Have you ever wanted to know how much money governments borrow and who exactly owes what? Well you're in luck, because the International Debt Statistics 2020 (IDS2020) has not just the latest 2018 external debt data, but also more than 250 new indicators in the database and online tables including external debt data broken down by debtor type (i.e. general government, other public sector, private sector guaranteed by the public sector). This gives users a much more comprehensive tool for analyzing the external debt of a country.

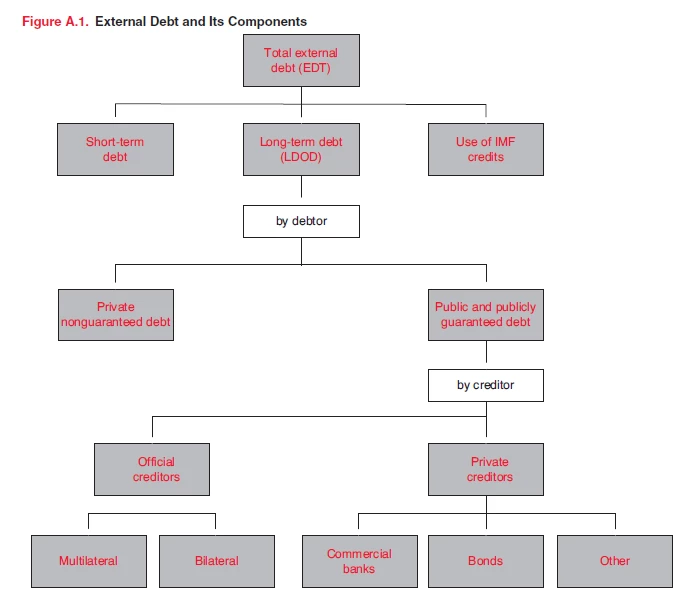

With countries like Argentina back in recession and many of the world’s poorest countries assessed at high risk of debt distress, there is a renewed interest in debt, and who exactly is responsible for repaying it. Part of the effort to increase debt transparency are these new indicators that offer users a way to examine external debt from the perspective of the debtor. Anyone familiar with IDS Figure A.1: External Debt and It’s Components, will recall that previously the data showed the debtor type broken into only two general categories: ‘Public and publicly-guaranteed debt (PPG)’ and 'Private nonguaranteed debt (PNG)’. This broad breakdown did not allow users to see how much debt is owed directly by the government, how much is owed by other public entities, and what the government might have to pay if a guarantee is called.

Now, the IDS2020 database and online tables give detailed debtor breakdowns: ‘Public and publicly guaranteed’ is now disaggregated by ‘Public sector’ and ‘Private sector guaranteed by the public sector’. The ‘Public sector’ is further disaggregated by ‘General government’ and ‘Other public sector’. Within each of these categories, the data is broken down as before, by creditor type such as official vs. private creditors and multilateral vs. bilateral creditors.

From the new breakdown (circled in red), users can now see how much money is borrowed by the government, other public entities and by the private sector with a guarantee from the government, thus enabling more detailed analysis and better comparability of data between different sources. For example, the new indicators show that before the 2008 financial crisis, the long-term external debt of governments in low- and middle-income countries was steady around $1 trillion USD, even falling 28% in low-income countries from $74 billion USD in 2000 to $53 billion in 2006. However, after the financial crisis hit, the LMY governments took on more than double the amount of debt in just 10 years from $1,008 billion USD in 2008 to $2,112 billion USD in 2018.

Let’s take a deeper look into the public sector. In 2018, the share of debt outstanding of external loans held by the government is more than two-thirds of PPG debt in most regions (Europe and Central Asia is the exception with 62%) with the highest share in Sub-Saharan Africa (89%).

Countries in Sub-Saharan Africa continue to rely heavily on the government for most of their external borrowing. Of the 44 Sub-Saharan African countries, the government’s share of long-term PPG external debt in 37 of those countries is 90% or higher and in 23 of them, 100% of the external debt is owed by the government. The creditor breakdown of the general government’s share of public debt is changing with more countries, including IDA-only countries, issuing bonds. In 2008, Sub-Saharan Africa’s general government borrowed mostly from official creditors (multilateral at 41% and bilateral at 37%) with private creditors making up only 23% (15% bonds) of all general government borrowing. A decade later, general government is now borrowing 43% from private lenders, of which the largest share (35%) is coming from bonds, thus reducing the share from official creditors from 78% in 2008 to 57% (32%-multilateral and 25%-bilateral) in 2018.

What other exciting analysis can be done with these new indicators? Give it a try and let us know in the comments section below!

IDS2020 and its products are available at https://data.worldbank.org/products/ids. It can also be accessed through the Debt Portal.

Join the Conversation

Hello: I have been looking at your International Debt Statistics. I see very useful statistics by debtor country, but I am trying to get data on bilateral creditors, including China. Do you have these data available, including looking at pair-wise statistics (creditor x debtor)?

For the Debt Service Suspension Initiative, we recently published monthly and annual debt service projections with additional disaggregation of some official multilateral entities and bilateral creditor countries at http://datatopics.worldbank.org/debt/ids/. The methodology is explained under "Debt Service Payments Projections: What do we measure" link. This is the only pair-wise statistics by creditor... country that we have at this time.

Read more Read less