Lady working on computer with mask

Lady working on computer with mask

At any given time in every country, some firms enter the market or expand by creating jobs, while others exit or shrink by reducing their workforce. This generates a reallocation of jobs due to firing and hiring. The year 2020, however, was not a typical year. World output fell by 3.5% year-on-year due to the COVID-19 pandemic.

So, what did the process of job reallocation look like in the aftermath of the initial pandemic shock? We examined this question using firm-level panel data on employment collected by the World Bank and partners in ten countries, including: Bulgaria, Indonesia, Kenya, Poland, Romania, Senegal, South Africa, Tanzania, Turkey, and Vietnam.

Ultimately, we found high rates of job destruction and reallocation across the globe – but particularly in countries in Sub-Saharan Africa . That said, differences did not emerge only between countries but also between sectors within country. For instance, some sectors in some countries (e.g. those with higher adoption of digital tools and that received more government support) fared better than others, and firms overall appeared to be optimistic about the future.

Before we dive into the details, though, it is useful to review some concepts that will be used in this blog.

Defining job destruction and creation

We followed Davis and Haltiwanger in using their now standard definitions: gross job destruction is the sum of employment reductions for firms that report shrinking in a certain period. In contrast, gross job creation is the sum of employment created by firms that report growing in the same period. Note that, due to data limitations, we are unable to account for firms that exit or enter the market. Net employment change is the difference between job creation and job destruction. Excess job reallocation is defined as the sum of gross job creation and absolute gross job destruction minus the absolute value of the net employment change. The excess job reallocation therefore indicates the amount of job movements above what is required to accommodate the observed net employment change. To measure these job flow measures as rates, we expressed employment changes as a percentage of initial total employment and also weighed each firm’s change by their share in total employment.

Let’s imagine for example an economy where there are two firms, Firm 1 creates 10 jobs and Firm 2 reduces its employees by 5, gross job destruction would be -5 jobs, gross job creation would equal +10, and the net job growth is +5. Excess job reallocation in this case would be 10, since there are 15 job movements overall, 10 more than required to cover the net employment creation of 5.

High job destruction and high excess job reallocation during the early pandemic

Our data from the early phase of the pandemic — between January and June 2020 — revealed a lot more job destruction than job creation (see Figure 1). This is true especially for the countries in Sub-Saharan Africa, whereas we found less job destruction and lower excess job reallocation for countries in Europe and Asia.

In all countries, few jobs shifted from one sector to another since most sectors shrunk, so the majority of reallocation occurred within the same sectors between firms. Overall, our results chime with recent evidence from the US showing that “COVID-19 is also a reallocation shock”.

Figure 1: Job dynamics in the early COVID-19 pandemic

What’s behind these patterns?

To investigate these patterns further, we calculated these job flow measures at the sectoral level in each country. Countries and sectors that were hit harder during the pandemic, as measured by the average amount of revenue losses, were characterized by lower job growth and higher excess reallocation, possibly since firms with large drops in sales fired more and hired less to reduce their costs.

Exports-oriented sectors (measured by the share of firms exporting) were hit harder than others. Sectors with a higher concentration of exporters also fared worse in terms of net job growth. They may have been affected by a large reduction of demand from their international trading partners, and changes to trading patterns as a response to increased transport costs or changing consumption patterns.

Technology and public policy made a difference

We also found that sectors with a higher share of firms adopting digital tools experienced both higher net job growth and higher excess reallocation. Similarly, sectors with more firms that introduced product innovations (i.e. changes to their product mix) experienced higher net job growth, though we did not observe a correlation with excess job reallocation.

In addition, public policy may have had a protective effect, because firms in sectors and countries with better access to public support experienced fewer job losses and less excess job reallocation.

