Photo: auphoto / Shutterstock.com

As Washington, D.C.’s infrastructure braces for its first winter freeze and 2017 draws to a close, this feels like the right moment for a recap on what the year has brought us in terms of closing the infrastructure gap across emerging markets and developing economies; policy directions within and outside of the World Bank Group; new instruments, tools, and resources; and—the proof in the pudding—actual investment levels.

There may not be one blog that can capture all of those themes in detail, but here is a brief overview of what 2017 has meant and what is on the docket for 2018 and beyond.

The world’s capitals as well as the international organizations and fora that give voice to global public goods, trends, and needs, have raised to a deafening crescendo on the need for more investment in infrastructure. The vocabulary differs by announcement: close the infrastructure services gap, diversify forms of financing, maximize finance for development, move from billions to trillions, match savings with long-term investment needs. But they all share the same imperative: government, bilateral, and multilateral institutions must cascade our way through a decision-making process that values scarce public resources and brings the private sector into infrastructure finance and/or operations, wherever practicable, affordable, and sustainable.

After a year’s breather, the G20 brought back infrastructure as a primary topic demanding attention from the world’s major economies. The new presidency of the G20, Argentina, stated in its G20 priorities declaration:

Mobilizing private investment toward infrastructure is crucial to closing the global infrastructure gap. […] We will seek to develop infrastructure as an asset class by improving project preparation, addressing data gaps on their financial performance, improving the instruments designed to fund infrastructure projects, and seeking greater homogeneity among them.

This is a growing part of the agendas of the Bank Group, our client governments, and our stakeholders—both donors and beneficiaries.

Instruments, tools, and resources

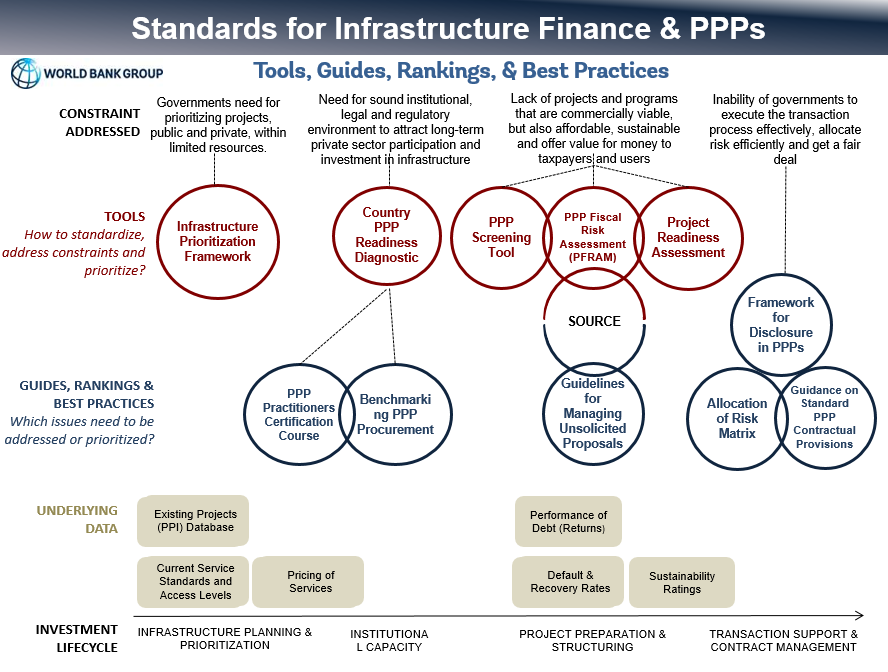

As the Bank Group, working with our MDB partners, build on experience in working with governments to prioritize investments, prepare projects, bring investments to market, and regulate contracts and services, a growing set of tools and resources have emerged to help standardize approaches and help financiers recognize the assets they are putting their capital into as a “class” of investments. Here is a preliminary snapshot:

Not to worry if this seems hard to decipher; the PPP Knowledge Lab provides a description and link to many of these tools.

…and the actual investments?

In terms of infrastructure investments with private participation that have come to financial close, the latest data from the World Bank’s PPI Database shows the first half of 2017 saw a bump up from 2016—a 24% increase in investment volume from the same months of 2016, representing $36.7 billion across 132 projects. These numbers are still lower than 2014 levels and represent somewhere around 10% of total investment in infrastructure in emerging markets and developing economies’ (EMDE). About half of the financing of PPPs comes from private sources. This year’s research shows PPPs have lower likelihoods of cancellation when MDBs are involved, and when there has been a program of multiple PPPs in a country.

One shift worth noting in recent years is toward the dominance of renewable energy generation among PPPs. Today, nearly 90% of all private power projects are wind, solar, or hydroelectric power plants. Still, that represents only about half of all new installed capacity. This is a ratio that hasn’t changed in recent years, as the ability of power systems to benefit from the availability of cheaper wind and solar will demand even more advances in storage technology to allow renewables to displace thermal baseload generation in the years ahead.

Of course, the medium term seems to be coming quicker and quicker with technological advances, a theme that will confront us in the years ahead.

In terms of our New Year’s resolutions, what more can we do?

- Here at the Bank Group, we can expect to take our nine pilot “maximizing finance for development” countries to fruition, building road maps for investment out of the diagnostics. We will expand those pilots vertically across sectors and horizontally into a new wave of countries.

- Financial Instruments: We’ll focus on expanding the use of credit enhancements, such as World Bank guarantees and Multilateral Investment Guarantee Agency (MIGA) products; further expanding the use of first loss facilities, such as IFC’s MCPP-Infra; and innovating in new risk instruments. This will require close collaboration with the growing suite of climate-focused investment vehicles and blended finance tools so the offerings do not confuse the market and the rating agencies.

- Pipeline of Investments: Finally, while new forms of finance and new instruments to manage risk are nice, nothing beats having something to invest in. As we have seen the Global Infrastructure Facility ramp up its support to the infrastructure pipeline, the Bank Group and other MDBs will redouble our efforts in working with governments to prepare commercially viable and sustainable projects. We will look at our own portfolio of public investments to see how they might be recycled—transforming brownfield assets into resources for new investment.

Related posts:

Coming together is the way forward: Maximizing Finance for DevelopmentScaling up World Bank guarantees to move the needle on infrastructure finance

G20 – Principles of MDBs’ strategy for crowding-in Private Sector Finance for growth and sustainable development

Slight bump in half-year private investment in infrastructure: a sign of recovery?

Join the Conversation