non-transparent investment regulations, the lack of investor protection, and cumbersome tax compliance rules—as well as restrictions to competition—such as from the operations of state owned enterprises in numerous markets. To strengthen firm capabilities for productive growth, state support needs to include non-financial support measures like management consulting services, supplier development programs, and easier access to soft infrastructure such as core support services. This is because such skills are currently lacking and hamper business development especially for SMEs.

Parallel financial support programs must shift to indirect approaches that support the kind of risk-taking associated with high value-added activities. At the same time, banks should be subject to competitive pressure through regulation and state programs so that they are encouraged to pursue the most viable projects rather than the comfort of large collateral that they typically require.

At the same time, developing robust monitoring and evaluation systems will facilitate adjustments to the support programs over time based on evidence of real impact rather than deployed resources.

Kazakhstan needs to take action now to institute real changes to the country’s banking operations and business support strategies. This will help the country to recover from the pandemic-induced crisis and put it on a path toward more robust productivity growth.

Join the Conversation