Firms are optimistic about the future

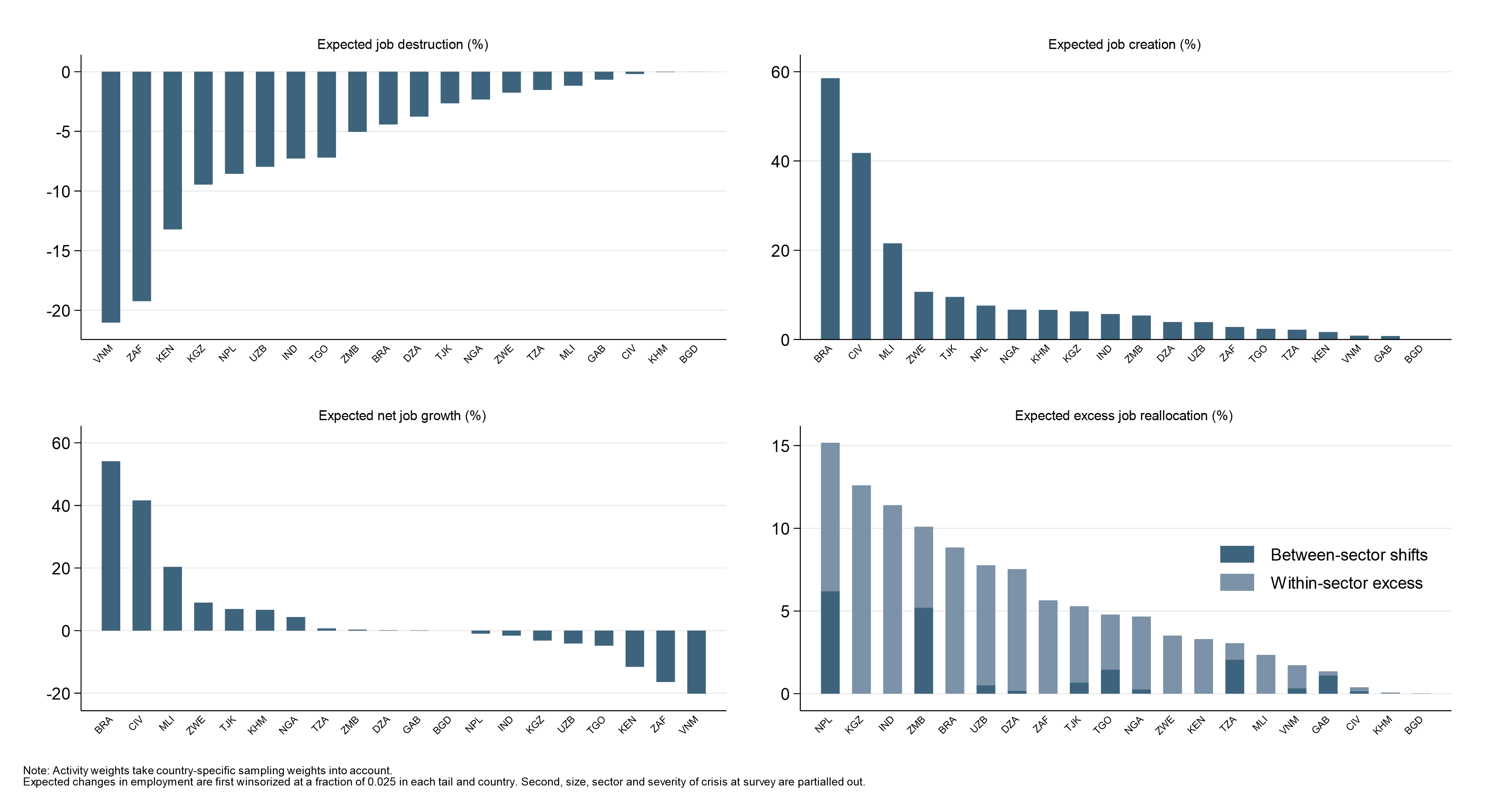

Finally, despite the very severe shock experienced, we can conclude on an optimistic note. We found that firms are much more optimistic about the future than the the recent past would indicate . For all countries included in both Figures 1 and 2, with one exception, the net job growth expected in the six months after the survey is higher than the past net job growth between January and June 2020, and the expected excess job reallocation is higher than the past excess job reallocation.

Figure 2: Expected job dynamics in the early COVID-19 pandemic

Join the Conversation