Melissa Thomas, author of Govern like us, speaking at the World Bank recently raised a very interesting question: is our expectation that poor countries with limited resources can deliver high-quality governance unrealistic?

Can these countries provide the public goods and services that citizens demand and need, to be able to forge a strong social contract?

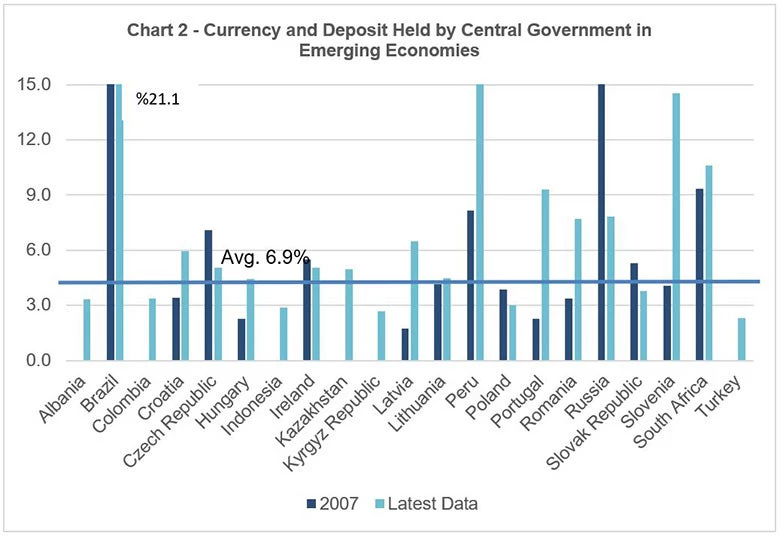

She compares the levels of revenue per capita in rich and poor countries and finds that in the poorest countries, levels of revenue per capita are so low that it would be years, or even decades, until they have enough to provide a decent level of public goods and services.

It is in that context that I thought of Sri Mulyani’s appeal during the Spring Meetings when she spoke of the need to clamp down on tax evasion and avoidance and boost the domestic resource mobilization (DRM) capacities of developing countries as a means of finding resources for financing development going forward.

When we look at the figures in Chart 1, we see that only 23 countries in the world have revenues per capita exceeding USD 10,000 PPP in 2009. Over 80 countries have less than USD 1,000 per capita. And there are as many as 54 countries with revenues less than USD 500 per capita.

The figures for revenue per capita of the US over the last century help us see the problem in its proper perspective. As far back as 1936, the per capita revenue in the US was $503, and since then it has grown steadily.

This leads us to two conclusions: one, the Bank’s role in undertaking tax and revenue mobilization reform projects to increase DRM capacities in developing countries is critical; and, two, DRM cannot completely replace overseas development assistance (ODA) in the poorest countries.

On the first, the World Bank can do a lot through its IPF and TA projects in the area of tax and revenue mobilization to enhance revenues per capita.

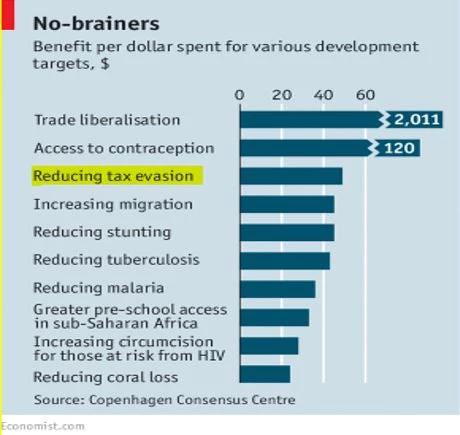

The Copenhagen Consensus Center has found that there is a very high return on investment in these projects: every dollar spent on tax administration reform and modernization yields 45 dollars , a 4,500 percent return! It appears to be imperative that the World Bank deploy sufficient resources to increase the number of projects in the area of tax and revenue mobilization.

However, there is a time lag between implementation of tax modernization projects and the results becoming visible in terms of higher revenues.

For some of the poorest countries with very low revenues per capita, despite Bank support, the resulting higher revenues will still be insufficient for achieving development goals. For these countries, the world must plan to supplement their DRM efforts with ODA to help them meet the Sustainable Development Goals.

Join the Conversation