Piotr Lewandowski is President of the Institute for Structural Research in Warsaw.

In my previous post I showed that Poland has become a country with the highest share of temporary contracts in Europe – now around 26.9% of workers. I argued that this process wasn’t triggered by any particular labor law reform, but rather interactions between several labor regulations (namely employment protection legislation, taxation, and the minimum wage). In particular, the use of civil law contracts (as opposed to those based on the labor code) has become increasingly common, resulting in a dual labor market, in which one segment of the work force is better off (in terms of wages, income, and training) than the other.

The Polish government has labeled these contracts “junk contracts” but so far it has failed to truly address the issue. Its main plan is to increase the social security contributions paid from income earned via civil law contracts. But although this might help the budget, it would only strengthen the incentive to relocate jobs in the shadow economy and wouldn’t address the precariousness resulting from the easy termination of these contracts and the lack of eligibility for unemployment benefits.

What can be done to overcome the current deadlock on this issue? In my recent paper (with Piotr Arak and Piotr Żakowiecki), we put forth a three-pronged proposal that is centered on the concept of a single type of employment contract that would base privileges and obligations solely on the tenure of a worker in a given company, not the type of contract. It follows the general lines of “single contracts” now being weighed in Italy and Spain.

A “Single Contract” For All Workers

How would the single contract work? It would be an open-ended (“regular”) contract that provided newly hired workers with greater protection against dismissal than is the case now for employees with civil law contracts or self-employed, although it would be less protection than enjoyed by those now with regular contracts. Crucially, the protection would increase gradually with time, becoming equal with that of current employment contracts after three years of employment. This arrangement would reduce the employers’ risk if the new employee failed to meet their expectations, while motivating the employee to work efficiently and be loyal. It would also eliminate civil law contracts but require higher social security contributions than those now paid by people with these.

A Reduced Tax Burden for Low Earners

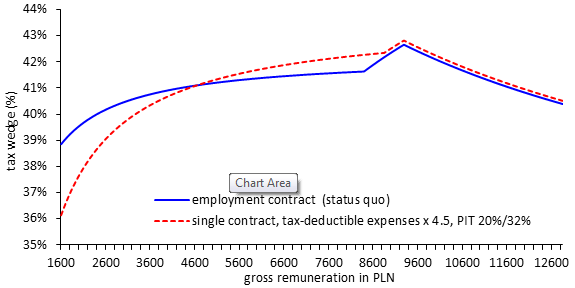

To cushion the impact of these higher contributions, we suggest reducing the personal income tax wedge for low earners – that is, the difference between the labor cost incurred by the employer (income tax and social security contributions) and the net remuneration received by the worker. Currently, it is the low-paid workers who are most likely to be crowded out from regular employment to civil law contracts because of the substantial difference in the tax wedge between the two.

We propose increasing the tax deductible expenses 4.5 times and raising the basic personal income tax rate from current 18% to 20% (the second income tax rate would remain at the level of 32% and the tax brackets would remain unchanged). This would mean reducing the tax burden only for employees earning up to PLN 4,000 gross per month and, most significantly, for individuals earning below PLN 3,000 gross. For minimum wage earners (PLN 1,600 gross in 2013), it would mean a net income increase of PLN 52.5 per month (or PLN 630 per year). However, the government revenue from this tax would remain unchanged, as the taxation of the 10% of the most affluent households would increase enough to compensate for the lower taxes paid by households below the median (see Figure 1).

(Contribution and tax wedge depending on changes in the personal income tax system, 2013)

Notes: Income tax and social security contributions as a percentage of the total cost borne by the employer, worker settling his/her tax individually and receiving no social transfers. PIT stands for personal income tax. PLN stands for the Polish zloty.

Source: Authors’ calculations.

A Regulation Break for Small Companies

Some of the problems related to the dual labor market could also be solved by introducing fewer obligations for small employers (those with fewer than 20 employees). This could be done by implementing a separate labor code that would free these firms of a number of requirements that currently pose a burden. Its provisions would include, for example, abolishing the protection against dismissal during the period of four years before the retirement age and covering the costs of sick leave only for up to 14 days (after that, the Social Insurance Institution would pay the costs).

* * * * *

All together, we strongly believe that the combination of a single contract, personal income tax reform, and less red-tape for small companies would open the door to a better balance between flexibility and security than currently exhibited by the Polish labor market.

(See also an interview with Tito Boeri on “Replacing Europe’s Dual Labor Markets with a Single Contract” and videos from the IBS October 8-9 conference in Warsaw on “Dual labor markets, minimum wage and inequalities.”)

Join the Conversation