This blog is the fifth in a series of nine blogs on commodity market developments, elaborating on themes discussed in the October 2021 edition of the World Bank’s Commodity Markets Outlook.

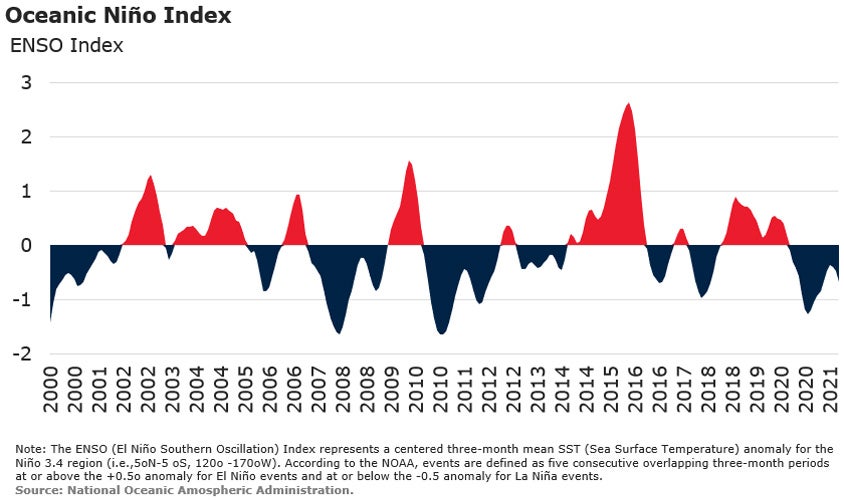

Food commodity prices stabilize. After gaining momentum earlier in the year due to supply shortfalls, high input costs, and stronger-than-expected demand, most food commodity prices stabilized during the past two quarters following optimistic assessments for the current crop season. However, prices for many commodities are well above pre-pandemic levels—the World Bank’s Food Price Index remains at its highest level since 2013. Following a projected increase of 28 percent in 2021, food commodity prices are expected to stabilize this year, although with some heterogeneity. The outlook is subject to various risks, including energy prices, diversion of food commodities to biofuel production, and the emerging La Niña weather pattern.

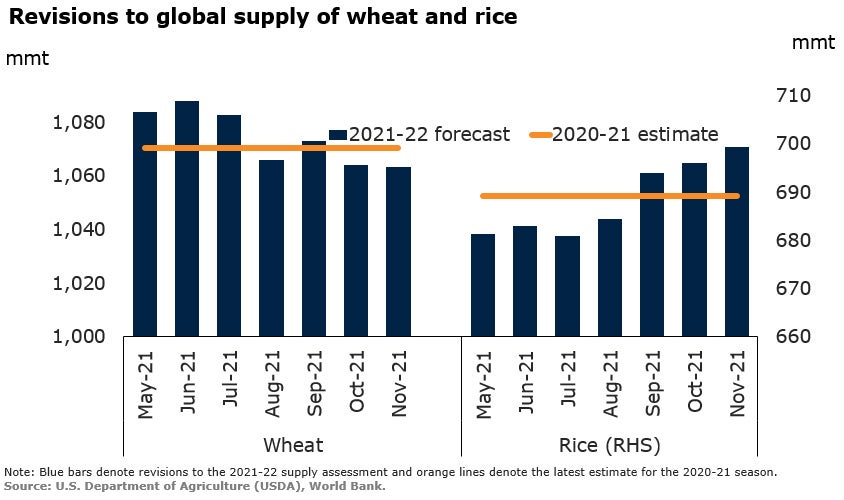

Supply estimates for most crops have been revised upward. Projections of supplies for most major crops for the current season have been revised upward since May. Growing conditions in North and South America have been favorable for maize and soybeans. Conditions for the rice crop have been broadly stable in Asia, world’s main rice producing and consuming region. Wheat is an exception due to reduced output in the United States and the EU.

Global supplies of food commodities is projected to increase in 2021-22. Global supply of grains (consisting of 9 commodities, including wheat, maize, and rice) is expected to grow by 1.7 percent (59 million metric tons (mmt)) this season, according to the U.S. Department of Agriculture. This is higher than the 30-year average growth of 45 mmt. Similarly, the supply of edible oils is expected to grow by nearly 3 percent, or 6.6 mmt, led by an increase in palm and soybean oil production.

The aggregate stocks-to-use ratio is projected to drop marginally. Stronger-than-expected consumption of most food commodities is expected to push the aggregate stocks-to-use ratio (a rough measure of supply relative to demand) to 27.7% in 2021-22, one percentage point lower than last season. Although this is the fourth consecutive annual decline, the ratio (which consists of 12 food commodities) remains high by historical norms.

Rising energy and fertilizer prices pose upside risk to agriculture prices. The surge in energy prices poses a significant risk to the food commodity outlook. For most grain and oilseed crops, energy represents a significant cost component through direct (fuel prices) and indirect channels (chemical and fertilizer prices). Higher energy prices, which surged during 2020Q3, have already affected fertilizer prices, in turn increasing the cost of food production and exerting upward pressure on food prices.

The emerging La Niña could pose an upside risk for some food prices. The emerging La Niña weather pattern could reduce the yield of crops growing in the Southern hemisphere due to drier-than-normal conditions. However, in the Northern hemisphere this winter could increase the yields of some crops, such as maize and wheat.

Diversion of food commodities to biofuels could exert upward pressure on food prices. In view of the ongoing transition from fossil fuels to renewable energy sources in order to meet climate change targets, many countries have announced plans to divert food commodities to the production of biofuels. If these policies become effective, global food prices could come under further upward pressure.

Join the Conversation