Mobile payments herald financial opportunity in Somalia. But for whom? And for how long? If Somalia’s telecommunications sector is the locomotive driving the economy, mobile money is the highway, transferring value and extending access to the economic playing field, nowadays at a rapid pace.

Somalia’s mobile money services, such as Hormuud’s EVC+ or Telesom’s Zaad, have been acting as a virtual, dollarized currency since their inception. However, mobile money usage, and the extent of the dollarization and virtualization of the currency it represents, is actually far higher than previously thought.

Research carried out throughout 2016, conducted with Altai Consulting through the World Bank’s Somalia ICT Sector Support Project and spanning all economic zones and Federally Ministered States, finds that it is the current mobile money ecosystem that achieves all this, and more.

A stark example is the prevalence of mobile money usage (73%) compared to the 15% of the population who have accounts with formal banks. And the use of mobile money to transfer incoming international remittances domestically reflects the strong links that exist between mobile network operators and money transfer businesses (MTBs).

This is a substantially different environment than telecommunications in countries across the rest of the African continent, which have been dominated by incoming multi-national companies such as India’s Bharti Telecom or France’s Orange.

Given the complexity of operating in the Somali political environment, investment in telecommunications has been almost exclusively led by Somalis, both from the diaspora and within the country. As a result, the ICT sector has been able to leverage Somali social and business networks, and has created products uniquely suited to the Somali context.

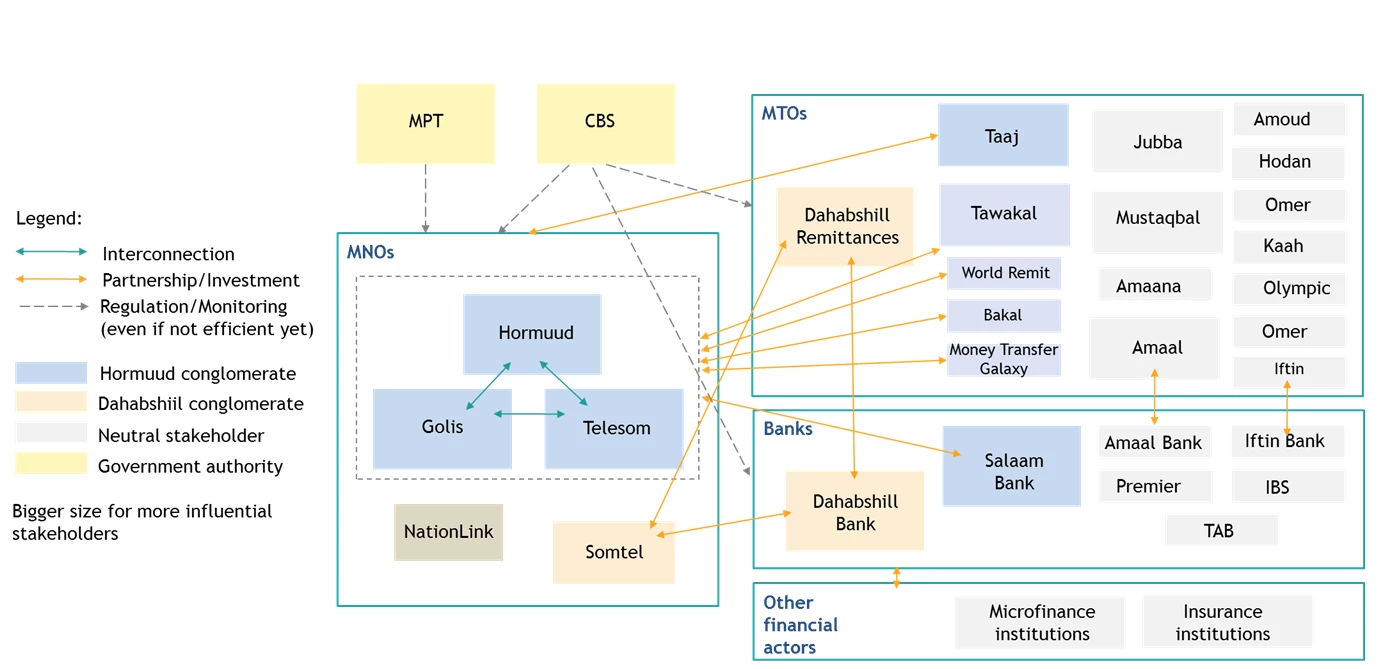

Figure 1: Somalia Mobile Money Ecosystem Mapping

Streets and storefronts in urban spaces and rural villages alike see customers using mobile money for purchasing everyday items, such as groceries, according to Egal Abdiwali, “Mobile Money, Why Somalia Should Take Charge of the New Financial Revolution.”

But, as the Somali President Mohamed Abdullahi Mohamed “Farmaajo” prioritizes security, service delivery, and strengthening collaboration with the private sector, the mobile money sector increasingly finds itself caught between policy reform and private sector growth.

The 2016 research finds 88% of Somalis above the age of 16 own at least 1 SIM card, while 83% of SIM card owners use mobile money.

Mobile money services are often used for cash-in transactions or deposits of eMoney to mobile money accounts, cash-out transactions, and cash withdrawals. They are also used for bills, salary receipts, and merchant payment transactions (of up to 5 times a month) typically ranging between US$20-US$200 each.

The ecosystem is already robust, with nearly two-thirds of users choosing to keep funds in their mobile accounts rather than cashing them out. Large shares in the value mix of disbursements and bill and merchant payments, suggest an expanding ecosystem as increasing numbers of institutions and businesses start using mobile money.

Real-time Growth and Reform

Yet, just as mobile money in Somalia offers startling opportunities, it also comes with staggering risks. The current system in use in the majority of Somali territory lacks formal Know Your Customer requirements on customer identity, and parity between eMoney and cash in banks. Many Somalis report that mobile money is unreliable and puts their money at risk because of a lack of interoperability between different services and transparency over funds. There are also reports of agents struggling to maintain cash for cash-out transactions while the system continues to lack customer guarantee.

Yet despite these concerns, the sector is growing, and Somalia is forecast to play a significant role in reaching GSMA’s expected 725 million unique mobile money subscribers in Africa by 2020.

As such, the following policy priorities are crucial for sustainable growth:

- Establishing parity between online and offline credit for mobile payments

- Developing trusted “know your customer” systems

- Ensuring interconnection of mobile payments between operators

- Passage of Communications Act to license mobile network operators

- Enabling Somali Shilling based mobile money transactions (alongside US$ based payments)

The pilot will model and test the role of industry-friendly regulatory best practices through salary payments to civil servants and cash transfers to support Somalia’s drought response.

What’s next?

To leverage the full potential of Somalia’s mobile money industry, operators need to offer more diverse, value added services to build up their user base and spur more use of mobile finance. This will require reliable regulatory support from the government, as well as private sector adherence to financial and consumer security requirements. This could then help the industry gain more trust from the international community and Somali consumers.

Recent Public Private Dialogues between the telecommunications sector and government have rekindled interest in collaboration. Will both sides be up to the challenge to support regulation and make these social and economic gains a reality?

Join the Conversation