The recently published International Debt Statistics 2022 highlighted the rise in external debt stocks of low- and middle-income countries at end-2020, reflecting mainly the ongoing COVID-19 pandemic. The combined debt stock of low- and middle-income countries increased by 5.3%, while for many countries in the group, the rise was at double digits. However, as the interest rates plunged to record lows, the interest payments arising from external debt liabilities dropped over the same period. This trend seems analogous to what we observed right after the 2008 global financial crisis—albeit forming at a higher level.

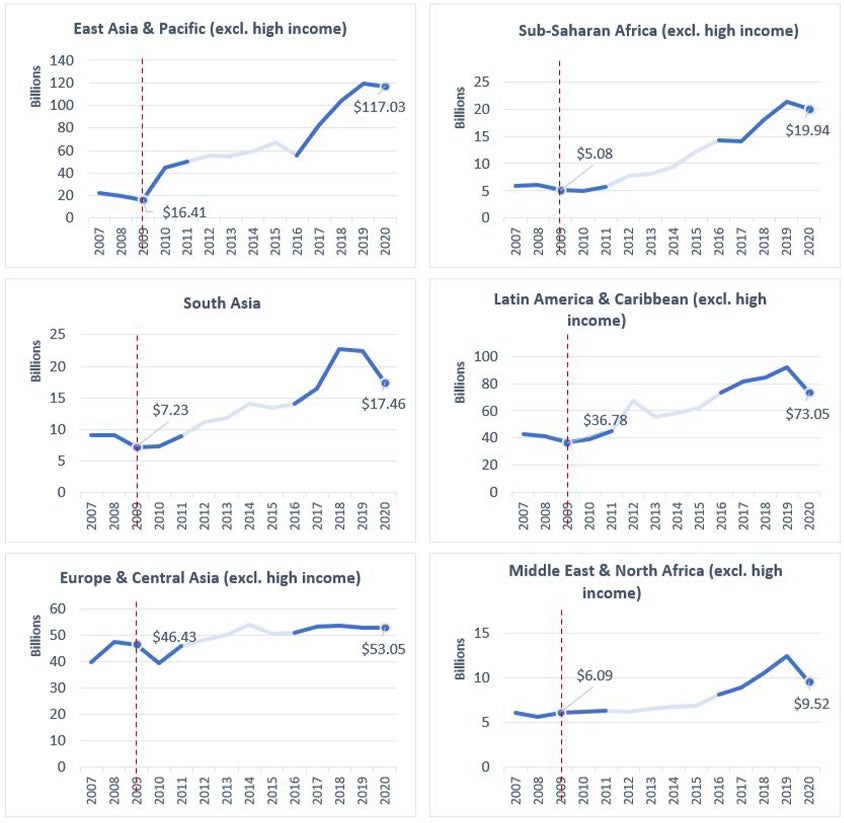

In 2020, the interest payments on external debt of low- and middle-income countries combined dropped by 9.5% compared to its dollar level in 2019. As such, it decreased to $290 billion from $321 billion in 2019. Similarly, the interest payments of the same group of countries declined by 8.9% to $118 billion from $129 billion in 2009, following the global financial crisis. Trends are analogous when the data on low- and middle-income countries are disaggregated by geographical regions.

- In East Asia and Pacific Region, the payments declined by 2.1% and 17.2% in 2020 and 2009, respectively.

- In Latin America and the Caribbean, the drop was more significant during the recent crisis. The interest payments decreased by 20.4% in 2020, compared to the 10.9% decline in 2009.

- In Europe and Central Asia Region, total interest payments decreased only slightly—by 0.1% in 2020, while the decline was 2.4% in the aftermath of the global financial crisis.

- In Middle East and North Africa, similar to the Latin America and Caribbean Region, the decline was more significant during the recent crisis. The total payments dropped by 23.5% in 2020, whereas it increased by 9.3% in 2009.

- In South Asia, in both crises, the plunge was substantial. The interest payments on external debt decreased by more than 20% after the onset of both crises.

- Finally, in Sub-Saharan Africa, interest payments declined by 6.7% in 2020 and about 17% in 2009.

Interest Payments on External Debt (US$) – Geographical Regions

Source: International Debt Statistics - The World Bank

When the analysis is broken down to the creditor level, the story is slightly different. Although low- and middle-income countries were able to contain their interest burden right after the global crisis, for the portion of the debt that they contracted from China, the interest payments did not decrease in 2009. On the contrary, it marked an increase of 24% from 2008 to 2009, which is the period when a significant drop was observed in interest payments to other creditors. Unlike in 2009, interest payments to China dropped right after the onset of the COVID-19 pandemic, as in the case of other creditors.

China has recently become the world’s largest official creditor to the emerging markets, based on the analysis of Reinhart et al. (2019) of the Chinese Balance of Payments (BOP) data. However, its lending terms are distinct from that of other large official creditors such as the World Bank or the International Monetary Fund (IMF). The concessional loans extended by these creditors carry lower rates, by definition, whereas China is known to offer higher lending rates. Besides, China was lending at fixed rates predominantly until recently. In order for the borrowers to benefit from the overall decline of the policy rates in the aftermath of the crisis, these loans should bear variable lending rates. In 2008, the weight of variable-rate loans of low- and middle-income countries from China was only 18.5% while this ratio was 52% for all creditors combined. Chinese lending rates gradually shifted from fixed rates to variable rates after the global financial crisis. Starting from 2015, the share of variable rate loans reached around 45%, which is comparable to that of other creditors. Thanks to this jump, the pandemic-driven plunge in global interest rates has resulted in a proportional decline in interest payments from low-and middle-income countries to China.

Share of Variable Rate Loans from China – Low- and Middle-Income Countries

Source: International Debt Statistics - The World Bank

Overall, when China is excluded, the data demonstrate that interest payments arising from external debt liabilities of low- and middle-income countries decreased sharply right after both crises. Although the debt stock of those countries continued to rise during both episodes, low levels of interest rates globally helped them to lower their interest burden. However, the data also depict that right after 2009, the trend in declining interest payments reversed very quickly. In 2010, the interest payments of low- and middle-income countries combined rose by 21%. Furthermore, systemically low interest rates incentivized not only households and firms, but also governments to borrow more during this period. This put an additional burden on the debt stocks which were already inflated by the stagnant global growth as well as the stimulus packages introduced by governments across the globe. Today, as global policy rates are set to normalize gradually, we are likely to witness a similar path for the year-end figures of 2021 following the short-lived decline in interest payments observed in 2020. The fact that China has also started to lend in variable rates more might exacerbate the bounce back in interest payments in tandem with the projected recovery in global lending rates.

Join the Conversation