We have documented changes in the insolvency laws of 190 countries around the world over the past 15 years. The goal of this dataset—part of the Doing Business project—is to enable research relating such changes to the development of financial markets and the real economy. In a 2008 research paper with professors Oliver Hart and Andrei Shleifer at Harvard University we explored the initial evidence. Now we examine the three most promising trends in reform, excluding changes that affect the legal index added in 2014.

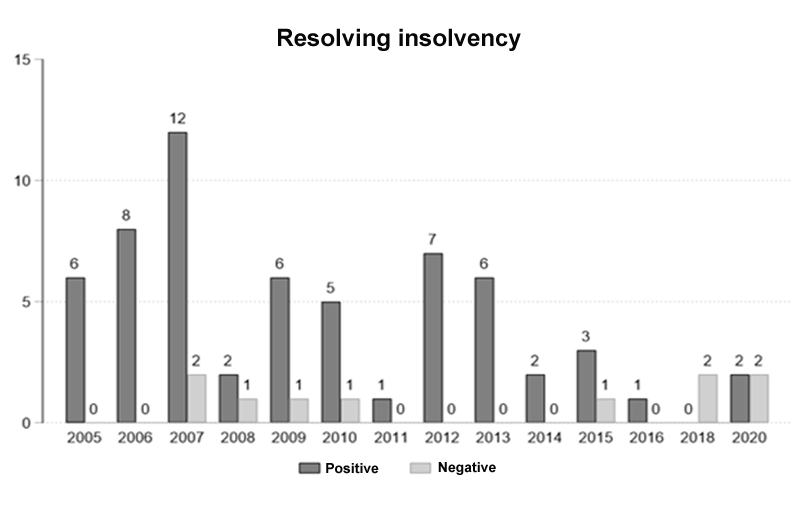

First, we plot the number of insolvency reforms by year (figure 1). A positive reform according to the Doing Business methodology is when the legal change keeps more value in the firm. For example, in 2015 North Macedonia tightened the time frames for insolvency proceedings and appeals, established electronic auctions of debtors’ assets and implemented out-of-court restructuring. A negative reform is when more value is destroyed as a result of the legal change, typically by making the insolvency process lengthier or by changing the priority of claimants. For example, in 2007 Bolivia prohibited the possibility of the debtor company to file for reorganization procedures—leaving as the only option an unwieldy bankruptcy procedure that typically takes several years.

Figure 1

Three types of change are most prevalent: introducing new restructuring procedures, strengthening creditors’ rights and protecting the company’s assets during insolvency.

Introduce reorganization

By allowing viable companies to continue operating as going concerns, the amendments to the insolvency law aim to support entrepreneurial risk-taking. The financial viability of a debtor’s business is restored through a reorganization plan, so that the business lives in spite of the financial deterrents.

In 2013 Slovenia created a simplified reorganization procedure for small companies and a preventive restructuring procedure for large ones. Before the reform was implemented it took almost 2 years to liquidate a company in Ljubljana. In 2015, reorganization became the more likely procedure and the time decreased to less than 1 year, maximizing the viability of companies in distress. In 2016 Kenya introduced reorganization procedures for companies as an alternative to the previously available involuntary winding-up. Again, the process is faster and more companies in distress survive.

Introducing insolvency is difficult at first. Finding expertise to prepare reorganization plans has proven challenging. It requires the capacity to negotiate a plan with multiple creditors in a short period of time to return the company to profitability. Managers of companies in financial difficulties often find it challenging to formulate a reorganization plan. Debtors turn to professionals who have expertise in drafting such plans. However, this approach is expensive, making reorganization procedures accessible to only a small number of debtors.

Strengthen creditors’ rights

Creditors should have a say in insolvency proceedings, thus providing higher debt recovery. Increasing the protection of creditors and their participation in bankruptcy proceedings lowers the cost of debt. The reason behind this pattern is that creditors are more willing to lend because they are more likely to recover their loans.

Kosovo, for example, adopted its first insolvency law in 2016. The law introduced the right of a creditor to reject claims by other creditors. In 2019 the Supreme People’s Court in China issued an order enabling an individual creditor to request information on the debtor’s financial affairs at any time during insolvency proceedings.

Protect the company’s assets during insolvency

The goal is for the distressed company to survive the insolvency procedure. This goal is better achieved if transparent rules are in place for the management of the debtor’s assets during insolvency proceedings. Such rules prevent debtors from distributing assets that can otherwise be used to pay off the creditors or to preserve the running of the business.

In 2014 Chile prohibited the termination of contracts on the grounds of insolvency. In 2015 Vietnam allowed debtors to reject burdensome contracts that may cause harm on the insolvent company. And in 2018 Morocco allowed debtor companies to access new financing once the insolvency proceedings have started, granting creditors who provide such financing with priority over previous claims.

The Doing Business data on insolvency reform allows a next step: research on the benefits to firms in terms of improved viability and access to new financing. Stay tuned.

Join the Conversation