This blog is the second in a series of nine blogs on commodity market developments, elaborating on themes discussed in the October 2021 edition of the World Bank’s Commodity Markets Outlook.

Oil prices continue to recover. Crude oil prices increased sharply in 2021Q3 and continued rising in October, driven by increased demand, weather-related supply disruptions, and restrained production by OPEC and its partners (OPEC+). Oil prices have also been supported by higher natural gas prices, which increased oil demand for heating and electricity generation. Crude oil prices are expected to average $74/bbl in 2022, before declining to $65/bbl in 2023 as global production recovers.

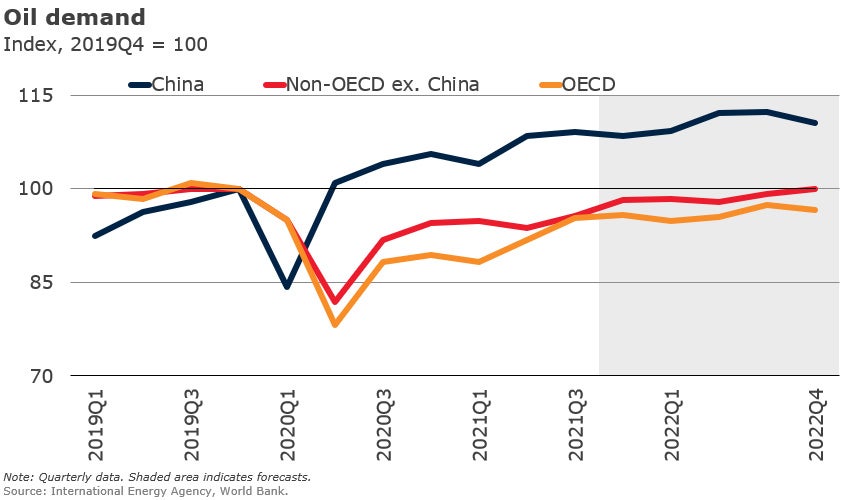

Continued recovery in oil demand. Oil demand rose in 2021Q3 as lockdown measures were lifted, especially in Europe. Global demand is now just 3 percent below its pre-pandemic peak. The strongest recovery has been in China, where demand is currently more than 10 percent higher compared to its pre-pandemic level, while it remains slightly below for OECD and non-OECD countries excluding China.

Supply disruptions have supported prices. After a gradual recovery since March 2021, global oil production declined in August and September. Production in the United States was affected by Hurricane Ida while OPEC and its partners (OPEC+) produced almost 1 million barrels per day (mb/d) below their quota due to maintenance and supply outages, especially for Angola, Kazakhstan, and Nigeria, according to data from the International Energy Agency.

Falling oil inventories. Oil inventories have continued to fall rapidly, dropping by just over 1 percent per month since August 2020. OECD industry inventories were around 4 percent below their five-year average in July 2021.

Outlook. Oil demand is expected to exceed its pre-pandemic level in 2022, although estimates of the speed of recovery vary. Increased substitution of oil for natural gas in heating and electricity is expected to boost demand by more than 0.5 mb/d. Global oil production is forecast to see a robust recovery of around 6 mb/d in 2022, as OPEC+ unwind their production cuts over the year, and output in the United States increases by about 1 mb/d.

Risks. In the short term, upside risks include greater use of crude oil as a substitute for natural gas, and the possibility that U.S. shale recovers slower than expected. To the downside, there is a risk that higher energy prices could start to weigh on growth, while renewed outbreaks of COVID-19 could also affect oil demand. Further out, there is a risk that future supply growth will be weaker than demand, which could lead to sharply higher prices. Investment in new oil production has been relatively weak since the 2014 oil price collapse, and investment fell further in 2020, particularly among oil majors.

Join the Conversation