This is the 14th in our series of posts by PhD students on the job market this year.

If you want to keep corrupt bureaucrats in check, should you audit them unexpectedly? The prevailing logic is that when an audit is predictable, bureaucrats can adjust their behavior to evade detection. So, maintaining unpredictability is better. But, in theory, this is not always the best approach. Whether you should audit bureaucrats unexpectedly or not depends on the responsiveness of (deterred) corrupt behavior as their expectations of being audited change.

Consider the following example. Suppose corrupt bureaucrats are only deterred by the threat of an audit when they are at least 80% sure an audit will occur. With limited resources, the audit agency can only audit 50% of bureaucrats. Then, a policy that provides no additional information to bureaucrats leads bureaucrats to believe there is a 50/50 chance of an audit. This policy achieves no deterrence, since a 50% probability is strictly lower than a 80% probability. Auditors could instead provide information to increase bureaucrats’ confidence about whether they will be audited or not. The outcome under this policy is that some bureaucrats are deterred while others are not, which is better in aggregate than no deterrence at all.

My job market paper provides an answer to this question by studying the monitoring policy of bureaucrats responsible for implementing India's Mahatma Ghandi National Rural Employment Guarantee Scheme (NREGS). Under this monitoring policy, bureaucrats took turns being audited. Audits were also randomly assigned, which generated exogenous and varying expectations of being audited among bureaucrats. I estimate the changes in misappropriated program expenditures as bureaucrats’ expectations of being audited change. Applying a signaling model to these estimates, I find that providing information to bureaucrats about their audit would have saved USD 35m in less misappropriated expenditures (16% of annual program expenditures in this setting) when compared to a policy that audits them unexpectedly.

The empirical setting

NREGS is the largest public employment program in the world, providing social insurance to 11.5% of the world’s population. The program guarantees employment to rural households to work on public projects. Issues with NREGS program implementation range from participant payment delays to poor work-planning to fabricated employment and material procurement. Existing literature and audit reports document the problem of financial misappropriation in NREGS.

This paper leverages a monitoring policy, implemented in the state of Jharkhand from 2016-19, where audits were staggered across years and randomly assigned without replacement. The combination of the staggered implementation, the randomization design, and the information from auditor announcements generated random variation in bureaucrats' expectations of being audited. Bureaucrats observe who has been and is waiting to be audited. For example, the longer bureaucrats wait to be audited, as audits are assigned in turn, the better they can predict their audit in advance. In contrast, those who were audited early expect their next audit will not occur until the ongoing round of audits has been completed for everyone.

I estimate these anticipatory responses of bureaucrats on monthly program expenditures by employing an event study specification around the timing of announcements. The challenge is that program expenditures comprise both honest and misappropriated expenditures. Using administrative and audit report data to overcome this challenge, I show in the paper that my estimates are consistent with changes in misappropriated expenditures and are inconsistent with potential confounding mechanisms that may drive changes in honest expenditures.

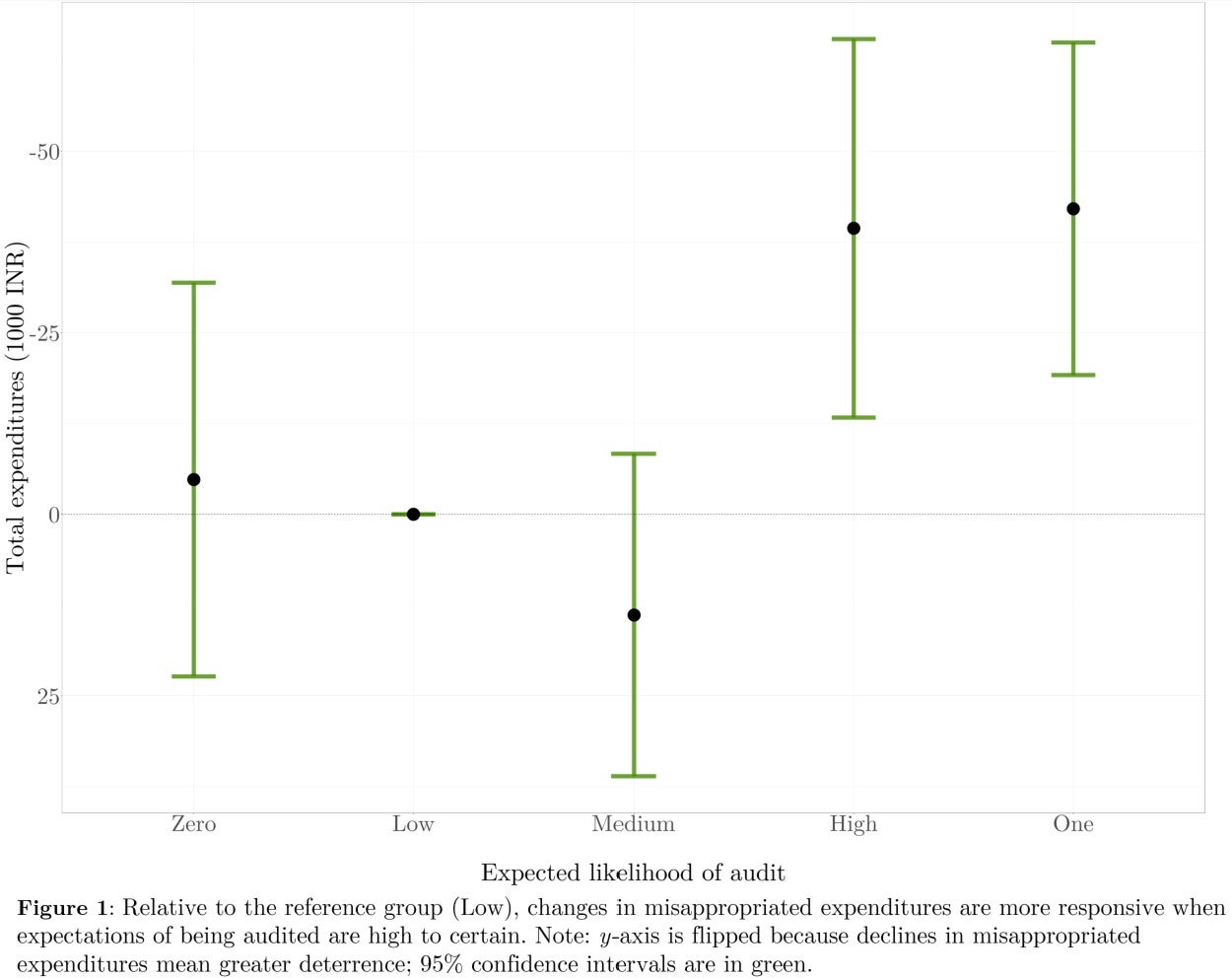

Bureaucrats are more responsive when expectations of being audited are high

Anticipatory effects of the audit on spending are substantial. They are more elastic at higher (i.e. highly likely to certain one will be audited) than lower expectations of being audited. When expectations of being audited are lower, expenditures are statistically indistinguishable between these periods. When expectations of being audited are high, there is a 15% decline in expenditures. A decline in wage expenditures drives this result. Using data from audit reports and other administrative data, these results are consistent with bureaucrats adjusting the timing and type of expenditure to misappropriate as their expectations of being audited increase.

Providing information about the audit in advance is best

I develop an optimal signaling model following the literature on Bayesian persuasion. In this model, a principal is concerned with maximizing deterrence among bureaucrats. The principal has a choice over the information communicated about the likelihood of being audited. The optimal communication of audit risk depends on the relationship between bureaucrat deterrence and their expectations of being audited. This relationship, specific to its setting, is determined by the relative benefit from engaging in additional misconduct considering bureaucrats’ costs from being caught and penalized under an audit. The relationship between bureaucrat deterrence and their expectations of being audited is a sufficient statistic for characterizing the principal's optimal communication policy and analyzing welfare under counterfactual policies. I estimate this sufficient statistic using the estimated anticipation effects.

The following figure plots (with 95% CI) the relationship between deterrence and bureaucrats’ expectations of being audit. Deterrence, on the vertical axis, is the estimated change in expenditures as a share of expenditures of the baseline group (taken from Figure 1). Expectations of being audited, on the horizontal axis, is the likelihood bureaucrats believe they will be audited. To be agnostic, I make a range of assumptions about bureaucrats’ expectations. I base these assumptions on information from the auditor announcements over time. The figure below shows the relationship when bureaucrats’ expectations are assumed to be based on concurrently observed information.

Suppose budget constraints only allowed the agency to audit 50% of bureaucrats. Bureaucrats’ prior expectations of being audited is then 50%. Without more information, this leads to an amount of deterrence demarcated by the square in the figure. Instead, the auditor could communicate information. That is, inform a random subset of bureaucrats of an audit (leading to an expectation of 1) and inform the rest of no audit (leading to an expectation of 0). This achieves a higher amount of deterrence demarcated by the diamond in the figure, which is a weighted combination of the endpoints.

Information design and the value of information

Informing a random subset of bureaucrats when they will be audited or not maximizes deterrence in this empirical setting . This conclusion is driven by the finding that bureaucrats' deterrence is more responsive on the margin at higher than lower expectations of being audited. Signals which communicate more information yield more deterrence than signals that maintain unpredictability. This also implies that assigning audits randomly without replacement is better than randomly with replacement. Welfare estimates show that a policy which informs of audits in advance would have saved USD 35 million (or 16% of average annual expenditures) in less misappropriated expenditures when compared to a policy that provides no information and maintains uncertainty . These gains are substantial given prevailing practices to maintain uncertainty among audit subjects. A change in the design of information may yield significant returns. This paper makes a strong case for evaluating this possibility in other settings.

Wendy N. Wong is a PhD student at The University of Chicago’s Harris School of Public Policy.

Join the Conversation